$3.63 Billion Growth Opportunities in IT, Electrical, Mechanical Infrastructure, General Construction, and Tier Standards

Indonesian Data Center Market

Dublin, April 29, 2024 (GLOBE NEWSWIRE) — The “Indonesia Data Center Market – Investment Analysis & Growth Opportunities 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

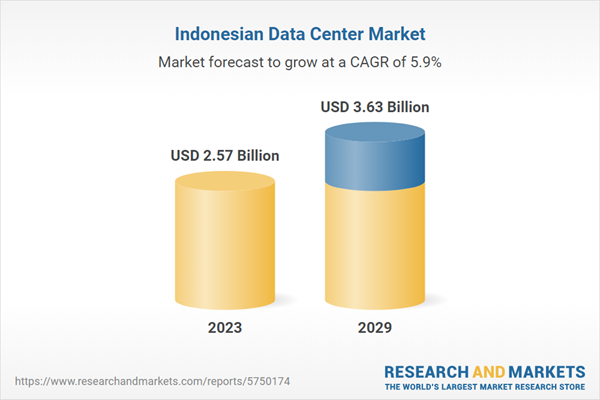

The Indonesia data center market is expected to grow at a CAGR of 5.91% from 2023-2029, from USD 2.57 Billion in 2023 to reach USD 3.63 Billion by 2029.

This report analyses the Indonesia data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

The market has several global support infrastructure providers, which will increase its competitiveness and lead to lower infrastructure prices in the coming years. Some of the support infrastructure vendors in the Indonesia data center market include ABB, Caterpillar, Cummins, Delta Electronics, Eaton, Mitsubishi Electric, and others.

The Indonesia data center market is dominated by several local and global construction contractors, such as Aesler Group International, Arkonin, AWP Architects, Barry-Wehmiller Design Group, Turner & Townsend, DSCO Group, and others. For instance, in March 2024, BW Digital and Citramas announced plans to construct a new data center and subsea cable infrastructure in Indonesia.

The Indonesia data center market is witnessing significant growth in Southeast Asia, driven by digitalization growth, rising connectivity, spill-up of demand from other major markets such as Singapore, and other factors contributing to market growth. Indonesia has positioned itself as a rapidly expanding data center location in Southeast Asia, experiencing significant growth in investments for data centers from local and global operators. For instance, in December 2023, Digital Edge announced that it had acquired the remaining shares of Indonesian digital infrastructure company – Indonet, with the initial acquisition beginning in 2021.

The rising opportunities in the market have attracted several new entrants to the Indonesia data center market, such as Equinix, Digital Edge, Gaw Capital, BDx, and others. Despite a growing Southeast Asian market, Indonesia is growing on the regional cloud computing landscape. This status encourages substantial investments from cloud service providers within the country.

Indonesia has a favorable climate for developing renewable energy sources. By 2060, it aims to be a net-zero carbon emissions country with increasing renewable energy production. For instance, in November 2023, under the Just Energy Transition Partnership (JETP), Indonesia aimed to limit CO2 emissions to 250 million metric tons in its on-grid power sector by 2030. Data center operators in the country are focusing on adopting renewable energy sources. For instance, a prominent data center operator, Telkom Indonesia, has announced the adoption of renewable energy for its data center in Batam.

The digitalization trend significantly propels the growth of the Indonesia data center market, with the Indonesian government actively undertaking initiatives to drive digital transformation. For instance, in December 2023, the Indonesian government announced its plans to introduce a Digital Rupee to boost economic growth. The Digital Rupee, set to be launched under the project code- Project Garuda – will be issued and managed by the country’s central bank, Bank Indonesia.

WHY SHOULD YOU BUY THIS RESEARCH?

-

Market size is available in terms of investment, area, power capacity, and Indonesia’s colocation market revenue.

-

An assessment of the data center investment in Indonesia by colocation, hyperscale, and enterprise operators.

-

Investments in the area (square feet) and power capacity (MW) across cities in the country.

-

A detailed study of the existing Indonesia data center market landscape, an in-depth market analysis, and insightful predictions about market size during the forecast period.

-

Snapshot of existing and upcoming third-party data center facilities in Indonesia

-

Facilities Covered (Existing): 73

-

Facilities Identified (Upcoming): 16

-

Coverage: 18+ Cities

-

Existing vs. Upcoming (Area)

-

Existing vs. Upcoming (IT Load Capacity)

-

Data Center Colocation Market in the Indonesia

-

Colocation Market Revenue & Forecast (2023-2029)

-

Wholesale vs. Retail Colocation Revenue (2023-2029)

-

Retail Colocation Pricing

-

Wholesale Colocation Pricing

-

The Indonesian data center market investments are classified into IT, power, cooling, and general construction services, with sizing and forecasting.

-

A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

-

Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

-

A transparent research methodology and the analysis of the demand and supply aspects of the industry.

KEY QUESTIONS ANSWERED

-

How big is the Indonesia data center market?

-

How many MW of power capacity will be added across Indonesia from 2024 to 2029?

-

How many existing and upcoming data center facilities exist in Indonesia?

-

What is the growth rate of the Indonesia data center market?

-

What factors are driving the Indonesia data center market?

-

Who are the key investors in the Indonesia data center market?

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

137 |

|

Forecast Period |

2023 – 2029 |

|

Estimated Market Value (USD) in 2023 |

$2.57 Billion |

|

Forecasted Market Value (USD) by 2029 |

$3.63 Billion |

|

Compound Annual Growth Rate |

5.9% |

|

Regions Covered |

Indonesia |

VENDOR LANDSCAPE

IT Infrastructure Providers

Data Center Construction Contractors & Sub-Contractors

-

Aesler Group International

-

AO

-

Arkonin

-

Asdi Swasatya

-

Aurecon

-

AWP Architects

-

Beca

-

Cundall

-

Barry-Wehmiller Design Group

-

DSCO Group

-

Leighton Asia

-

NTT Facilities

-

Obayashi Corporation

-

Parker van den Bergh

-

PT PP

-

Ramboll

-

Sarana Multi Infrastructure

-

Tetra

-

Turner & Townsend

-

Vale Architects

-

WT

Support Infrastructure Providers

-

ABB

-

Caterpillar

-

Cummins

-

Cyber Power Systems

-

Delta Electronics

-

Eaton

-

Fuji Electric

-

HITEC Power Protection

-

Legrand

-

Mitsubishi Electric

-

Piller Power Systems

-

Rittal

-

Rolls-Royce

-

Schneider Electric

-

STULZ

-

Vertiv

Data Center Investors

New Entrants

-

Big Data Exchange (BDx)

-

Gaw Capital

-

Digital Edge DC

-

EdgeConneX

-

Equinix

-

Evolution Data Centres

-

K2 Data Centres

-

Minoro Energi Indonesia

EXISTING VS. UPCOMING DATA CENTERS

REPORT COVERAGE

IT Infrastructure

Network Infrastructure

Electrical Infrastructure

Mechanical Infrastructure

Cooling Systems

General Construction

-

Core & Shell Development

-

Installation & Commissioning Services

-

Engineering & Building Design

-

Fire Detection & Suppression Systems

Physical Security

Tier Standard

-

Tier I & Tier II

-

Tier III

-

Tier IV

Geography

-

Jakarta

-

West Java

-

Other Cities

For more information about this report visit https://www.researchandmarkets.com/r/tmtsyi

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900