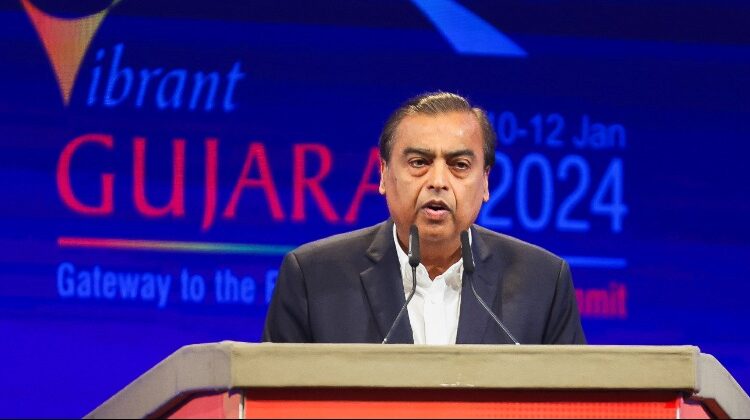

Goldman Sachs Predicts Mukesh Ambani’s Next Big Investments Over the Next 3 Year

Goldman Sachs reports that Reliance Industries has made significant investments of over $125 billion in the past decade, primarily focusing on its hydrocarbon and telecom sectors. Looking ahead, the conglomerate plans to shift its investment focus towards less capital-intensive areas such as retail and upstream new energy over the next three years.

Recent investments

Reliance has recently completed major capital expenditure cycles in its hydrocarbon and telecom divisions. Between fiscal years 2013 and 2018, the company invested nearly USD 30 billion to enhance the scale, integration, and cost competitiveness of its O2C (oil to chemical) business. Additionally, it allocated close to USD 60 billion between fiscal years 2013 and 2024 for 4G/5G capabilities to develop a high-growth telecom business.

With the anticipated completion of the pan-India 5G rollout and potential telecom tariff hikes on the horizon, Goldman Sachs foresees the telecom business becoming a strong generator of free cash flow, complementing its existing cash cow O2C business, which includes its large oil refinery and petrochemical complexes.

The target sectors for the next three years.

Goldman Sachs believes that Reliance Industries Limited (RIL) is focusing its investments in the next three years on businesses such as retail and upstream new energy, which are comparatively less capital-intensive, offer higher returns, and have shorter gestation periods.

Typically, a refining or petrochemical facility takes at least five years to start up (including construction and ramp-up time), while an integrated poly-to-module solar facility takes about two years, and a retail store can be ramped up in 6-12 months.

RIL has invested over USD 125 billion in capital expenditure in the last decade, primarily in hydrocarbon and telecom sectors, which are more capital-intensive and have longer gestation periods. While the capital expenditure cycle for hydrocarbons and telecom 4G was completed during FY17-19, an accelerated telecom capital expenditure cycle for 5G is expected to be completed in FY24.

The report anticipates that the capital expenditure intensity will peak at USD 17.6 billion in FY23 (April 2022 to March 2023 fiscal year), gradually decreasing to USD 11.2 billion by FY26E. Goldman Sachs stated that the new business segments are likely to yield higher returns, with a faster turnaround from capital expenditure to EBITDA. Additionally, RIL has frontloaded a significant portion of the capital expenditure for the retail business.

The statement suggests that the retail EBITDA is expected to nearly double between FY24-27, with the share of consolidated EBITDA increasing to 14.3% in FY27 from 12.4% in FY23, while the capital expenditure intensity will decline sequentially.

Regarding RIL’s capital expenditure in new energy, it is envisioned to occur in two phases. The first phase will focus on upstream manufacturing, with approximately USD 10 billion planned for completing fully integrated solar and battery manufacturing plants, largely by the end of FY27.

The report foresees a significantly larger capital expenditure in the planned second phase of deployment. In this phase, RIL may potentially establish capacities for solar downstream, electrolyser, and wind energy production.

For the latest and more interesting financial news, keep reading Indiatimes Worth. Click here