AST SpaceMobile: Moonshot Investment Opportunity In Direct-To-Cell (NASDAQ:ASTS)

Eoneren/E+ via Getty Images

AST SpaceMobile, Inc. (NASDAQ:ASTS) is on track to disrupt the telecommunications industry thanks to its goal of delivering direct-to-cell (“DTC”) services to smartphone users who are out of terrestrial cellular coverage. With the company on track to launch its first five Block 1 BlueBird satellites next month, it is well positioned to realize its first revenues by Q4 this year. Given the significance of this milestone, I expect AST to continue its bullish price movement on a successful launch.

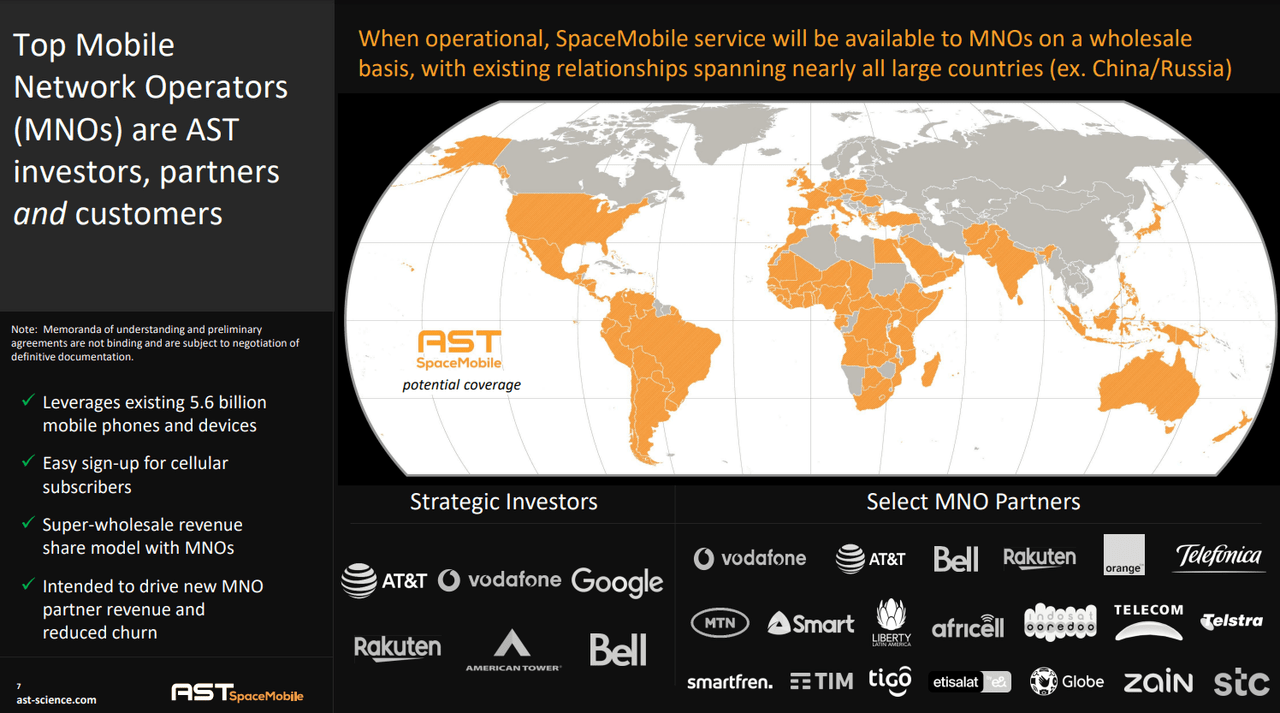

Meanwhile, the company’s advanced technology, compared to its direct competitors SpaceX (SPACE) and Lynk (SLAM), as well as its relationships with more than 40 MNOs with user bases of more than 2.8 billion users could see its revenues grow exponentially over the coming years. In my opinion, these factors set AST up to attract a substantial portion of the adults living in the “effective coverage gap” who are estimated to reach 532 million by 2035. In light of this, I’m rating AST as a strong buy with a price target of $144 by 2030, implying 1018% upside from current levels.

Business Overview

AST is a vertically integrated space-based cellular broadband network provider with more than 3350 patents and patent pending claims. The company intends to operate a constellation of LEO satellites that will provide connectivity directly to mobile phones at broadband speeds.

