Market Revenue & Forecasts, Existing and Upcoming Facilities, Retail and Wholesale Colocation Revenue

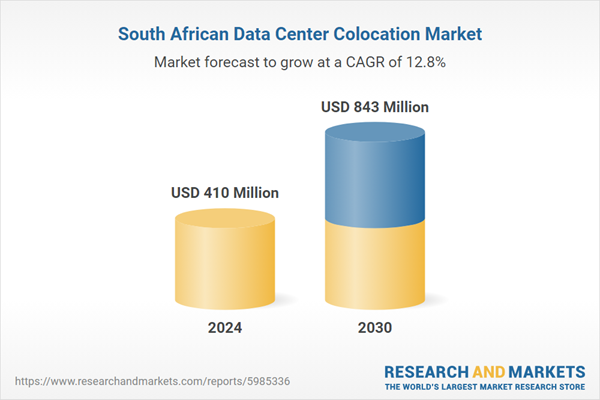

The South Africa Data Center Colocation Market is projected to grow from USD 410 million in 2024 to USD 843 million by 2030, with a CAGR of 12.76%. South Africa hosts 69 operational data centers as of December 2024, with plans for further investment and expansion. Johannesburg remains the central hub, with 15 existing and 6 planned data centers. The market is diversifying beyond Johannesburg, with major projects in Cape Town, Durban, and Centurion. Key expansions include a 20 MW AI-ready center in Cape Town by Africa Data Centres. The report covers market trends, colocation demand, and vendor landscapes, catering to REITs, construction firms, infrastructure providers, and more.

South African Data Center Colocation Market

Dublin, Nov. 24, 2025 (GLOBE NEWSWIRE) — The “South Africa Data Center Colocation Market – Supply & Demand Analysis 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

The South Africa Data Center Colocation Market was valued at USD 410 million in 2024, and is projected to reach USD 843 million by 2030, rising at a CAGR of 12.76%.

South Africa has around 69 operational colocation data centers, as of December 2024, and this number will increase over a period, as several existing and new companies have planned investments in the country.

Johannesburg continues to be South Africa’s hub for data center, marked by a concentrated growth in advanced facilities and dedicated cloud regions. There are 15 existing and 6 upcoming data centers in the city.

The data center ecosystem of South Africa is expanding beyond Johannesburg, with significant investments from prominent colocation providers in cities such as Cape Town, Durban, and Centurion. For instance, Africa Data Centres planned a 20 MW, AI-ready data center in Cape Town.

WHAT’S INCLUDED?

-

A transparent research methodology and insights on the colocation demand and supply aspect of the market.

-

Market size available in terms of utilized white floor area, IT power capacity and racks.

-

Market size available in terms of Core & Shell Vs Installed Vs Utilized IT Power Capacity, along with the occupancy %.

-

An assessment and snapshot of the colocation investment in South Africa.

-

The study of the existing South Africa data center market landscape, and insightful predictions about South Africa data center market size during the forecast period.

-

An analysis on the current and future colocation demand in South Africa by several industries.

-

Impact of AI on Data Center Industry in South Africa.

-

The study on sustainability status in South Africa.

-

Analysis on current and future cloud operations in South Africa.

-

The snapshot of upcoming submarine cables and existing cloud-on-ramps services in South Africa.

-

Snapshot of existing and upcoming third-party data center facilities in South Africa

-

Facilities Covered (Existing): 69

-

Facilities Identified (Upcoming): 9

-

Coverage: 28 locations

-

Existing vs. Upcoming (White Floor Area)

-

Existing vs. Upcoming (IT Load Capacity)

-

-

Data center colocation market in South Africa

-

Colocation Market Revenue & Forecast (2024-2030)

-

Retail Colocation Revenue (2024-2030)

-

Wholesale Colocation Revenue (2024-2030)

-

Retail Colocation Pricing along with Addons

-

Wholesale Colocation Pricing along with the pricing trends.

-

-

An analysis on the latest trends, potential opportunities, growth restraints, and prospects for the colocation data center industry in South Africa.

-

Competitive landscape, including market share analysis by the colocation operators based on IT power capacity and revenue.

-

Vendor landscape of each existing and upcoming colocation operators based on existing/ upcoming count of data centers, white floor area, IT power capacity and data center location.