Andrii Yalanskyi

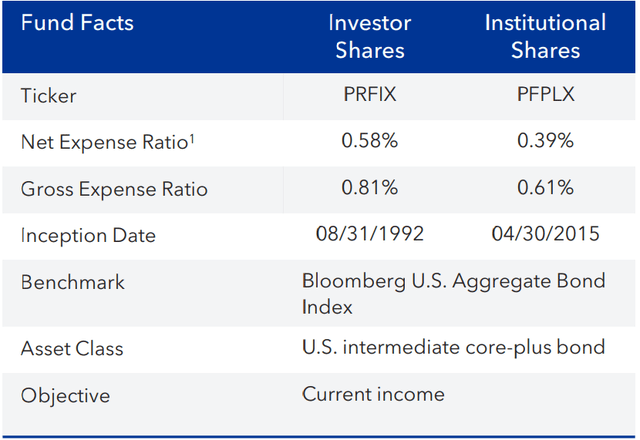

The strategy pursues an attractive level of current income by owning a core-plus bond portfolio with a significant allocation to green/sustainable bonds that further climate and sustainability goals.

Market Review

Federal Reserve rate policy continues to drive returns

U.S. economic growth slowed during the quarter as consumer spending, building permits and housing starts weakened. Stubbornly high inflation eased in June as better-than-expected price data showed decelerating growth. Amid weaker economic data, yields were volatile, continuing their year-to-date rise in April but finishing the period relatively unchanged. Higher activity in corporate debt issuance, coupled with political uncertainty, caused spreads to widen, paring corporate bond gains. Credit spreads, though, remained near historically tight levels as the continued health of corporate balance sheets kept the risk of defaults low. Rapidly changing opinions about the future direction of rate cuts amid mixed economic data led to heightened volatility, and the rally in Treasuries that started in early June stalled as the month ended.

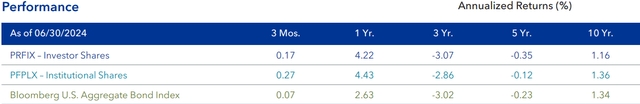

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Performance Review

Demand for corporate credit remained strong, aiding results Parnassus Fixed Income Fund (Investor Shares) returned 0.17% for the second quarter period, outperforming the nearly flat 0.07% return for the Bloomberg U.S. Aggregate Bond Index. The portfolio maintained an average duration (6.6 years) that was relatively close to that of the index (6.2 years) as spreads widened.

While the corporate bond overweight detracted from the fund’s relative returns, security selection within corporate bonds aided the fund’s performance. Security selection in government-related bonds also aided results, while an underweight to Treasuries hampered relative performance.

The portfolio’s overweight to corporate bonds drove the majority of portfolio returns as these issues continued to benefit from a strong economy. Among corporate bonds, selection within and an overweight to the Financial Institutions sector helped relative performance due to balance sheet strength, ample interest rate coverage and robust demand for new issuance ahead of potential rate cuts. Relative performance was also aided by security selection among Industrial sector corporate bonds, but an overweight to the Industrial sector detracted.

The portfolio’s underweight to Treasuries was a modest detractor. Treasuries and government-related bonds outperformed in a volatile environment that first saw government bonds rally in a flight to quality but pare gains near the end of the period.

Among securitized bonds, our selection within mortgage-backed securities helped relative performance. Mortgage rates remained elevated, while defaults were low.