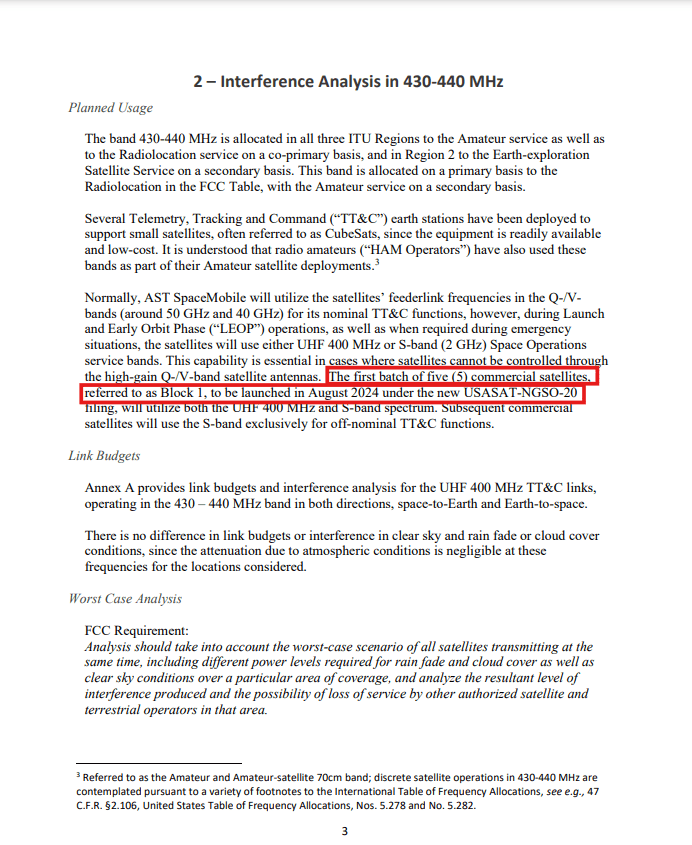

The first five BlueBird satellites of the company’s constellation, representing Block 1 and are fully funded, are expected to launch in August, per a supplement filed with the FCC on July 18th. Given that management previously shared that they expect to spend around three months to test and calibrate these satellites in orbit, it could be safe to expect the company to start generating revenues in Q4 this year, including $20 million in revenue commitments from AT&T (T).

FCC International Communications Filing System

Currently, the company is in the process of building and developing the next generation of the BlueBird satellite which is designed to improve throughput by 10 times. The next generation of the BlueBird satellite will be launched as part of Block 2 which will include 20 satellites and its launch is estimated to be in late Q4 2024 or in Q1 2025

With the five Block 1 satellites and 20 Block 2 satellites, AST will be able to provide limited and non-continuous service as it needs 45-60 satellites for continuous services in the US, and 90 satellites to be fully operational. With that in mind, the company stated in its latest 10-Q filing that in addition to its cash balance of $212.4 million, it has to raise between $350-$400 million to fund the costs associated with designing, assembling, and launching the 20 Block 2 BB satellites.

On that note, AST’s business model appears to be following the pattern of high CapEx and low operating costs. The launch and deployment of a large constellation of LEO satellites requires significant upfront investments, as shown by the capital AST used and intends to use for the upcoming launches of BB1 and BB2 satellites.

Once these satellites are successfully deployed in LEO, AST is likely to incur relatively low operating costs associated with monitoring the satellites and maintaining them in orbit. That said, LEO satellites are estimated to have a lifespan of seven to 10 years, which means that the company may have to launch new satellites to replace the old ones by around 2031.

At the same time, it should be noted that AST doesn’t have physical infrastructure since it leverages the cellular network infrastructure of its partner MNOs on the ground. This helps the company reduce its need for extensive physical maintenance compared to traditional telecom companies.

AST’s business model also allows it to incur minimal sales and marketing costs since it doesn’t offer its service directly to consumers, but its service is offered by its partners to their subscribers. Accordingly, the company relies on its partners’ subscriber growth to increase its addressable market.

With that in mind, the company estimates that its partnerships with global MNOs provide it with access to more than 2.8 billion subscribers. These partners include AT&T, Rakuten (OTCPK:RKUNY), Vodafone (VOD), and Verizon (VZ), which has recently partnered with the company in late May. This large addressable market is especially promising for AST considering that it might be operating a 50-50 revenue share model based on its deal with AT&T, as mentioned in the Q1 earnings call.

