You may also like:

This report will examine the top seven trends impacting the real estate industry in 2024.

One of the key underlying drivers for these trends is a relocation from big cities to the suburbs.

But there are several other important changes in the real estate space to keep an eye on over the next 18-24 months.

With that, here are some of the most important real estate trends to know:

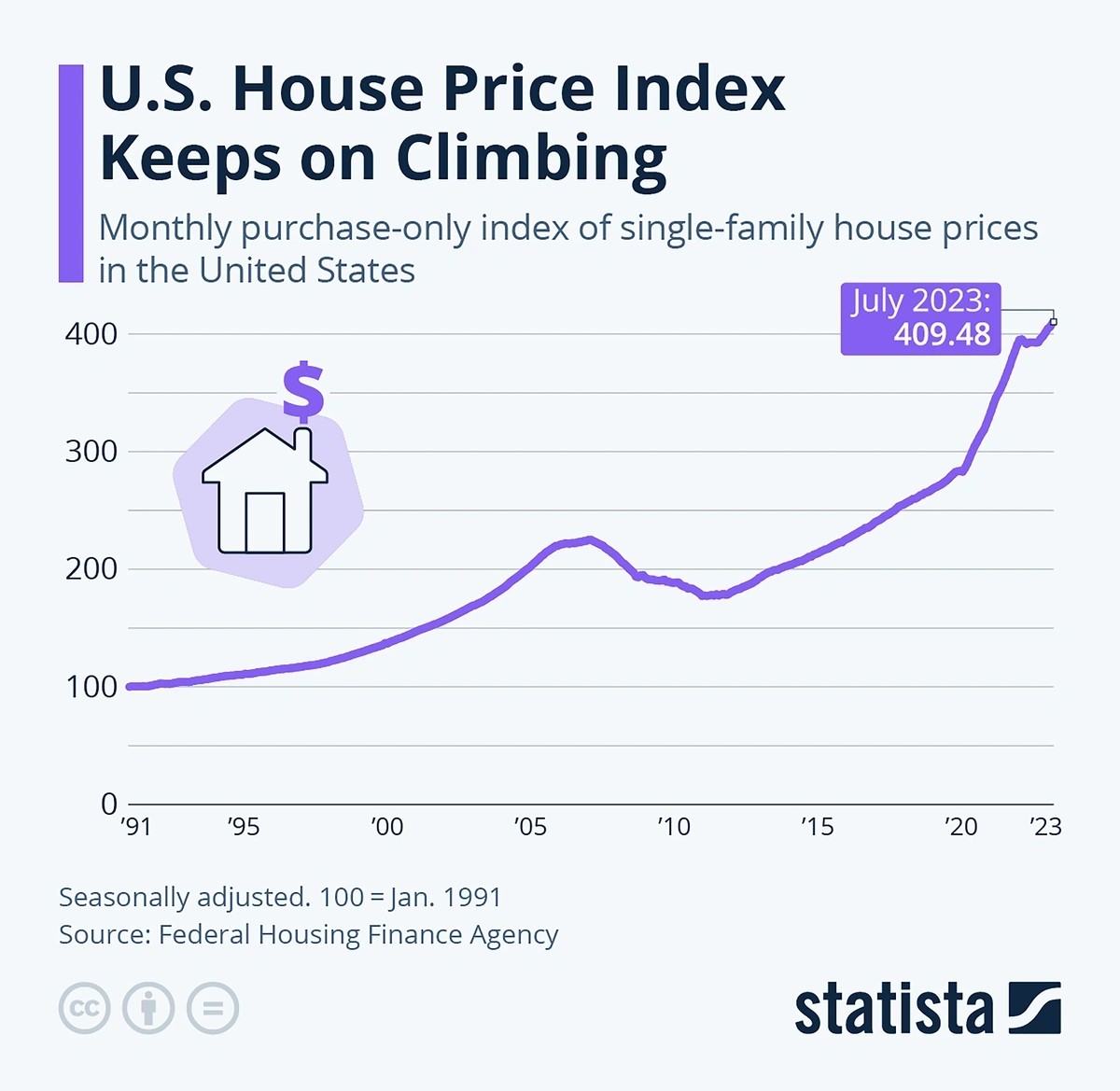

1. Home prices continue to climb

Due to the increased demand for single-family homes and dwindling supply, prices for single-family homes have increased by 42% over the last 3 years.

