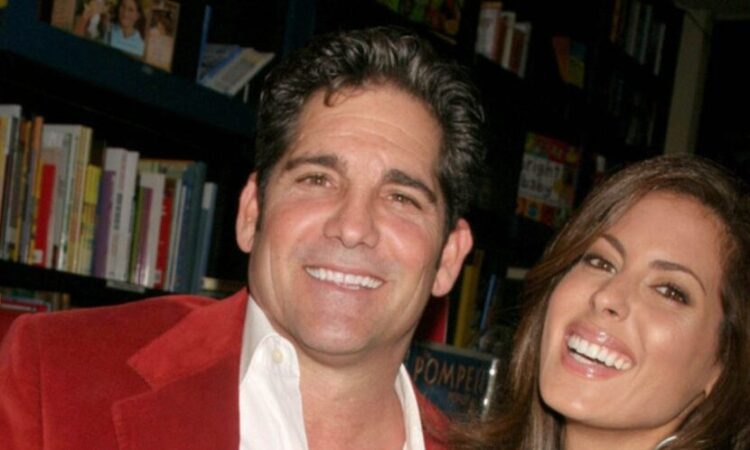

Grant Cardone Says Real Estate Tokenization Will ‘Democratize Access,’ But Warns SEC Is ‘Dragging Its Feet’

Grant Cardone, founder of Cardone Capital, is optimistic about the future of real estate investing through blockchain technology. As the world of finance increasingly integrates blockchain, Cardone sees real estate tokenization as an opportunity to make property investments more accessible to the public. He is set to speak on this topic at the upcoming Benzinga Future of Digital Assets event.

Democratizing Real Estate Investment

Cardone emphasized that real estate tokenization could lower the barriers to entry for investors. “I am very excited about the potential of real estate tokenization to democratize access to Real Estate investing by allowing fractional ownership,” he said.

He believes this approach could give a broader range of people the chance to invest in real estate, a market historically dominated by institutions and wealthy individuals.

Regulatory Hurdles Holding Back Progress

While enthusiastic about blockchain’s potential, Cardone pointed out that the lack of regulatory clarity remains a major obstacle. “The biggest hurdle is and remains regulation by the SEC, which has been dragging its feet on blockchain regulation,” Cardone said. Without proper guidelines, even well-established investors like Cardone hesitate to leverage blockchain for real estate fully.

Real-World Application and Challenges

Recently, Cardone tested the waters by listing a high-value property on a blockchain platform. The results were promising, attracting offers and generating interest. “Blockchain transactions are a game-changer for residential and commercial real estate,” he said, noting that the technology can potentially disrupt the industry. However, he also acknowledged that this disruption may be unsettling for regulators and traditional real estate firms.

As the Benzinga Future of Digital Assets event approaches, Cardone is expected to delve deeper into how blockchain could transform real estate investing. He remains determined to lead in this emerging space, but his sights are set on regulatory progress as the key to unlocking blockchain’s full potential for the real estate market.

As the digital asset market continues to mature, the convergence of regulatory shifts, M&A activities, and adoption trends will define the future of this dynamic field. Benzinga’s Future of Digital Assets event in New York City this November will provide industry leaders and investors with a platform to explore these developments further, offering insights into the evolving regulatory environment and the latest market dynamics.

Read Next:

Photo: s_bukley/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.