Data science is rapidly becoming a cornerstone of success in commercial real estate (CRE) investing.

With vast amounts of data available, firms are seeking advanced analytics to gain a competitive edge, optimize portfolios, and enhance decision-making. Despite the industry’s widespread recognition of data’s potential, there remains a great deal of uncertainty regarding its implementation, sophistication, and true impact.

This article is a summary of Altus Group’s global research report, The state of data science in commercial real estate investing. This report provides a comprehensive look into how CRE firms are adopting data science, the challenges they face, and the opportunities for differentiation in a competitive market.

Research methodology

Altus Group commissioned B2B International, an independent market research firm, to conduct qualitative and quantitative research with hundreds of CRE investment decision-makers. Over 400 participants from investment firms across North America, Europe, and the Asia-Pacific region were surveyed to explore motivations, challenges, and the current state of data science capabilities. The respondents represented a mix of banks, asset management firms, developers, funds, real estate owners/operators, and brokers, providing a broad industry perspective on data science adoption and challenges.

Data science in CRE: The adoption gap

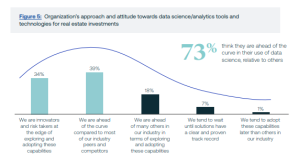

The report highlights a paradox in the industry: while more than half (55%) of investors already employ data science tools, many remain unclear about where they stand relative to their peers. Surprisingly, 73% of respondents believe they are ahead of the curve, even though their actual capabilities do not appear to match this perception. The lack of clear benchmarks creates confusion, leading to both complacency and misplaced anxiety among investors.

Furthermore, there is a fundamental distinction between data science and data analytics capabilities. While many firms utilize data analytics to interpret datasets and identify patterns, fewer are leveraging true data science applications like predictive modeling, machine learning, and algorithmic analysis. This suggests that while the industry is advancing, there is still significant room for growth in more sophisticated applications.

Who is leading the charge?

Despite the rapid adoption of data science, no clear industry leaders have emerged. When asked to name firms they view as pioneers in data-driven CRE investment, 59% of respondents could not identify a single company. This absence of recognized frontrunners presents a unique opportunity for firms that prioritize data science innovation to establish themselves as industry leaders.

Larger firms, particularly those with over $1 billion in assets under management (AUM), are at the forefront of internal data science development. These organizations are more likely to have dedicated data science teams, Chief Data Officers, and proprietary predictive models. Regionally, firms in the Asia-Pacific (APAC) region appear to be leading in hiring and training internal teams, while North American firms focus more on external solutions.

Establishing data science capabilities: Internal vs. external solutions

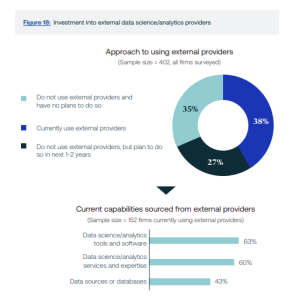

A key decision for CRE firms is whether to develop data science capabilities in-house or leverage external providers. The report reveals a mixed view with 29% of firms mainly developing internal capabilities, 20% starting external then moving internal, 46% equally using a mix of internal and external resources. Only 5% rely solely on external providers.

For firms building internal capabilities, common investments include developing proprietary metrics, machine learning applications, and predictive modeling tools. However, internal development comes with challenges, including difficulties in obtaining high-quality data, securing organizational buy-in, and hiring and retaining qualified data science talent.

External providers, on the other hand, offer access to specialized tools, expertise, and high-value datasets. Among firms that currently use external solutions, 63% purchase data science software, 60% invest in analytics expertise, and 43% rely on external data sources. While external providers help firms enhance their capabilities quickly, challenges such as software usability and integration remain significant barriers.

Investor goals and differentiation strategies

One of the most compelling insights from the report is that CRE firms are increasingly viewing data science as a means of differentiation. The top reason for investing in data science is to gain a competitive advantage, followed by improving market and asset selection and enhancing investment strategies. However, with data science becoming an expectation rather than a differentiator, firms must find innovative ways to leverage analytics for a true competitive edge.

Regional differences also play a role in investment motivations. North American firms focus on gaining a competitive edge, while European firms prioritize improving market selection, and APAC firms emphasize refining investment strategies. Additionally, midsize firms (with $500 million to $1 billion in AUM) place the highest importance on improving confidence in their business strategies.

The challenges of data science implementation

Despite the promise of data science, implementation challenges persist. The most significant obstacles include:

•Data quality and availability: Nearly half of firms struggle to obtain high-quality, relevant data.

•Organizational buy-in: 41% of firms find it difficult to secure internal adoption of data science initiatives.

•Talent acquisition and retention: Finding skilled data scientists remains a major hurdle for 39% of firms.

•ROI uncertainty: Many firms underestimate the time and investment required to realize the benefits of data science.

Additionally, firms in North America and Europe report underestimating the resources required for data science initiatives, while APAC firms are more likely to struggle with setting realistic expectations about what data science can achieve.

The future of data science in CRE

Looking ahead, firms are prioritizing investments in:

•Statistical tools for data interpretation

•Predictive modeling and machine learning

•Automation systems and frameworks

•Enhanced benchmarking and performance analysis

External providers will continue to play a crucial role in supporting CRE firms. While overall satisfaction with external data science solutions is high (with an average rating of 8.3 out of 10), there is room for improvement in areas such as software usability and the flexibility of these solutions to support new and existing use cases.

A call to action for CRE firms

Data science is no longer an optional enhancement but a fundamental component of CRE investment success. The field of data science in CRE is still evolving, and now is the time for firms to establish themselves as industry leaders.

Download the full report to access deeper insights including full graphs to support the data discussed, expert recommendations, and a roadmap for integrating data science into your investment strategy.

Altus Group has led the industry in R&D investment, with substantial commitments to data standardization, data integration, change management, and data science. We are partnering with clients to improve investment outcomes, enhance strategies on a go-forward basis, deliver innovations in nation-wide valuation benchmarking, and leverage data-driven insights to identify drivers of NOI performance, underperforming and over performing investments, and more.

Don’t let uncertainty hold your firm back—equip yourself with the insights needed to navigate the data revolution in commercial real estate.