Meta’s AI Investments, Llama Expansion, Ad Tech Growth Earn Analyst Conviction – Meta Platforms (NASDAQ:META)

On Thursday, Meta Platforms, Inc META stock is trading higher after multiple firms raised their price forecasts on the stock after the company reported better-than-expected fourth-quarter sales results yesterday.

- JMP Securities analyst Andrew Boone maintained Meta Platforms with a Market Outperform and a $750 price target.

- Rosenblatt analyst Barton Crockett reiterated Meta Platforms with a Buy and raised the price target from $811 to $846.

- Stifel analyst Mark Kelley maintained a Buy rating on Meta Platforms and set a price target of $740.

- Needham analyst Laura Martin reiterated Meta Platforms with an Underperform.

- Scotiabank analyst Nat Schindler maintained Meta Platforms with a Sector Perform and raised the price target from $583 to $627.

- Truist Securities analyst Youssef Squali reiterated Meta Platforms with a Buy and raised the price target from $700 to $770.

- Benchmark analyst Mark Zgutowicz upgraded Meta Platforms from Hold to Buy and a price target of $820.

- JP Morgan analyst Doug Anmuth maintained an Overweight on Meta Platforms with a price target of $725.

- RBC Capital analyst Brad Erickson reiterated Meta Platforms with an Outperform and raised the price target from $700 to $800.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained Meta Platforms with an Overweight and raised the price target from $720 to $790.

- Goldman Sachs analyst Eric Sheridan reiterated Meta Platforms with a Buy and raised the price target from $688 to $765.

- DA Davidson analyst Gil Luria maintained Meta Platforms with a Buy and raised the price target from $700 to $800.

- BofA Securities analyst Justin Post reiterated Meta Platforms with a Buy and raised the price target from $710 to $765.

- Morgan Stanley analyst Brian Nowak maintained Meta Platforms with an Overweight with a price target of $660.

JMP Securities: Boone continues to be impressed with Meta’s execution as it benefits from AI, improving the relevance of its content and ads in the near term. Notably, the analyst said it is still early in AI’s benefit to Meta’s core platform while it unlocks new services like Meta AI that could be meaningful over time.

With significant optionality in XR and the potential for Meta to create the next scaled consumer compute platform with Orion, he wants to continue to chase the shares as the Street continues not to give Meta credit for its FRL investments not to give Meta credit for its FRL investments while growth appears increasingly sustainable.

Rosenblatt: The fourth quarter of 2024 was a strong quarter for Meta but included things to digest, including higher spending in 2025 and a slower revenue growth pace in the first quarter of 2025, mainly due to foreign exchange.

Beyond that, Meta paints a compelling picture of how these investments can accelerate sales in the near and long term while improving cost trends in 2026 and beyond. Nobody is more bulled up on AI than Meta. And Meta might have more benefits to show from AI than anyone.

Stifel: Meta reported fourth-quarter results ahead and delivered first-quarter 2025 revenue guidance below the Street. Last week, the fiscal 2025 capital expenditure outlook was offered, and total expense guidance exceeded expectations.

The Llama investment cycle continues, with expectations for internal operational improvement, early wins on the consumer-facing side, and with advertisers.

Overall, Kelley does not expect the stock to move much post-print but remains positive on the overall health of the digital ads market, which should drive better-than-expected growth throughout the year.

Needham: Meta reported strong fourth-quarter of 2024 results. However, from their guidance, Martin would call out rapidly decelerating revenue and EPS growth, rapid FTE growth, and no respite from rapidly rising capital expenditure, which is disappointing given DeepSeek’s announcements this week.

Also, Meta promised “hundreds of billions of dollars” in long-term capital expenditure, suggesting 2025 is just the beginning of pressure on free cash flow and margins. Martin does not expect multiple expansions, given this outlook.

Scotiabank: Meta reported a fourth-quarter of 2024 revenue beat by ~3% (up ~21% Y/Y), even against tougher comps, with broad-based strength in advertising and family of apps.

Near the top of the list of investor concerns going into results were capex and depreciation trends, especially with the recent DeepSeek news.

While questions continue to circle DeepSeek, there are a few concerns, especially regarding Llama 3.1 405B. DeepSeek V3 and Llama 3.1 were trained in under two months, but V3 is 66% larger than Llama and used 88% fewer Nvidia Corp NVDA AI accelerators.

At a presumed rate of $2 per accelerator per hour, V3 costs $5.6 million, 14 times less than Llama. This continues to play into Schindler’s concerns that he had written about since his initiation: Meta may have trouble containing costs and driving monetization through AI over the coming few years. While Meta needs to invest heavily to stay on top of technology, it’s still too early to see if AI monetization will drive earnings growth.

