seb_ra

Upwork (NASDAQ:UPWK) stands out as a “worth-having” stock for a well-diversified portfolio. An idea with high optionality, offering investors an exposure to a growing market with immense potential. If you are a long-term investor and believe that the freelancing industry will continue its digitalization process, Upwork’s represents a very well-balanced risk/reward stock to invest in.

The idea of Upwork means talking about a great risk-reward binomial stock based on the optionality you get for the price you pay.

In this article, my objective is to explain both sides, why do I think there is a great optionality and why do I believe that at this price the market is implicitly not valuing it.

Upwork’s Optionality

To understand its attractive “optionality” we must focus on its business, in specific, on its free-cash flow generation potential which is, of course, dependent on two things: growths rates and returns on invested capital.

Growth

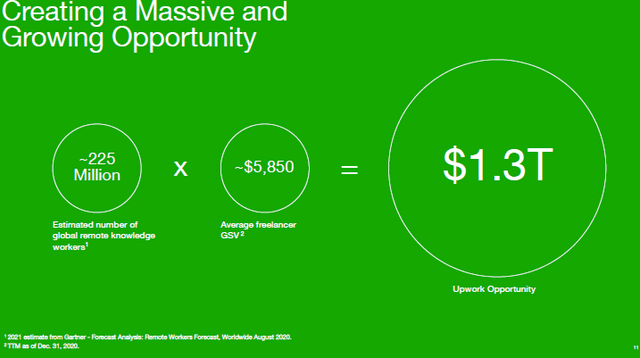

In the case of Upwork, here it is where its optionality is mostly derived from. In particular, the most important factor it is to understand its huge TAM.

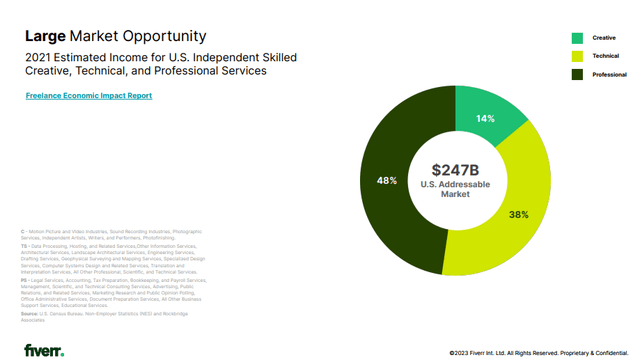

Upwork’s product consist of an online platform interconnecting jobs and talents (freelancers). Freelancers looking for jobs sign up into the platform offering its services. Enterprises looking for talent become Upwork’s customers when posting job needs and “hiring” freelancers’ services. As explained by its main players, we are talking about a massive and growing opportunity, in which Upwork currently stands as the market leader.

Company website Company website

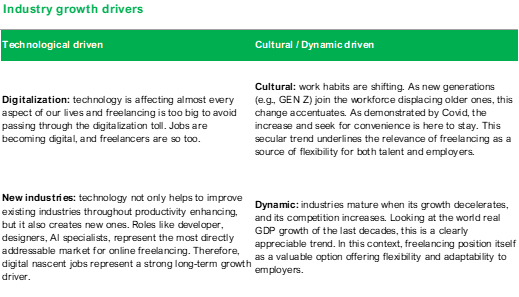

The growth of the online freelance industry, defining online freelance as an individual working for himself offering services to multiple clients through the internet, is driven by very solid fundamentals. As shown below, I highlight four key drivers divided in two categories: technological and cultural/dynamic driven forces.

Own analysis

The relevance is that we are talking about the impact of the technology and whether the freelancing industry can avoid its effect or not. Despite certain psychological/cultural aspects might act as barriers, technology is absorbing and changing almost every part of our lives, and I do not find reasons strong enough to think that labor will be an exception.

Knowing that, the reason I think Upwork will benefit from this growth is because it is the leader of the industry, it is well positioned with recurrent and loyalty large enterprises (refer to cohort behavior analysis), and it has both the product and the name.

