Olemedia

Cloud Computing Background

The momentum surrounding AI that was unleashed in 2023 continues to grow, and one thing we have learned is that cloud infrastructure is a critical part of the growth in AI. According to Microsoft (MSFT), cloud computing is:

“The delivery of computing services—including servers, storage, databases, networking, software, analytics, and intelligence—over the internet (“the cloud”) to offer faster innovation, flexible resources, and economies of scale.”

The benefits of cloud computing to companies include cost savings, on-demand access to computing power, economies of scale, performance tied to a network of data centers with state-of-the-art hardware, security, and disaster recovery. The growth outlook for cloud computing is bright and is estimated at 16.5% per year through 2032[1]. So how does an investor gain exposure to companies focused on this space? The answer is not as clear as you might think.

Companies involved in cloud computing can be broken into two categories. There are firms that have most of their revenue tied to cloud related services, which we refer to as “pure plays.” Equinix, Inc. (EQIX) (a cloud data center) and Arista Networks (ANET) (cloud networking software) are examples of such pure plays, as they each have 100% of their revenue tied to cloud computing.

The other category is large, technology-based firms with a cloud related product line(s) that in total are less than 50% of revenue. For example, Cloud Computing services represent roughly 38% and 16% of revenue for Microsoft and Amazon (AMZN), respectively.

The distinction between pure plays and the large, diversified tech players is important when evaluating the holdings of an ETF. When you look across the product lines of the S&P 500, cloud computing represents just under 5% of the total weight in the index. However, when the exposure is measured by a company’s primary business line, the weight in the index is less than 1%. This highlights much of the exposure to cloud computing is held as secondary and tertiary business lines of large companies, with relatively little weight allocated to pure play cloud computing companies.

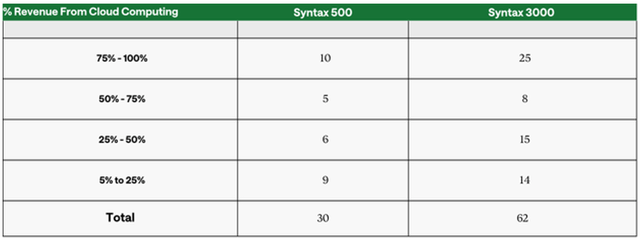

This fact makes it difficult to construct a diversified cloud computing portfolio focusing on pure play companies alone. To illustrate this point, in Exhibit 1, we breakdown the companies in the Syntax 500 (US large cap) and Syntax 3000 (US total market) universes by the percentage of their revenue attributable to cloud computing.

Exhibit 1: Distribution of Cloud Computing Revenue % in the Syntax 500 and Syntax 3000 Universes

Number of companies as of March 31, 2024. (Source: Syntax Data)

The results show:

- In the Syntax 500, just one third of the 30 companies with any exposure to cloud computing have 75% or more of their revenue tied to the cloud, while in the Syntax 3000 the number is about 40%.

- In both universes, about half have a majority of their revenue from cloud computing, implying the other half of revenue is not related to the cloud. Increasing the universe from the Syntax 500 to Syntax 3000 roughly doubles the number of companies with any cloud computing exposure.

- Increasing the universe from the Syntax 500 to Syntax 3000 roughly doubles the number of companies with any cloud computing exposure.

A takeaway from this analysis is that there is a limited universe of pure play companies to choose from, and if you would like exposure to the various components of cloud computing, you will need to invest in both pure play and diversified large companies.

Analyzing The Cloud Computing ETF Market

A takeaway from this analysis is that there is a limited universe of pure play companies to choose from, and if you would like exposure to the various components of cloud computing, you will need to invest in both pure play and diversified large companies.

