Green shoots are emerging in commercial real estate, signaling a cautiously optimistic outlook for the sector despite ongoing challenges with the capital environment.

Office-to-residential conversions are on the rise as developers seize on declining office property values. Rapid advancements in AI are triggering increasing demand for data centers. Meanwhile, e-commerce is reshaping retail real estate and bolstering investor appetite for industrial properties.

Real estate deal value started to rise last year, with investors particularly keen on niche investments such as student housing. This year’s outlook for real estate dealmaking remains uncertain. The Federal Reserve is holding interest rates steady as it monitors whether inflation resurges, with tariffs potentially adding upward pressure on prices.

At Goodwin’s RECM Conference on March 6, which we co-host with Columbia Business School, real estate thought leaders will offer insights on some of the forces set to spur growth in real estate this year and beyond.

Below are real estate trends we’re thinking about as we approach our conference.

Office Conversions Gain Steam

With office vacancy rates remaining elevated and office property values declining, developers are increasingly finding that the time is right to convert empty offices into residential units.

Seventy-three office conversions were completed in the US as of the third quarter of 2024, up from 63 for all of 2023 and the highest level for records tracing back to 2016, according to commercial real estate investment firm CBRE.

The momentum is picking up. CBRE estimated that an additional 279 office conversion projects would be completed in 2025 and beyond, with most of them office to residential.

Of course, the economics of office conversions don’t always work out, and it’s essential that developers consider many different regulatory and financial challenges. But conversions offer huge potential to help revitalize downtown business districts that are still struggling with the pandemic-driven shift to hybrid work.

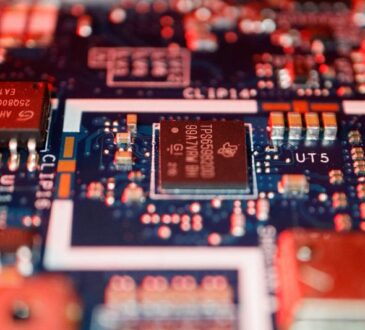

AI Drives Massive Demand for Data Centers

Significant investments in AI are boosting the need for powerful, efficient data centers. The US colocation data center market has doubled in size since 2020, according to JLL Research’s mid-year 2024 report.

More construction of data centers is on the way. The Trump administration, in collaboration with technology companies, has announced up to $500 billion in private investments for the construction of AI infrastructure.

Unsatiable demand helped drive the data center vacancy rate to a record low 3% in mid-2024, per JLL Research. As AI transitions from training models to full-scale commercial use, demand for infrastructure and real estate to support AI will only increase. As a result, data center vacancy rates could trend even lower.

E-commerce Growth Helps Reshape Retail Real Estate

The rise of e-commerce was once seen as a threat to brick-and-mortar retail. Contrary to those projections, however, e-commerce has helped boost the appeal of some physical stores in recent years.

Many traditional retailers have successfully implemented services such as curbside pickup that reinforce the importance of physical stores. E-commerce retailers are also increasingly opening up in-person stores so that customers can pick up items and process returns.

Open-air shopping centers are effectively leveraging their physical spaces, as evidenced by rising occupancy rates. As online retail sales grow, these shopping centers will likely focus even more on facilitating online pickups and returns.

Industrial Properties Remain Attractive Investments

E-commerce has fueled a surge in demand for industrial properties in recent years.

The industrial sector experienced the largest growth in market cap of any property type between 2018 and 2024, followed by data centers and self-storage facilities, according to JLL Research.

Real estate investors expect that the sector’s strength will continue. According to the Deloitte 2025 commercial real estate outlook survey, investors see the industrial sector as offering the greatest opportunities in the next 12 to 18 months (with digital economy and multifamily ranking second and third, respectively).

Will Real Estate Deal Value Rebound?

Real estate dealmaking started to improve last year after a slowdown driven by monetary policy tightening. Deal value in North America rose to $73.6 billion in the first nine months of 2024, a 5% increase from the comparable prior-year period, according to investment data company Preqin.

Real estate deal value is still down from the boom days of the pandemic and faces an uncertain future, with the path of interest rates hinging on the trajectory of inflation.

Student Housing and Other Niche Sectors Emerge as Hot Investments

Niche real estate including student housing, senior living, and healthcare are seeing strong gains in transaction value. The niche sector accounted for 7.7% of North American deal value in the third quarter of 2024, up from 3.3% in 2020, according to Preqin.

Investor interest in student accommodation has surged. Last year, student accommodation funds across the globe were set for their best fundraising year since 2019, Preqin figures show.

Student accommodation and many other niche sectors also fall under operational real estate (OpRE), where investment returns are closely tied to management and property operations. As property types such as offices face challenges, investors will continue looking beyond traditional asset classes to these OpRE sectors.

[View source.]