From future investments to stock market prediction – Gautam Adani highlighted these 4 things

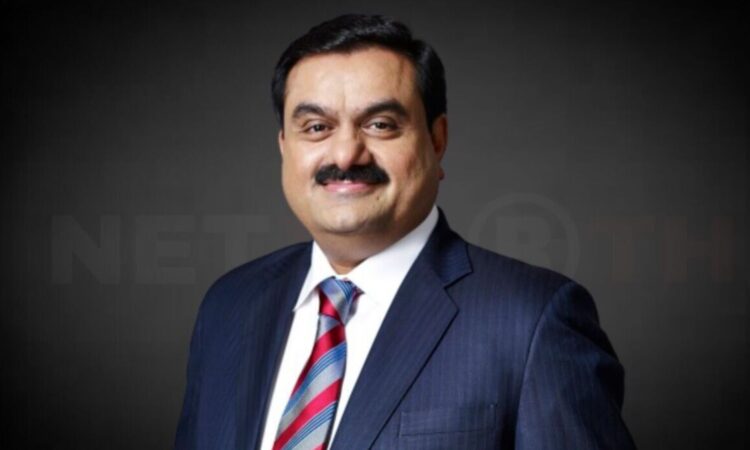

Adani Group founder Gautam Adani on June 19 spoke about India’s infrastructure sector, stock market, GDP growth, and future investments at “Infrastructure – the Catalyst for India’s Future” event organized byCrisil.

“I am honoured to have been invited to deliver the keynote at Crisil’s Annual Infrastructure Summit. It is a privilege to speak at an event hosted by an institution that laid the foundation for the development of Credit Ratings and Advisory Services in India,” he said.

Here are four key highlights from Gautam Adani’s speech –

Infrastructure sector growth

Over the past decade, India has seen remarkable advancements in its infrastructure sector, largely attributed to what experts call the country’s “single most important catalyst”: the quality of governance.

“India’s remarkable infrastructure journey is fundamentally rooted in this government’s effectiveness in institutionalizing policy for transforming our nation’s landscape—from one of challenges—to one of possibilities,” Adani said.

He went on saying, “NIP(National Infrastructure Pipeline) project that has outlined a projected investment of INR 111 lakh crore over the period FY20 to FY25, is the benchmark in how a government can galvanize an entire sector and put in view of several thousand infrastructure projects across sectors like energy, logistics, airports and social infrastructure.”

Future investments

The Adani Group plans to invest over $100 billion in energy transition projects and the manufacturing of essential components for green energy production, Chairman Gautam Adani said.

“The next decade will see us invest more than $100 billion in the energy transition space and further expand our integrated renewable energy value chain that today already spans the manufacturing of every major component required for green energy generation,” he said.

In addition to constructing solar parks and wind farms, the conglomerate is establishing facilities to manufacture electrolyzers for green hydrogen production, as well as wind power turbines and solar panels.

GDP growth

He added that India is targeting to become $10 trillion economy.

“While every nation has its challenges, I can confidently state that India’s real growth is yet to come. The platform to create several trillion-dollar market spaces is already in place. Our estimates show that by FY32- India is targeted to become a 10 trillion-dollar economy – the cumulative spend on infrastructure will exceed 2.5 trillion dollars. About 25% of this entire spending is expected to be on energy and energy transition,” Adani said.

Stock market prediction

While expressing optimism in the Indian market, he added that there has never been a more promising era for India. He projected that within the next decade, India would begin contributing a trillion dollars to its GDP every 12 to 18 months, aiming to achieve a $30 trillion economy by 2050.

“Given the pace at which India is growing and the way the government has been executing social and economic reforms, I anticipate that within the next decade, India will start adding a trillion dollars to its GDP every 12 to 18 months,” the Indian billionaire said.

At present, the market capitalization of the Indian stock market exceeds $5 trillion.

“This will put us well on track to be a $30 trillion economy by 2050. At this time, I expect the stock market capitalisation to have exceeded $40 trillion. What this effectively means is that over the next 26 years, India will potentially add $36 trillion to its stock market capitalisation,” he added.

3.6 Crore Indians visited in a single day choosing us as India’s undisputed platform for General Election Results. Explore the latest updates here!