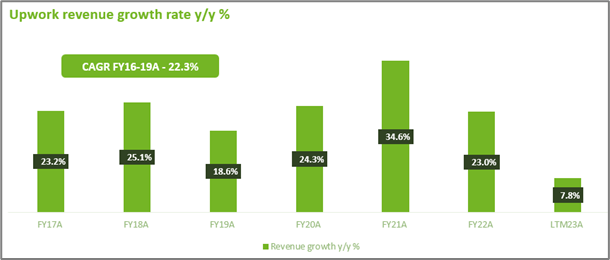

For valuation purposes, a way to estimate a reasonable and sustainable medium to long-term growth rate for the Company is to look at both industry outlook reports, in which growth estimations range from 14% to 17% CAGR for the next 5 to 7 years, and to Upwork’s historical performance. Note that, when looking at Upwork financials, we should focus on growth rates prior to COVID-19, as 2023 has demonstrated that Covid growth rates are non-recurrent.

Company filings & Own analysis

Therefore, considering Upwork historical growth trajectory alongside industry estimations, I believe reasonable to assume a mid-low double-digit growth for the medium to long term future.

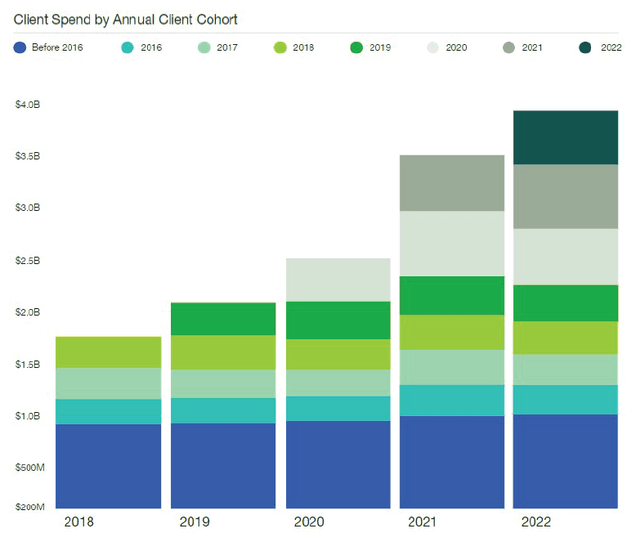

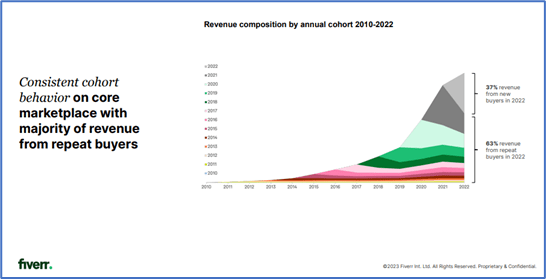

As already mentioned, there is one KPI from both Upwork and its main competitor Fiverr that reinforces this view of “sustainable long-term growth rates” and that it is the current online freelancing clients’ cohort behavior. This data evidences that retention and recurrence levels among their customers bases are remarkably strong, particularly in the case of Upwork, given its skewness to large size companies.

Client spend by Annual Client cohort – FY22A (Company filings) Revenue composition by annual cohort 2010-2022 (Company website)

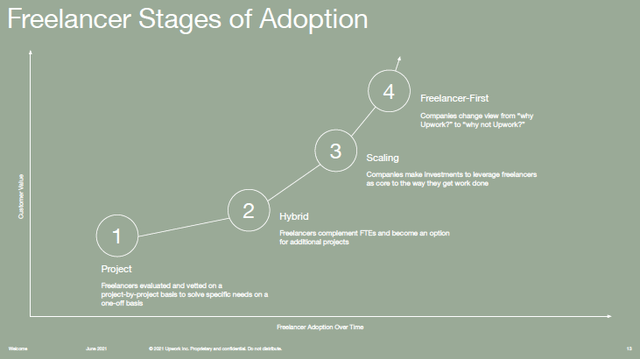

Additionally, it supports the idea that the industry is still in its first stages in which online freelancing, as offered by this type of companies, is still being evaluated and used on a project-by-project basis to solve specific needs. Consequently, if success is proven, as it seems it might be happening as demonstrated by cohorts’ behavior, freelancers should become an option for additional projects and end-up being a core product or tool used by companies to get work done.

Learning curve according to Upwork (Company website)

Margin and Capital Needs

As already mentioned, return on capital is the other leg supporting the great optionality that Upwork’s idea offers to investors. To understand this fully, we should examine Upwork’s business model.