Truist Securities: Squali remains constructive on Meta following more substantial fourth-quarter results and a bullish 2025 outlook.

The bullish outlook reflects ongoing improvements in ad performance from AI-driven recommendation & ranking algorithms fueling higher ad conversion and pricing; the upcoming launch of Llama 4 should power a growing roster of capabilities across Meta AI, commerce, and services; and sustained user growth and engagement built around Meta’s extensive family of apps.

While the race to AGI drives capital expenditure and operating expenditure materially higher than expected, Squali noted Meta has earned the right to invest.

JP Morgan: Meta delivered strong fourth-quarter results, along with a more mixed outlook primarily due to higher expenses, and framed 2025 as a defining year for most key long-term initiatives.

DeepSeek was a critical focus area for investors. While Meta does not have all the answers yet, management expects to be able to leverage DeepSeek’s advances and emphasized that Meta’s heavy investments in capex and infrastructure will be strategic advantages over time.

Anmuth remained bullish on Meta AI’s potential as it has considerable room to grow within Meta’s 3.35B Family DAP and expects a wide range of e-commerce & services functionality to be added this year driven by Llama 4.

RBC Capital: Meta’s fourth quarter was good. The company beat and raised, laid out a host of new product and monetization drivers into 2026, and was compelling in defending and reiterating its ambitious AI spending plans given the recent DeepSeek controversy.

Erickson raised his fiscal 2025-2027 estimates, introduced his 2028 estimates, and raised his price target. Valuation and bull case awareness levels are the primary nitpicks.

Still, given the company’s leading position in AI, broad opportunities to grow utility for its users, and differentiated optionality stemming from compute capacity, Erickson noted that only the most select group of companies might be as comprehensively well-prepared to fully or over-participate in the long-term adoption of AI.

Goldman Sachs: Over the long term, Sheridan continues to see Meta as focused less on the forward 6-12 months and more on long-term opportunities with an increased focus on aligning investments across a world-class computing infrastructure, open-source software initiatives, and a raised range of forward capital expenditure.

The analyst remains focused on increased levels of visibility into rates of investment and return profile on such investments as critical to a better understanding of the compounded earnings potential from 2025 through 2028.

He sees Meta as well-positioned against several long-term secular growth themes. He is encouraged by the positive momentum across key product initiatives, including Reels, click-to-messaging Ads, AI, and Advantage+ adoption.

DA Davidson: The rating reflected fourth-quarter earnings that beat top and bottom-line expectations. Meta’s Family of Apps strengthened as the company continues to integrate AI into its products.

Management expects 2025 to be a defining year for the company in relation to its AI ambitions, with Mark Zuckerberg highlighting several anticipated developments, including the release of Llama-4.

BofA Securities: While earnings momentum will stall in 2025, Post noted Meta sent an upbeat tone on an “exciting product roadmap” for Meta AI, Llama, Meta Coding agent, and Meta AI glasses and an “opportunity to deliver strong revenue growth” without any real headwind warnings.

Post noted that a higher multiple is justified as Meta’s Al-driven ad improvements are still early. Meta is building considerable AI assets with an internal Al supercomputer, in-house LLM, and custom Al chips to leverage massive Facebook, Instagram, and messaging user pools.

Morgan Stanley: Meta remains the cleanest GPU-enabled winner in the sector. It is investing more than expected, but revenue, engagement, and pipeline are all shining.

The price target is unchanged, but the bull case rises to $900 as Nowak detailed revenue acceleration and a pipeline that could drive multiple expansions to the bull case.

Price Action: META stock is up 2.40% at $692.71 at the last check Thursday.

Also Read:

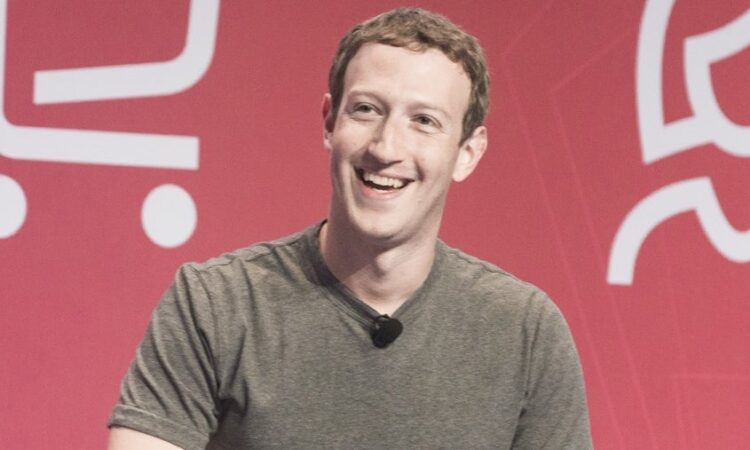

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.