Fidelity Investments® Releases 2025 Retiree Health Care Cost Estimate, a Timely Reminder for All Generations to Begin Planning

24th Annual Estimate Reveals 65-year-old retiring today could spend $172,500 on health care in retirement

One-in-five Americans say they have never considered health care costs during retirement

While HSA adoption rates are increasing, opportunities exist for greater education

BOSTON, July 30, 2025–(BUSINESS WIRE)–Fidelity Investments® today shared its 24th annual Retiree Health Care Cost Estimate, revealing that a 65-year-old retiring in 2025 can expect to spend an average of $172,500 in health care and medical expenses throughout retirement1. This represents a more than 4% increase over 2024 and continues the general upward trajectory of projected health-related expenses since Fidelity’s inaugural $80,000 estimate in 2002.

This year’s estimate comes as Americans’ confidence in their retirement prospects has slightly decreased and a record-number begin their final stretch to reaching the traditional retirement age of 652. Of concern, recent Fidelity research shows 1-in-5 Americans say they have never considered health care needs during retirement—a figure that rises to one-in-four among Gen X. More so, across all generations, 17% have taken no action at all when it comes to planning for health expenses in retirement3.

“Year after year, so many Americans underestimate how much they’ll need to save to cover health care costs in retirement,” said Shams Talib, head of Fidelity Workplace Consulting. “We recognize the impact health care costs can have on retirement savings. With the right tools and guidance, pre-retirees and retirees alike can take greater control of their financial futures by beginning the planning process as soon as possible.”

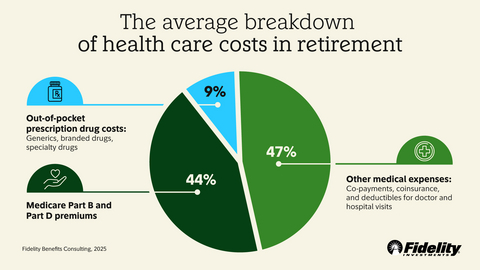

The Retiree Health Care Cost Estimate helps Americans of all ages understand the potential impact of rising health care costs on their financial planning and helps them make more informed decisions about saving for retirement. The estimate assumes enrollment in Original Medicare (Parts A and B) and Medicare Part D, which includes premiums, co-payments, and other out-of-pocket costs for medical care and prescription drugs. It does not include long-term care expenses.

Health Savings Accounts: a tax-advantaged tool for health care costs

Health savings accounts (HSAs) can play an important role in preparing for health care costs both now and in the future. The most notable feature of an HSA is its triple-tax advantage4: contributions to the account are made pre-tax; you can withdraw funds to pay for qualified medical expenses tax-free; and you can invest HSA funds, too, with any investment growth also considered tax-free.