The town of Longboat Key’s fiscal year 2025 mid-year report included some positives like investment income, but staff also acknowledge more work needs to be done.

Town Manager Howard Tipton and Finance Director Sue Smith presented the update on May 5 at the town’s regular meeting.

“It has been a remarkable seven months in this fiscal year since the hurricanes,” Tipton said.

The town’s fiscal year begins on Oct. 1 and runs through Sept. 30. Hurricanes Helene and Milton impacted the island at the end of September 2024 and early October 2024, which is near when FY25 started.

Positive yields on investment income were a large part of the positives Smith shared about the budget so far.

“We had a very favorable year,” Smith said. “If you want to look at some of the larger revenues, the one that stands out is our interest income on investments.”

Smith said, despite an expected drop in interest rates, they remained relatively firm. Yield rates remained generally stable, from 5.03% in 2023 to 5.19% in 2024.

Expecting the rate decrease, the town budgeted investment income of $441,000 for FY25, but the actual revenue is now closer to $1.4 million. Smith said $425,739 is unrealized, meaning the investment remains unsold and its value reflects current market prices.

When looking at the general fund budgeted revenue versus actual, charges for services are tracking to be $283,383 higher than budgeted. Increases in EMS fee rates resulted in about $120,000 of that increase.

Smith and Tipton also shared good news of the town’s recent audit of FY24 which received high marks and a clean review.

There are still about five months left in the current fiscal year, and finance department staff will stay on top of FY25 while also preparing for FY26.

“Moving forward, we’re going to continue to monitor the revenues and we’ll adjust spending when needed,” Smith said.

One of the biggest questions heading into the upcoming fiscal year is regarding the losses experienced from the hurricanes.

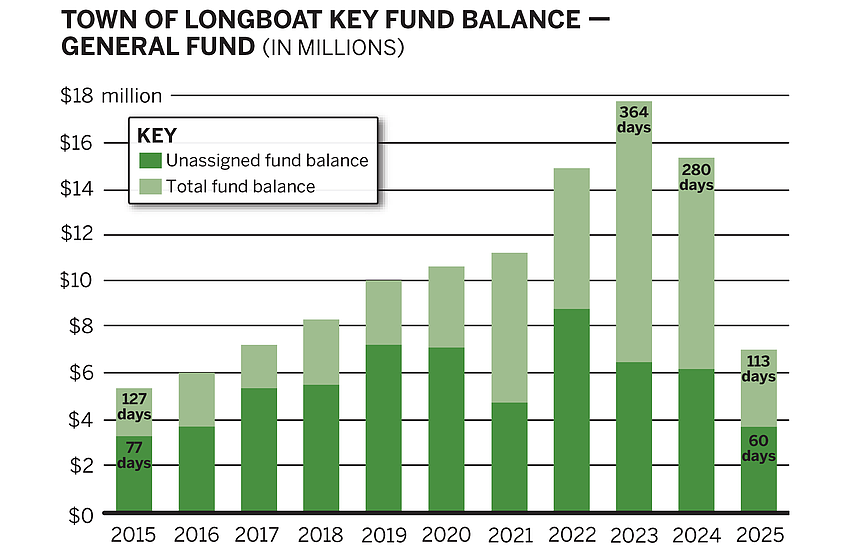

The town estimated about $5 million was drawn from the general fund to respond to Helene and Milton. Of that, about $4.2 million to $4.4 million was for debris removal.

The town had to draw from an emergency fund which sets money aside for natural disasters. Before the hurricanes, that fund was at $3.7 million, or 60 days of the town’s operating expenses.

The balance of the emergency fund within the general fund dwindled to $477,000 after the hurricanes.

As a whole, the remaining general fund balance in FY25 is about $7.04 million, or about 113 days of general fund operating expenses.

The fund policy outlines the preferred range should be between 120 days to 180 days of operating expenses. In FY24, the total fund balance was closer to 280 days.

Reimbursements are one of the principal ways for the town to recover the losses.

These expenditures, and others related to hurricane recovery, will likely be eligible for different categories of claims through the Federal Emergency Management Agency. The town could receive 75-100% reimbursement depending on the claim.

Smith said the town is working to stay on top of FEMA for those claims, but the process is slow. Over the coming months, it will be important for town staff to continue pressing for the reimbursements.

“We have meetings ongoing and we’re going to be making phone calls to our representative as well to help push this along, especially the Category A debris removal,” Smith said. “That’s the one we have to push because that’s the biggest chunk of our expense.”

Looking ahead, the town’s first public workshop for the FY26 budget will be at 10 a.m. on May 19 at the Longboat Key Town Hall (501 Bay Isles Road).