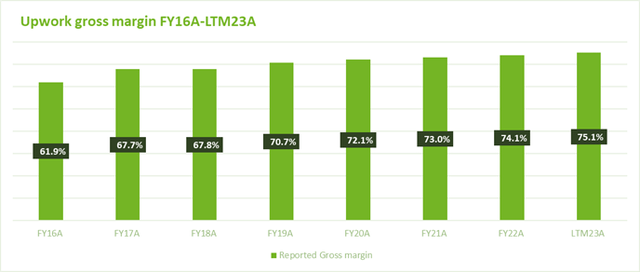

First thing to look at is Upwork’s sustainable gross margin, as it provides a baseline for evaluating the capacity of the company of generating profits from its core business. Not only that, elevated gross margin levels are usually a synonym of high quality business, either because it reveals pricing power or because it usually means highly scalable business.

Company filings & Own analysis

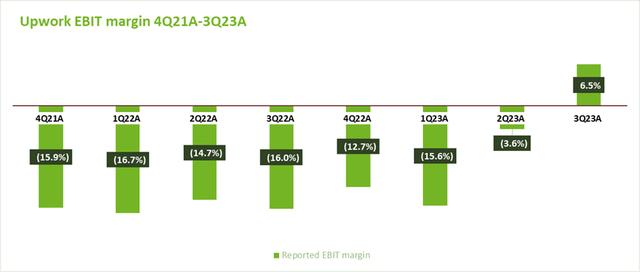

As shown below, Upwork’s platform has limited direct costs and presents elevated gross margin levels (>70%) which is a very positive sign. On the other side, operating margins have been mostly negative during the past. However, note that this was mainly due to its focus on growing its business. As demonstrated during 2023, the Company can quickly rely more on its own clients, reduce marketing spending, and move margins up.

Company filings & Own Analysis

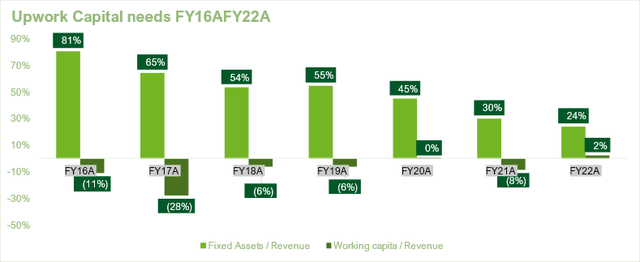

The second thing to look at is Upwork’s capital needs. As shown below, the company has a capital-light business model with no significant working capital needs and no need for high-value physical assets.

Company filings & Own analysis

Thus, considering (i) Upwork’s market leader position in the industry, (ii) industry’s growth expectations and (iii) historical Upwork’s margins and capital needs it is fair to consider that if growth materializes, Upwork’s highly profitable business model should emerge. More normalized growth expectations, post-COVID-19, should allow Upwork to wait for the industry to take off while progressively increase margins thanks to an already proven operating leverage.

Based on that, I estimate that operating margins should increase up to 20% in the long term, which it would be within the range of other tech/internet peers margins.

Cash Flow Generation

In short, Upwork’s optionality consist of understanding that it operates in a massive market, which has hardly been exploited yet, and that it has a business model that, if successful, should have an enormous cash flow generation potential.

Price

Once explained why I think there is a great optionality, it is time to expose the reasons that make me believe that the market is not properly valuing it.

Opportunity Generation

Even-though not the desired situation, moments of market stress usually result in opportunities as investors tend to overreact and that is what has happened with Upwork’s idea.

Although industry long-term drivers seem compelling, the truth is that its players such as Upwork or Fiverr have been hit with a hard reality check. In consequence of the COVID-19 pandemic, industry expectations spiked to unexpected limits, fueled by the increase in the number and spending of new customers who rapidly saw online freelancing as a solution to restrictions and labor force scarcity. However, as the pandemic curb ceased, the industry realized that a significant part of this “COVID-19” growth was non-recurrent.

In addition, as inflation and macroeconomic conditions worsened during the last two years, company’s budgets for freelancers started to get questioned, resources got cut and new client’s ramp-up time significantly extended. All that resulted in a dramatic slowdown of revenues’ growth rates, frightening many investors and leaving everybody wondering, “What is the “true” growth rate of the industry? Will growth re-accelerate in 2024, or is it low-single-digit growth the truth going forward?”

