Main Street Capital Corp Reports Record Net Investment Income and Dividends in Q4 and Full Year 2023

-

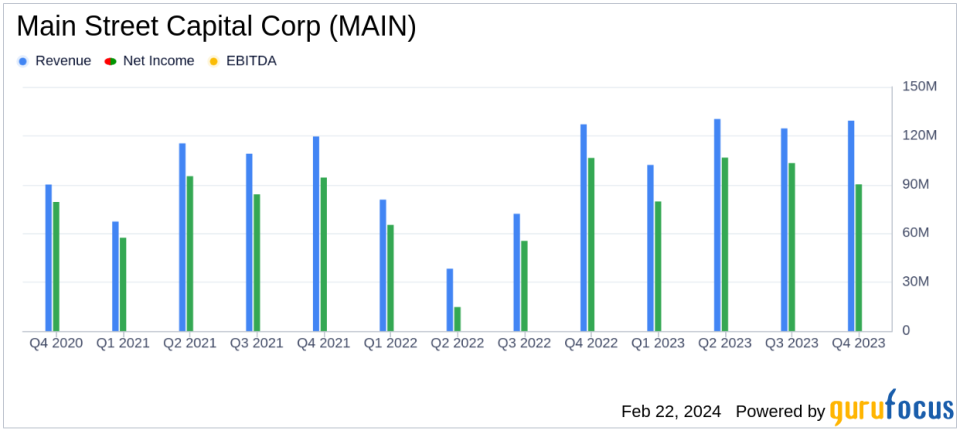

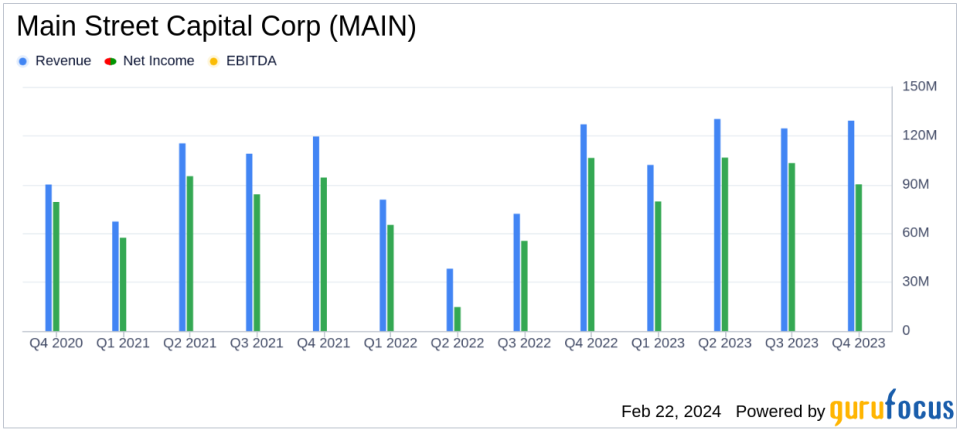

Net Investment Income: $90.1 million, or $1.07 per share for Q4; $339.0 million, or $4.14 per share for full year 2023.

-

Distributable Net Investment Income: $94.8 million, or $1.12 per share for Q4; $356.8 million, or $4.36 per share for full year 2023.

-

Net Asset Value (NAV): Increased to $29.20 per share, up 3.1% from Q3 2023.

-

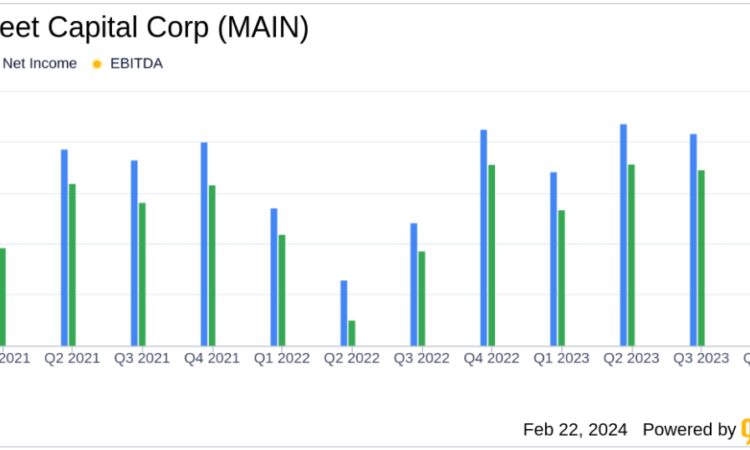

Total Investment Income: Rose to $129.3 million in Q4, a 14% increase year-over-year.

-

Dividends: Regular monthly dividends declared for Q1 2024 total $0.72 per share, a 6.7% increase from Q1 2023.

-

Portfolio Investments: Completed $92.3 million in LMM investments and $160.4 million in private loan investments in Q4.

-

Liquidity and Capital Resources: Aggregate liquidity of $1,125.1 million as of December 31, 2023.

Main Street Capital Corp (NYSE:MAIN) released its 8-K filing on February 22, 2024, announcing its financial results for the fourth quarter and full year ended December 31, 2023. MAIN, an investment firm specializing in debt and equity financing for lower and middle market companies, reported a net investment income of $90.1 million, or $1.07 per share, and distributable net investment income of $94.8 million, or $1.12 per share for the fourth quarter. The company’s net asset value per share increased to $29.20, reflecting a 3.1% rise from the previous quarter.

MAIN’s total investment income for the fourth quarter reached $129.3 million, a 14% increase from the same period in the previous year, driven by higher interest and dividend income. The company’s cost efficiency remained industry-leading, with an Operating Expenses to Assets Ratio of 1.3% on an annualized basis. MAIN also declared and paid a supplemental dividend of $0.275 per share, contributing to a total dividend of $0.98 per share for the fourth quarter, marking a 28.9% increase from the fourth quarter of 2022.

The company’s investment activities included $92.3 million in lower middle market (LMM) portfolio investments and $160.4 million in private loan portfolio investments. MAIN’s liquidity and capital resources were robust, with $1,125.1 million in aggregate liquidity, including cash and unused capacity under its credit facilities.

CEO Dwayne L. Hyzak commented on the company’s performance, stating, “We are extremely pleased with our performance in the fourth quarter, which closed another record year for Main Street across several key financial metrics.” He highlighted the company’s quarterly and annual records for net investment income per share and distributable net investment income per share, as well as a return on equity of approximately 19% for the full year.

“These results demonstrate the continued and sustainable strength of our overall platform, the benefits of our differentiated and diversified investment strategies, the unique contributions of our asset management business and the continued underlying strength and quality of our portfolio companies,” said Hyzak.

Looking ahead, MAIN is positioned for growth with strong liquidity and a conservative leverage profile, as it continues to focus on its lower middle market and private loan investment strategies.

For a more detailed discussion of the financial and other information included in this press release, please refer to the Main Street Annual Report on Form 10-K for the year ended December 31, 2023, to be filed with the Securities and Exchange Commission (www.sec.gov) and Main Streets Fourth Quarter 2023 Investor Presentation to be posted on the investor relations section of the Main Street website at https://www.mainstcapital.com.

Explore the complete 8-K earnings release (here) from Main Street Capital Corp for further details.

This article first appeared on GuruFocus.