Advantages of Satellite Based Networks

While some might be skeptical of the company’s business direction, I believe its tech could be a game changer for the millions living in the coverage gap and on the edge of coverage. Per GSMA estimates, around 240 million adults will be living outside the range of a 3G, 4G, or 5G network in 2025.

At the same time, another group that lives within range of a 3G, 4G, or 5G signal but experiences patchy service at home or in transit for work or travel is estimated to reach 280 million adults in 2025. These groups living in the “effective coverage gap” will be the main growth drivers for satellite based networks, similar to AST’s offering.

I believe that’s the case since integrating satellite and terrestrial mobile networks on these groups’ mobile phones could help fill in service gaps and maximize geographic and population network coverage. Thus, satellite networks could help bridge the digital divide and bring opportunities and economic benefits to remote communities.

Furthermore, commercial and government services will also drive growth in this emerging market. Communication services for public safety and national safety could be natural use cases for DTC services. In fact, satellite networks can be a lifeline during natural disasters or emergencies when terrestrial networks are down, allowing people to call for help and stay in touch with loved ones during these difficult times.

Competitive Landscape

Looking at the competitive landscape in the DTC space, AST faces direct competition from Lynk Global, which is set to go public through a SPAC merger with Slam Corp. (SLAM) later this year, and SpaceX’s Starlink division. That said, AST’s technology appears to be more advanced than its competitors in the field of DTC connectivity.

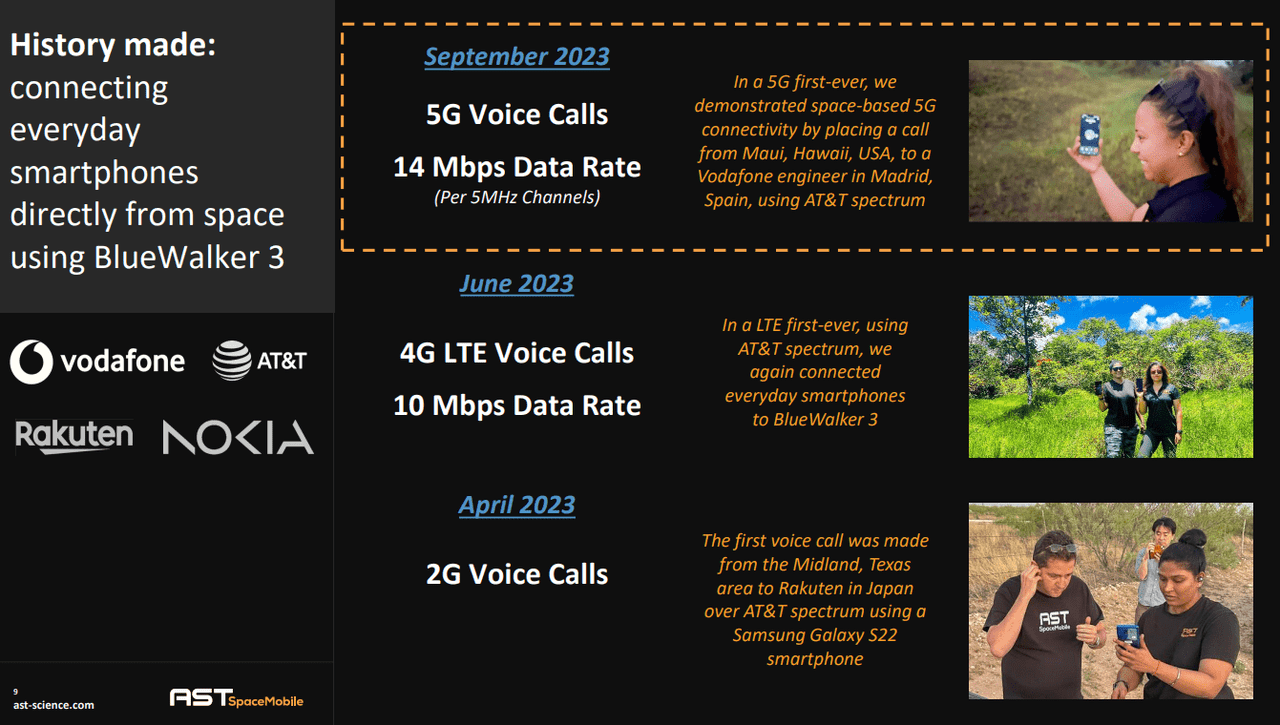

Over the course of last year, AST achieved several milestones highlighting its satellites’ capabilities. That said, the most impressive feat the company achieved was making the first ever 5G voice call and achieving a 14 Mbps data rate in September 2023.

