The SA suburbs where investment performance was higher than interest rates and inflation

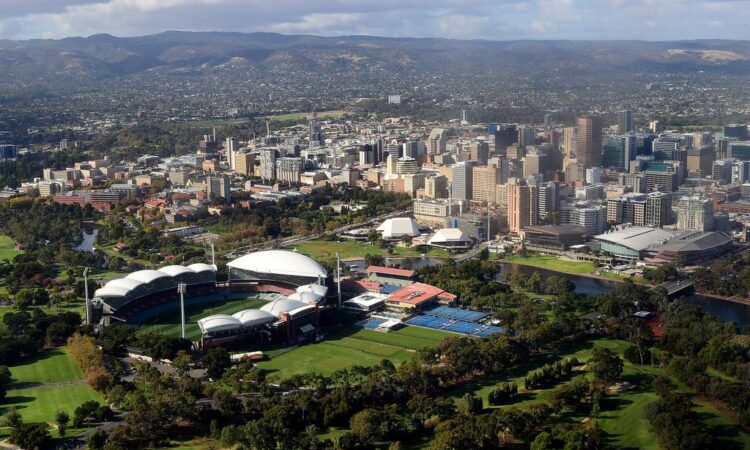

Adelaide has one of the tightest rental markets across Australia, making it a hotspot for potential investors. Picture: supplied.

A “peaceful” riverside community and two well-serviced inner-city suburbs are among some of the best spots to park your property investment dollars in Adelaide, new data shows.

According to PropTrack, units in New Port, Enfield and Renown Park boast the strongest rental yields for landlords heading into 2024 – recording returns of over seven per cent.

Data canvased also highlighted favourable investment opportunities for both houses and units in Adelaide’s north and north west, where 15 suburbs recorded yields well over six per cent.

This included Bedford Park, Lightsview, Woodforde, St Marys, Ovingham, Mawson Lakes, Salisbury East, Elizabeth South, Tranmere, Prospect, Kilburn, St Claire, Walkerville, Paralowie and Semaphore.

MORE NEWS

Where properties are being snapped up in just weeks

How much property prices are tipped to rise in 2024

Would you renovate this home to get into its popular suburb?

How is this for a view? The New Port property at 602/2-6 Pilla Ave sold in October for $645,000. Picture: realestate.com.au

Meanwhile, at least 54 suburbs across greater Adelaide recorded yields of over five per cent.

PropTrack senior economist Paul Ryan said the figures painted a compelling picture for investors keen for a small slice of the fast-growing South Aussie capital.

He said the number of suburbs recording yields over five per cent was significantly lower (around 30 per cent) than figures recorded two years ago, however this was about to change.

“We’ve seen property prices increase faster than rents, so that has pushed yields down and at the same time, we’ve obviously had mortgage rates increase quite sharply,” Mr Ryan said.

“Of course, we’ve now seen really strong rental growth.

“Across Adelaide, rents increased by 11 per cent over the past year.

“I would expect that we will get more strong rent growth over the next year, more than we will likely see property prices grow … meaning yields will start to improve and we’ll likely see more suburbs over the five per cent mark.”

This one bedroom New Port apartment at 507/2-6 Pilla Ave sold in December for $389,333. Picture: realestate.com.au

Sales specialist Carmine Catalano, of Ray White West Torrens, said he wasn’t surprised to see New Port, a “peaceful and secure” riverfront community in Adelaide’s inner northwest, emerge on top.

He said affordable property prices in a great locale had made the suburb a buyer hot spot, particularly for those looking to invest in Adelaide’s unit market.

According to PropTrack, New Port currently has a median unit price of $345,000 – $105,000 lower than the greater Adelaide average.

Meanwhile, the average home rents for $530 a week, $80 more than the Adelaide average, delivering SA’s strongest rental investment return of 7.99 per cent.

“New Port is actually really peaceful and just has a really good community vibe to it, it feels really safe,” Mr Catalano said.

“Homes here, which are predominantly units, seem to appeal to downsizers and retirees in particular, but because of affordability, it’s also a great location for first-home buyers.”

Regionally, properties in Coober Pedy, Solomontown, Peterborough and Port Pirie West delivered the highest investment return with gross rental yields of more than nine per cent.

Adelaide suburbs with rental yields above 5 per cent

New Port – 7.99%

Enfield – 7.01%

Renown Park – 7%

Bedford Park – 6.53%

Lightsview – 6.50%

Woodforde – 6.44%

St Marys – 6.39%

Ovingham – 6.32%

Mawson Lakes – 6.24%

Salisbury East – 6.22%

Elizabeth South – 6.18%

Tranmere – 6.12%

Prospect – 6.11%

Kilburn – 6.11%

St Claire – 6.09%

Walkerville – 6.08%

Paralowie – 6.05%

Semaphore – 6.05%

Seaford Meadows – 5.91%

Munno Para – 5.91%

Adelaide – 5.86%

Alberton – 5.83%

Hawthorn – 5.79%

Newton – 5.75%

Elizabeth North – 5.72%

Davoren Park – 5.70%

Westbourne Park – 5.68%

Woodville North – 5.62%

Goodwood – 5.58%

Highgate – 5.58%

Brooklyn Park – 5.52%

Kent Town – 5.47%

Marden – 5.44%

Plympton – 5.41%

Salisbury North – 5.41%

Royal Park – 5.41%

Elizabeth Towns – 5.40%

Smithfield Plains – 5.39%

Camden Park – 5.39%

Gawler South – 5.37%

Salisbury – 5.36%

Toorak Gardens – 5.35%

Woodville South – 5.34%

Evanston – 5.34%

Elizabeth – 5.33%

Munno Para West – 5.33%

Broadview – 5.32%

Payneham South – 5.32%

Blakeview – 5.31%

Elizabeth Park – 5.29%

Black Forest – 5.28%

Hope Valley – 5.28%

Henley Beach South – 5.27%

Bowden – 5.24%

Glenside – 5.24%

Smithfield – 5.24%

Evanston Park – 5.23%

Edwardstown – 5.20%

Woodville – 5.16%

Findon – 5.15%

North Adelaide – 5.15%

Marleston – 5.14%

Grange – 5.09%

Andrews Farm – 5.09%

Oaklands Park – 5.08%

Brompton – 5.04%

Craigmore – 5.04%

Christie Downs – 5.04%

Clarence Park – 5.02%

Hackham – 5%

Salisbury Park – 5%

Mitchell Park – 5%

Regional areas with rental yields over 5 per cent

Coober Pedy – 9.49%

Solomontown – 9.35%

Peterborough – 9.32%

Port Pirie West – 9.91%

Whyalla Playford – 8.18%

Whyalla Norrie – 8.05%

Whyalla Stuart – 7.58%

Port Augusta – 7.56%

Roxby Downs – 7.17%

Ceduna – 7%

Whyalla Jenkins – 6.71%

Bordertown – 6.62%

Risdon Park – 6.58%

Port Augusta West – 6.55%

Tailem Bend – 6.48%

Port Pirie South – 6.39%

Renmark – 5.99%

Balaklava – 5.91%

Barmera – 5.82%

Loxton – 5.77%

Berri – 6.62%

Murray Bridge – 5.53%

Whyalla – 5.52%

Waikerie – 5.36%

Whyalla Playford – 5.33%

Port Lincoln – 5.32%

Kapunda – 5.30%

Port Broughton – 5.15%

Mount Gambier- 5.07%

Port MacDonnell – 5.05%

Mount Barker – 5.03%

(Source: PropTrack)