Base Case Valuation

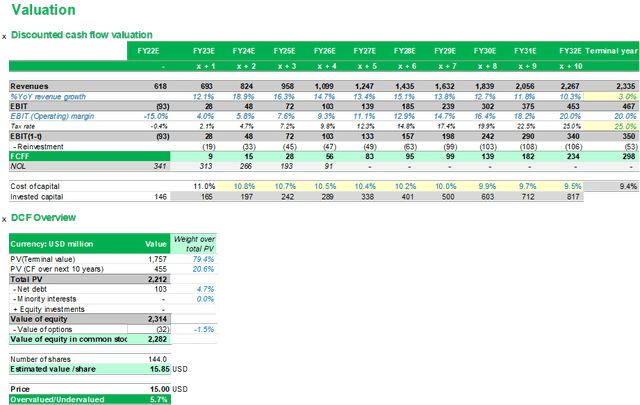

Despite the inherent uncertainty associated with a relatively new industry, I have tried to do an exercise of abstraction from the prevailing market sentiment and based on my expectations derive a base case intrinsic value for Upwork:

DCF Valuation – Base case Upwork (Own Analysis & Company filings)

Based on the analysis performed and trying to be conservative, Upwork’s base case narrative reminds me more of one of a growth story in which Upwork’s business is about to end a hangover process caused by a huge party during COVID-19 pandemic. Although the headache might last longer, long term growth drivers seem healthy, and the opportunity might be worth well enough to compensate today’s turbulences.

Scenario Analysis

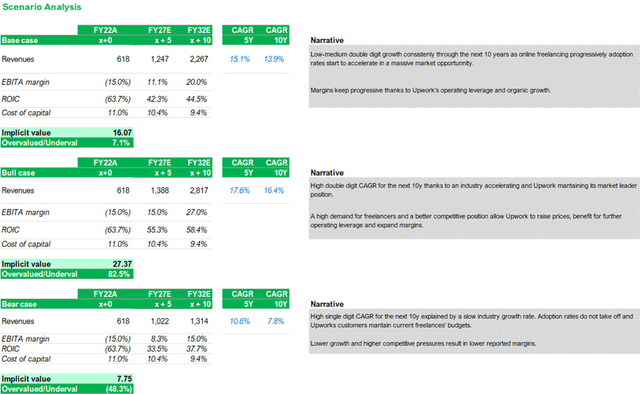

Given the early stage of the industry, scenario analysis becomes a very useful tool. Starting from our base case, I elaborate on to two additional narratives. Upwork as one of the key players of a huge industry adds value to both enterprises and freelancers while benefiting from an extremely efficient business model and, on the other side, Upwork as an eternal promise that gets never fulfilled.

Upwork scenario analysis – DCF valuation (Own analysis & Company filings)

Conclusion

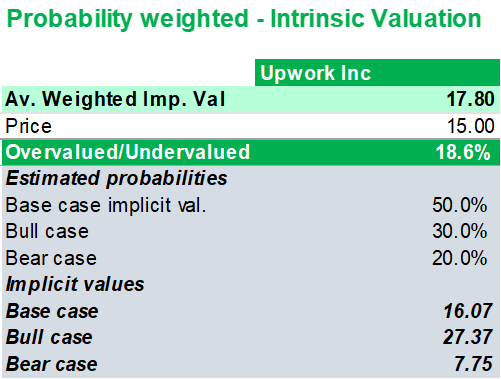

In my (biased) opinion, I have reasons to overweight base and bull scenarios over the pessimistic one. Therefore, assigning a 20% probability to the worst case, and a 50% and 30% to the base and bull case respectively, I arrive at an intrinsic value of USD18.

Estimated intrinsic value Upwork (Own analysis & Company filings)

Looking at my estimated intrinsic values, my conclusion is that Upwork is a worth-having stock for long-term diversified investors who want to play the optionality of being invested in one of the companies leading the transformation of the freelance industry. As shown above, if things go right, Upwork investment idea will be a very profitable one.

Some words to finish: Is it Upwork a bargain? No, it is not. Does it have a lot of optionality? Yes, it does. Is it a well-balanced risk-reward idea? In my opinion, yes, it is.

As it happened with Fiverr, Upwork seems like a very good opportunity for very long-term investors who want to play the digitalization of the freelance economy.