In comparison, Starlink successfully sent and received its first text message to and from unmodified cell phones on the ground to its satellites in space using T-Mobile (TMUS) network spectrum last January. While SpaceX didn’t share details regarding speeds, latency, or other limitations, the company shared a photo on X showing that one of the sent messages was lost during transmissions. This shows that Starlink is far behind AST in terms of its satellites’ capabilities given that it plans to expand its service to support voice and data in 2025, something AST has already achieved successfully.

Moreover, Elon Musk previously shared that the cellular Starlink system is designed to supply about 7 Mbps per cell which is only good for text messages. Meanwhile, AST already achieved a data rate double of that at 14 Mbps, as mentioned earlier, and its planned operational satellites are designed to support capacity of up to 40 Mhz which could enable data transmission speeds of up to 120 Mbps.

As for Lynk, the company has built 11 satellites and plans to use the proceeds from its SPAC merger to expand production to 12 satellites per month, per its investor presentation. With that in mind, Lynk’s CEO Charles Miller, has previously shared that the company’s plan is to build 200 satellites per month and reach 5000 satellites within 2 years.

In my opinion, these plans are extremely optimistic considering the financial state of the company. Per Lynk’s investor presentation, the cost of producing a satellite is $300 thousand and the launch cost is around $650 thousand. Meanwhile, the merger deal has a minimum cash agreement of $110 million. On that note, Slam’s latest 10-Q filing shows that it has just less than $100 million held in trust. That said, Lynk has a commitment from Antara Capital to invest $25 million to help offset redemptions.

In parallel with its SPAC deal, Lynk is looking to raise $40 million in a Series B funding round. This would bring its total cash raised to $150 million through all of these capital raises, which are expected to help produce more satellites, secure launches, and support satellite designs and operations. In my opinion, these figures don’t align with the company’s plan to produce 5000 satellites within two years since the cost of producing 5000 satellites, without taking launch costs into consideration, would be $1.5 billion, while that figure would balloon to $4.8 billion when considering launch costs.

|

Planned Satellites |

5000 |

|

Cost Excl. Launch |

$1,500,000,000 |

|

Cost Incl. Launch |

$4,750,000,000 |

Meanwhile, the $150 million Lynk has access to are only enough to produce 500 satellites, without considering launch costs and operating costs, or 158 satellites when taking launch costs into consideration.

