UK-based Entain PLC’s (GB:ENT) U.S. sports betting and iGaming business, BetMGM, achieved $1 billion in sales in the first half of 2024, marking a 6% year-over-year growth. However, BetMGM incurred a loss of $123 million, mainly due to higher marketing investments. Entain’s shares declined by nearly 8% as of writing.

Based in London, Entain is a gaming and sports betting company that owns brands like Bwin, Ladbrokes, Partypoker, and PartyCasino. Meanwhile, BetMGM is a leader in sports betting and iGaming in the U.S., jointly owned by Entain and the U.S.-based MGM Resorts (MGM).

BetMGM First-Half Update

Among BetMGM’s revenues, Online Sports Betting NGR (net gaming revenue) per active user rose 16% year-on-year in the second quarter. Meanwhile, iGaming saw an 18% year-on-year increase in average monthly actives, marking an acceleration from 9% growth in the first quarter.

In the first half, BetMGM expanded its geographic footprint by launching digital sports betting in North Carolina in March and across the District of Columbia in July.

Moving forward, BetMGM stated that it has surpassed its targets for both customer acquisition and retention and expects this to result in higher year-over-year revenue growth in the second half of the year.

Are Entain Shares a Good Buy?

Analyst Ed Young from Morgan Stanley expressed his confidence in BetMGM’s outlook in the U.S. He expects it to achieve a significant position in the large U.S. market with increased investments.

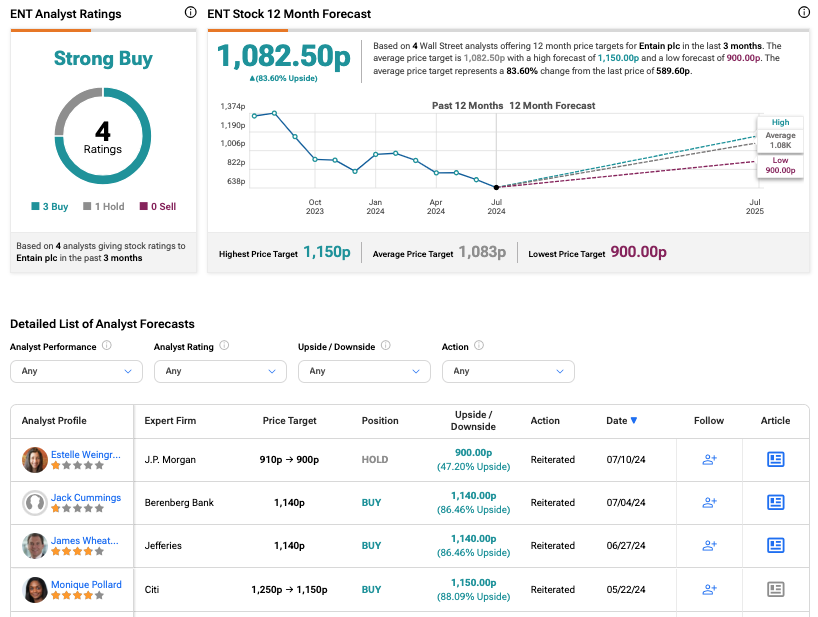

According to TipRanks consensus, ENT stock has received a Strong Buy rating, backed by three Buys and one Hold recommendation. The Entain share price prediction is 1,082.50p, which is 83.6% higher than the current trading levels.

Year-to-date, ENT stock has lost 40% of its value in trading.