Videndum (LON:VID) shareholders have endured a 72% loss from investing in the stock three years ago

It’s not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Videndum Plc (LON:VID) investors who have held the stock for three years as it declined a whopping 75%. That would certainly shake our confidence in the decision to own the stock. And the ride hasn’t got any smoother in recent times over the last year, with the price 67% lower in that time. Furthermore, it’s down 17% in about a quarter. That’s not much fun for holders.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they’ve been consistent with returns.

Check out our latest analysis for Videndum

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Videndum became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it’s worth checking some other metrics too.

Revenue is actually up 14% over the three years, so the share price drop doesn’t seem to hinge on revenue, either. It’s probably worth investigating Videndum further; while we may be missing something on this analysis, there might also be an opportunity.

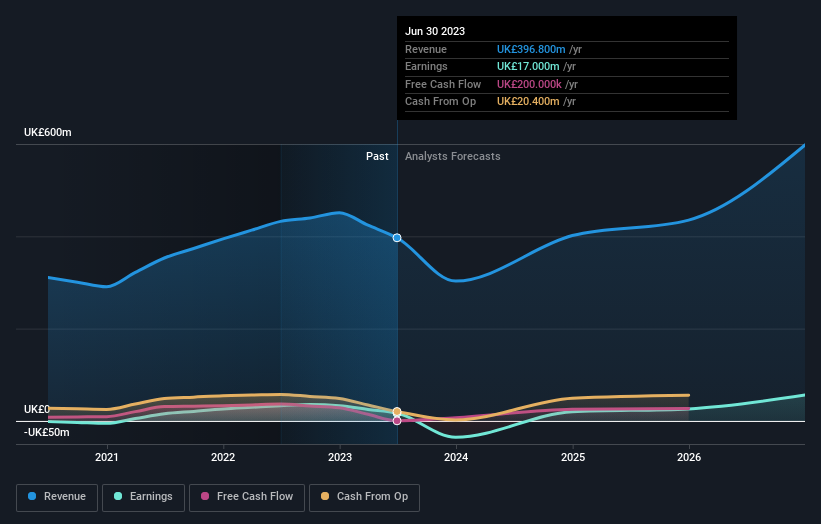

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We’ve already covered Videndum’s share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Videndum’s TSR of was a loss of 72% for the 3 years. That wasn’t as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 6.7% in the last year, Videndum shareholders lost 66%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should “buy when there is blood on the streets”, but we caution that investors should first be sure they are buying a high quality business. It’s always interesting to track share price performance over the longer term. But to understand Videndum better, we need to consider many other factors. Case in point: We’ve spotted 4 warning signs for Videndum you should be aware of, and 2 of them shouldn’t be ignored.

Videndum is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.