|

Cash |

$150,000,000 |

|

Launch Cost/Sat |

$650,000 |

|

Sat BOM Cost |

$300,000 |

|

Total Cost/Sat |

$950,000 |

|

Possible Sats Excl. Launch |

500 |

|

Possible Sats Incl. Launch |

158 |

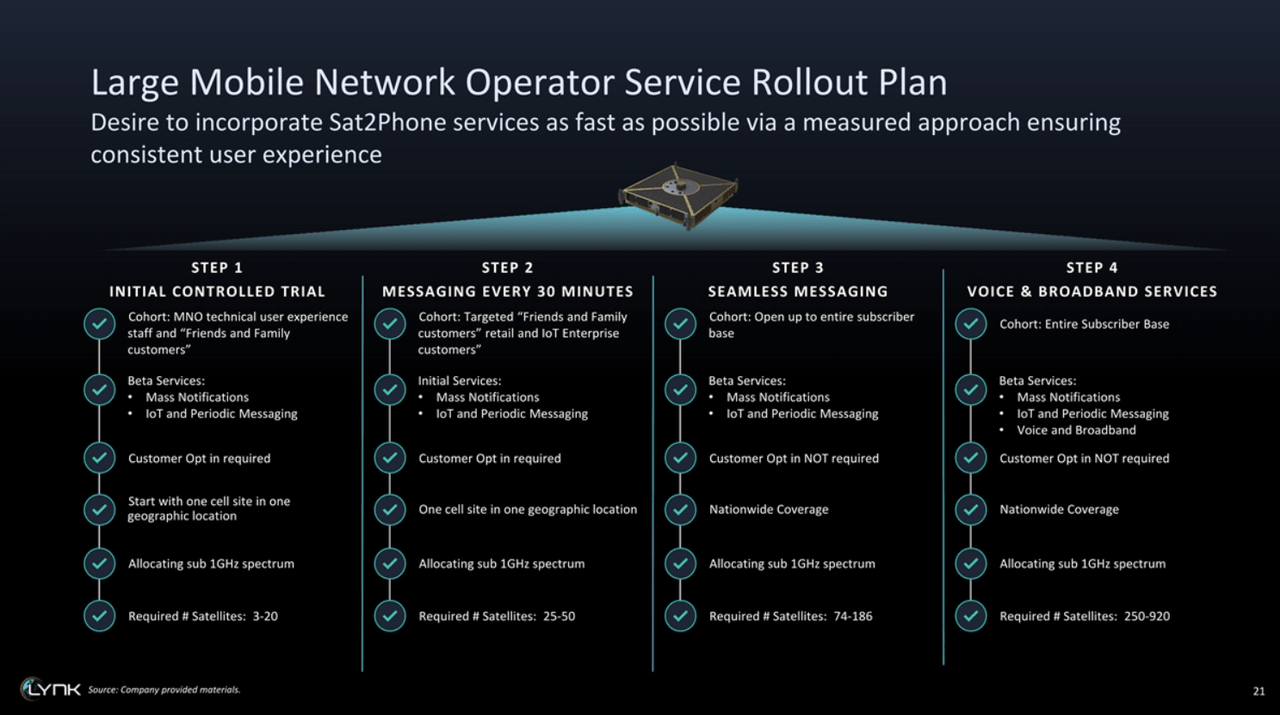

Moving to technology, Lynk appears to be far behind AST, as per its investor presentation, it requires 25-50 satellites to support messaging every 30 minutes, 74-186 satellites to support seamless messaging, and 250-920 satellites to support voice and broadband services.

In comparison, AST’s initial five Block 1 satellites and 20 Block 2 satellites can offer all of those services, albeit limited, in the US, and requires 90 satellites only to cover the whole world, per its president Scott Wisniewski.

Revenue Projections

While AST’s partners have 2.8 billion subscribers, the company can’t access this potential customer base until its service is available globally, which can only be possible when it has 90 satellites launched. With the company launching its first five Block 1 satellites next month, and plans to launch 20 Block 2 satellites in late Q4 2024 or Q1 2025, it would have 25 satellites capable of providing limited service in the US.

AST has an existing capacity to produce two satellites per month and a potential capacity of six satellites per month. Assuming the company is able to produce four satellites per month in 2025, it can reach more than the 90 satellites required for full deployment in 2026. This timeline is in line with the company’s plan to provide its service in Japan through Rakuten in 2026.

|

Year |

Satellites |

|

2024 |

5 |

|

2025 |

73 |

|

2026 |

121 |

Given that AST is partnered with AT&T and Verizon in the US, it can offer its service to both companies’ user bases of 114.5 million and 114.8 million, respectively, meaning that its potential user base in the US in 2025 is around 229.3 million. Please note that Verizon’s users figure can be found inside the Financial & Operating Information file.

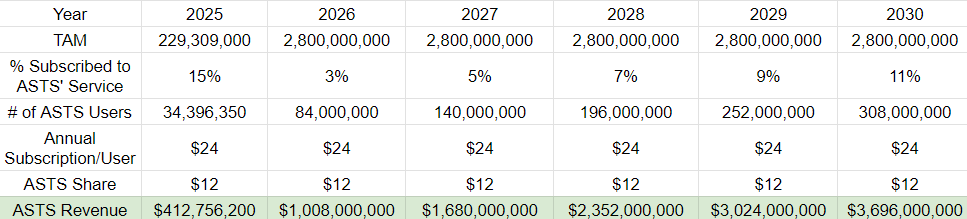

Meanwhile, unconfirmed reports suggest that AT&T expects between 30-40% of its US users to subscribe to AST’s service which is reported to be around $2 per month. In light of this, I’ll be projecting AST’s revenues based on the following assumptions.

|

Assumptions |

|

|

Monthly Subscription |

$2 |

|

ASTS’ Share of Subscription |

50% |

|

ASTS’ Monthly Rev/User |

$1 |

|

ASTS’ Annual Rev/User |

$12 |

For 2025, I’m forecasting AST’s revenues assuming 15% of AT&T and Verizon’s users subscribe to the company’s service, which is a conservative approach in my opinion based on the unconfirmed reports from AT&T. Accordingly, my revenue estimate for 2025 is $412.8 million.