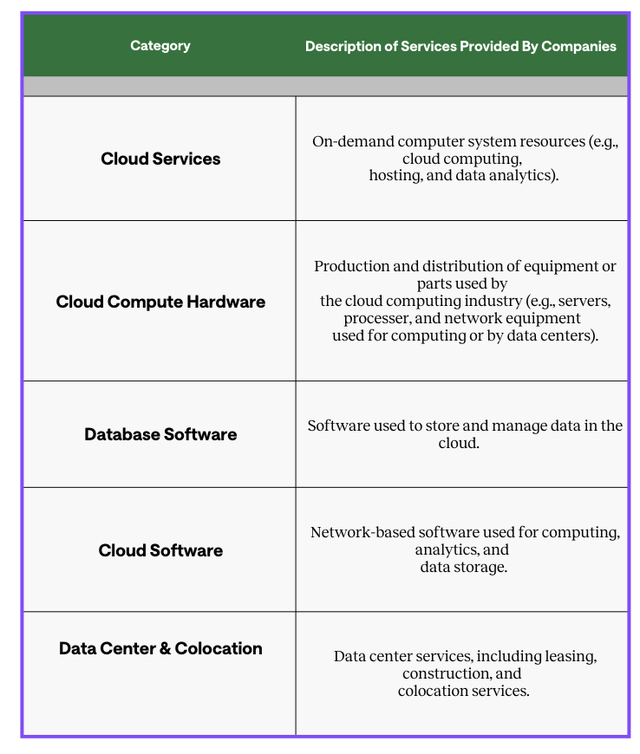

Exhibit 2: Syntax Cloud Computing Lens Components

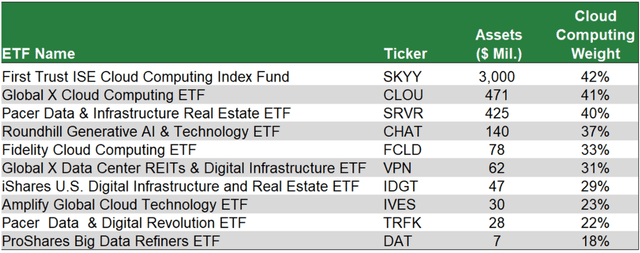

The results of our screen are shown in Exhibit 3.

Exhibit 3: ETFs With Meaningful Cloud Computing Exposure

Highlights from the exhibit include:

- The ETFs shown have Cloud Computing exposure ranging from 18% to 42%.

- The First Trust ISE Cloud Computing Index Fund at $3 billion in assets is the largest ETF by a wide margin. The Global X Cloud Computing ETF and the Pacer Data and Infrastructure Real Estate ETF have meaningful assets at $472 million and $425 million, respectively.

- The ETFs have varied themes referenced in their names. Four ETFs have “Cloud Computing” or “Cloud” in their name; other wording includes “Digital Infrastructure,” “Data Center,” and “Big Data.”

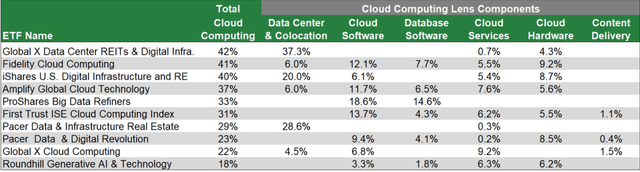

To better assess what the focus of the cloud computing exposure is in each of these ETFs, we expanded our analysis in Exhibit 4 to show the six components that comprise our Cloud Computing Lens. This table is sorted by the Total Cloud Computing exposure from highest to lowest.

Exhibit 4: Exposure To Cloud Computing Components

The ETFs have varying exposures to cloud computing in total and its components.

- The largest weight to cloud computing is 42%, reinforcing the fact there are limited pure play opportunities.

- Six of the ETFs have exposure to Data Centers, including the top four ETFs by concentration weight. Note that many of these companies are organized as REITs and are typically classified in the Real Estate sector.

- Exposure to Cloud Services and Cloud Hardware is found in most of the ETFs. The exposure to Software (Cloud and Database Software combined) is roughly 50% or more in five of the ten ETFs.

- Diversification levels vary within the ETFs: four ETFs are invested in five categories of the six components within the Cloud Computing Lens, three are invested in four categories.

Conclusions

The cloud computing investment landscape is a complicated and nuanced space. Based on Syntax’s product line classification data, we can cultivate a better understanding of the opportunities provided by cloud computing ETFs. We identified the top 10 ETFs with meaningful allocations to this space and showed:

- The ETFs analyzed covered a variety of named themes in their titles, including “Cloud Computing,” “Digital Infrastructure,” “Big Data” and “Generative AI.”

- As many cloud computing companies are not pure plays, it is difficult to construct a portfolio with substantial exposure to cloud computing [PK1]. However, there are three ETFs with between 40% – 42% of their assets in Cloud Computing per our analysis.

- There are four ETFs with over $100 million in assets, with the largest having roughly $3 billion in assets.

We highlighted how the market is split between companies that can be considered pure plays and firms where cloud computing business lines are a minority of their revenue. EFT issuers may choose to invest in large tech companies like Microsoft and Amazon to gain exposure to the Cloud Services segment of the market, which makes sense. The challenge is, for example, Cloud Services represent just 16% of Amazon’s total revenue, which means the ETF also has exposure to the 84% of Amazon’s revenue tied to their e-commerce and other business lines. This is one of the reasons why most of the 10 ETFs we analyzed total exposure to our Cloud Computing Lens was in the range of roughly 25%-45%. The takeaway here is that ETFs focused on the full range of cloud computing opportunities will be a combination of cloud computing and other technologies. We believe this underscores the need to move beyond the name of the ETF and focus on its holdings at the product line level.

Additionally, for investors that have significant exposure to the S&P 500, they need to be aware of whether they may be doubling up on the concentration risk in certain large tech companies.

Investors should realize as well that there is some subjectivity associated with defining an investment category or theme such as cloud computing based on the nuances above. Individuals and firms will have different perspectives, so it is difficult to say one view is better than another. What we do believe, however, is when investing in a theme, it should be clearly defined. It also reinforces the need to look beyond sectors: cloud computing is an amalgamation of different business lines that cut across sectors, hence the need to identify and quantity these exposures as done using our Cloud Computing Lens.

Footnote

1] Cloud Computing Market Size, Share, Value & Forecast [2032] (fortunebusinessinsights.com)

Original Source: Author