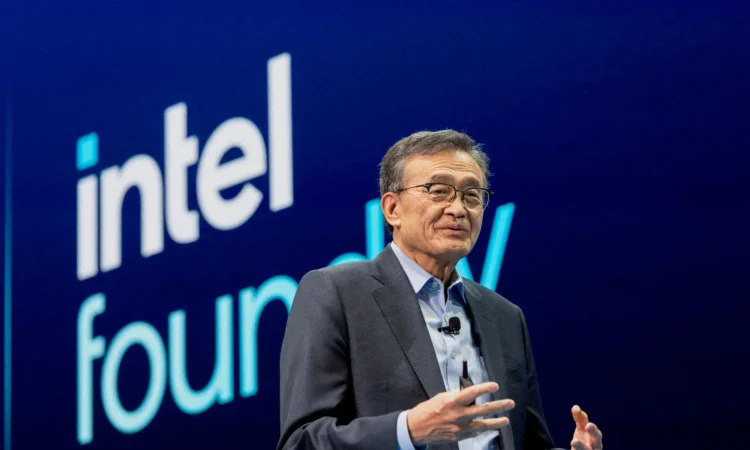

INTEL shares surged nearly 9 per cent in premarket trading on Friday (Oct 24) as investors rallied behind CEO Tan Lip-Bu’s aggressive cost-cutting measures that helped the chipmaker surpass quarterly profit estimates and regain stability amid a flurry of high-stakes bets on future growth.

The results mark a turning point for Intel, which has struggled to maintain relevance in the face of fierce competition and manufacturing setbacks.

After a bruising 2024 that saw its first annual loss in nearly four decades, the company is now leaning on strategic investments and operational discipline to rebuild investor confidence.

Steadying the ship

Intel also drew support during the quarter from multi-billion-dollar investments by Nvidia and Japan’s SoftBank as well as a US government stake, moves that offered a financial cushion as it works to revive growth.

These investments, along with Tan’s turnaround efforts, have offered a lifeline to the stock, which has rebounded by more than 90 per cent in 2025, outperforming AI chip leaders Nvidia and AMD. Intel trades at a 12-month forward price-to-earnings ratio of 71.51 versus 30.49 for Nvidia and 40.14 for AMD.

“Intel has turned a corner and is steadying the ship,” said Ben Bajarin, CEO of Creative Strategies. “It feels like a strong setup for 2026.”

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Turnaround far from over

Intel said demand for its chips was outpacing supply, particularly in data centres where operators are upgrading central processing units to support AI workloads.

However, finance chief Dave Zinsner cautioned that yields for its advanced 18A manufacturing process will remain below industry standards and won’t reach “acceptable levels” until 2027.

Tan has also sold a majority stake in Altera and shifted Intel’s capital strategy to rely more on external commitments, following criticism of his predecessor’s spending-heavy approach. He has pared back Intel’s manufacturing ambitions and cut over 20 per cent of the workforce.

“We understand the desire to claim victory for the embattled company, but this fight is far from over; perhaps it’s better to call it a draw for now,” analysts at Bernstein said.