For 2026 and beyond, once AST is able to offer its service globally, I’m assuming its share of its partners’ users to be 3% in 2026, 5% in 2027, 7% in 2028, 9% in 2029, and 11% in 2030. The reason why I expect users of AST’s service to increase is that with more satellites launched and better coverage, its service could attract more users in the “effective coverage gap”, which GSMA estimated to reach 532 million adults by 2035.

In light of these assumptions, my revenue projections for AST until 2030 are as follows.

Own Calculations

Please note that my projections don’t take into consideration any potential growth in the user bases of AST’s partners.

Valuation

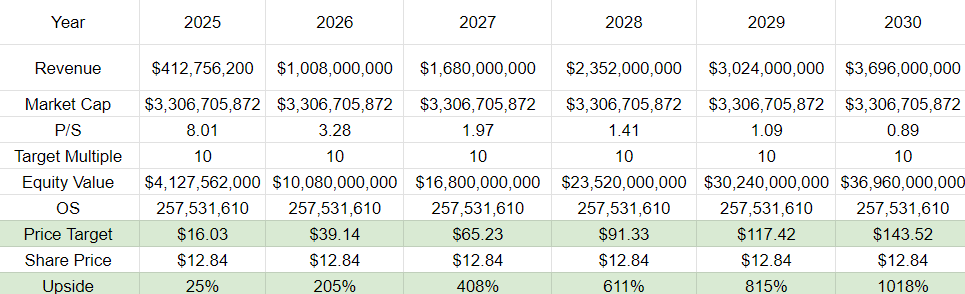

In order to reach a price target for AST, I’ll be comparing its valuation to SpaceX since Lynk’s SPAC merger is yet to be closed. As is, both SpaceX and Lynk are the only direct competitors to AST. With that in mind, SpaceX is estimated to be valued at $210 billion based on its latest tender offer in late June. At the same time, SpaceX is forecasted to generate $13.3 billion in revenues this year, including $6.85 billion from its Starlink division.

While these data imply that SpaceX’s P/S ratio is 15.79, my target P/S ratio for AST is 10 since SpaceX derives its value from both its launch division and Starlink division, which is AST’s direct competitor.

|

SpaceX Valuation |

$210,000,000,000 |

|

SpaceX Proj. Rev |

$13,302,000,000 |

|

SpaceX P/S |

15.79 |

Based on this, my price targets for AST until 2030, based on my revenue estimates, are as follows.

Own Calculations

Risks

Although I’m bullish on AST, there are a few risks to consider. The first risk to my thesis is the financial viability of the company. The costs of building, launching, and maintaining LEO satellites are high as the company still anticipates raising $350-$400 million to launch the 20 Block 2 satellites. Therefore, the company might resort to dilution to raise future capital to launch its entire constellation, which is crucial for providing its service globally.

That said, the company is backed by several giant MNOs who can provide it with strategic investments, similar to the investments it received from AT&T, Verizon, and Vodafone. The company’s partners could also fund the development and launch of future satellites, given the service’s potential to attract more users to these MNOs.

The second risk to my thesis is market adoption of AST’s technology. Demand for DTC connectivity, especially 5G connectivity, in underserved areas is still evolving. As such, it remains to be seen whether users will adopt this technology or be willing to pay for such service.

Another risk to my thesis is potential regulatory hurdles as satellite communications and spectrum allocations are subject to heavy regulations. These regulations exist to protect the radio frequency spectrum, which is a finite resource, prevent interference between users on the spectrum to ensure smooth operations, and coordinate spectrum use between countries to avoid conflict. As such, these regulations could impact AST’s operations in some regions.

Conclusion

In summary, I’m bullish on AST due to its growth potential through its first mover advantage in the DTC space and technological advantage over its direct competitors, SpaceX and Lynk. The company is on track to launch five Block 1 satellites next month and intends to launch 20 Block 2 satellites in Q4 2024 or in Q1 2025. Through these initial satellites, the company can offer limited service to the 229.3 million AT&T and Verizon users in the US. With that in mind, unconfirmed reports from AT&T suggest that 30-40% of the telco giant’s users would be willing to subscribe to AST’s service, which is reported to cost $2 monthly.

Meanwhile, AST could be on track to start offering its service globally in 2026, providing it with access to its partners’ user bases of more than 2.8 billion. Considering that adults living in the “effective coverage gap” are estimated to reach 532 million by 2035, these relationships could allow AST to attract a substantial portion of this population. In light of these factors, I’m rating AST as a strong buy with a price target of $144 by 2030, representing 1018% upside from current levels.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.