Portfolio Positioning

Finding return opportunities across asset classes

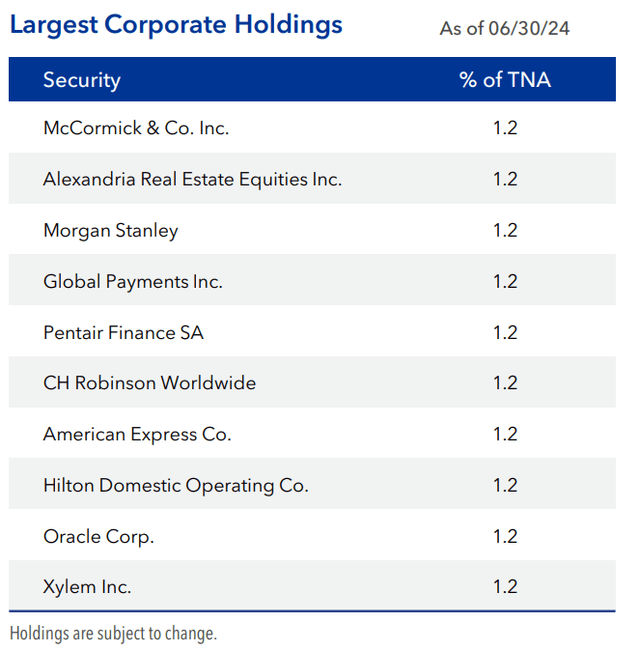

While we believe that corporate bonds provide the best long-term returns because they have higher initial yields, we have further reduced our exposure to the asset class. Credit spreads are historically tight, meaning that investors anticipate a continued strong economy and are willing to accept less yield for less credit risk. We agree that most companies are in excellent financial condition but are seeing opportunities away from corporate bonds, including in mortgage-backed securities. Our allocation to corporate bonds fell from 60% in the first quarter to about 57% at the end of the second quarter. By contrast, the fund typically holds about 70% of assets in corporate bonds. We maintain our overweight position relative to the index because we believe in the long-term prospects of our corporate holdings.

Our portfolio allocation to mortgage-backed bonds stands at 14%, up from about 8% at the end of last year. These bonds have been disproportionately impacted by higher interest rates, as homeowners are locked into their existing mortgages and the government is no longer purchasing the securities as part of its quantitative easing programs. We think mortgage-backed securities are poised to perform well should yields fall.

We added a new green bond issued by Dominion Energy during the quarter. We can purchase green bonds from issuers that might otherwise be outside of Parnassus’ sustainable investment scope because these bonds provide funding to help companies transition away from fossil fuels and into renewable energy sources. We are excited to support that effort and think these bonds are an attractive addition to the portfolio. We exited Discover Financial, based on its potential upcoming merger with Capital One, and exited Block due to concerns about the regulatory environment.

Outlook

The economy softens from a position of strength

As we anticipated last spring, the Federal Reserve (Fed) has continued to reduce its forecast for interest rate cuts this year. Outside of housing, the economy has proved resilient despite interest rate hikes, making it difficult for the Fed to justify reducing its policy rate. However, most of that data has been backward-looking, and we see indications that the economy is cooling into the second half of the year. Certain consumer metrics, from spending to subprime delinquencies to confidence, are showing signs of weakness. The economy is starting from a particularly strong position, which should help mitigate some of the impacts of a slowdown.

Given this data, we began insulating the portfolio from the impacts of a slower economy. Some of those changes include reducing the exposure to corporate bonds, as discussed above. As part of these moves, we’ve also reduced the duration of our corporate portfolio. This makes our corporate bonds less sensitive to interest rate and credit spread changes. We’ve also extended the duration of our Treasury portfolio. We believe that interest rates are nearer the peak than the trough, and Treasuries are likely to benefit as the economy normalizes. We remain diligent in monitoring the data and alert to making further changes to the portfolio in response to changing conditions.

Portfolio Managers

Samantha Palm, Portfolio Manager, Senior Analyst

Minh Bui, Portfolio Manager, Senior Analyst

|

Glossary Green Bond: A fixed-income instrument designed to support a specific climate-related or environmental project. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The30-DaySECYieldis computed under an SEC standardized formula based on net income earned over the past 30 days. It is a “subsidized” yield, which means it includes contractual expense reimbursements and it would be lower without those reimbursements. The Unsubsidized 30-Day SEC Yield is computed under an SEC standardized formula based on net income earned over the past 30 days. It excludes contractual expense reimbursements, resulting in a lower yield.

|

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.