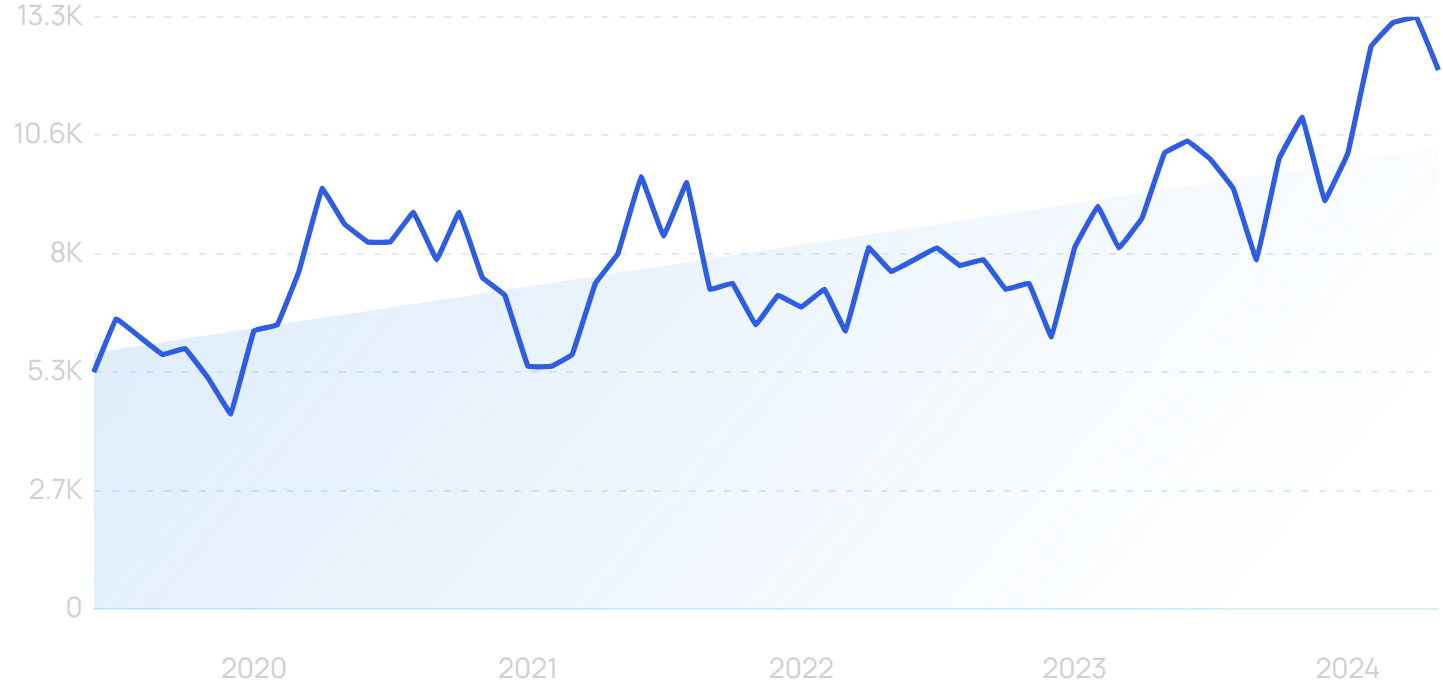

Single-family home prices are on a rapid rise (chart source).

This trend is good for some but bad for others.

For existing home owners, they’re seeing the equity in their homes increase substantial.

(Home equity is the overall home value minus the amount owed on it).

So, as market value increases, home equity does too.

In fact, the average home owner grew their home equity by $24,000 last year alone.

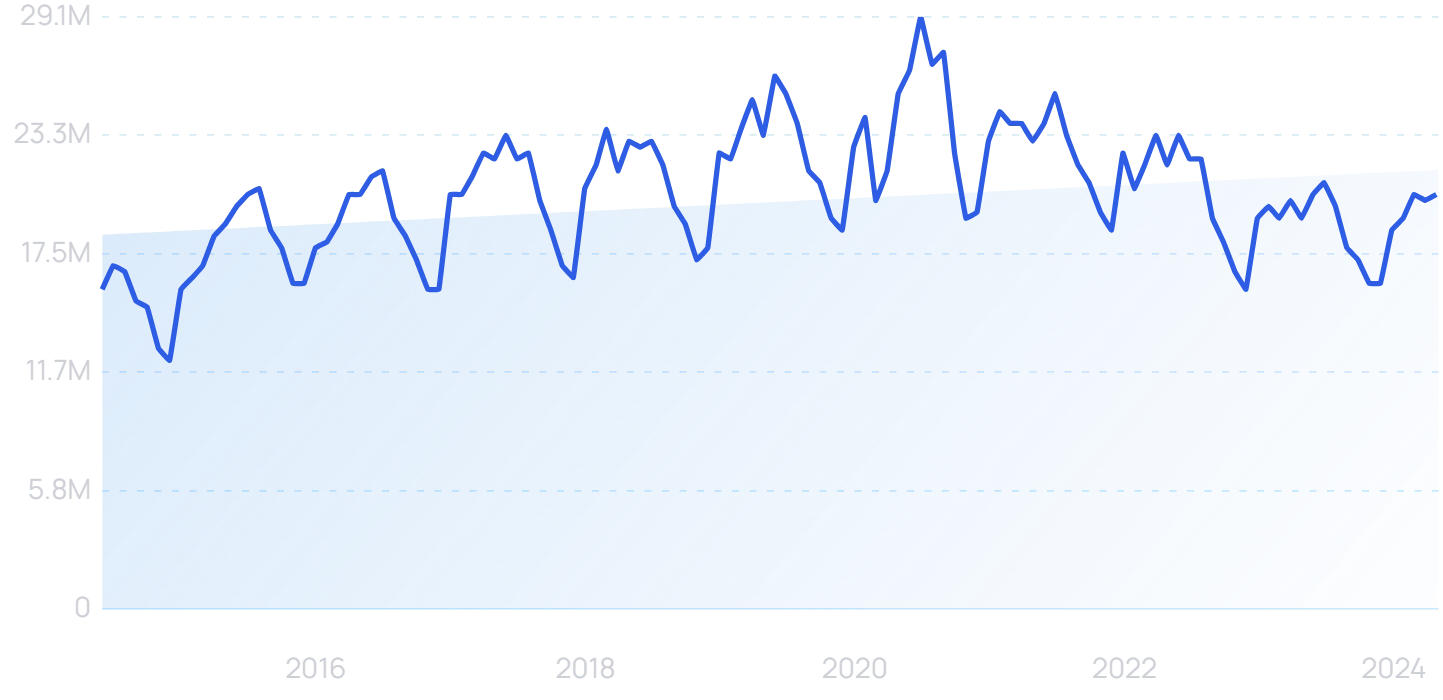

Online searches for “home equity” have steadily increased over the last decade.

But for first-time home buyers, high prices have largely locked them out of the housing market entirely.

However, it’s worth noting that the housing market is showing some signs of cooling.

Median housing prices actually declined in the first quarter of 2024.

2. The sun belt’s popularity continues to rise

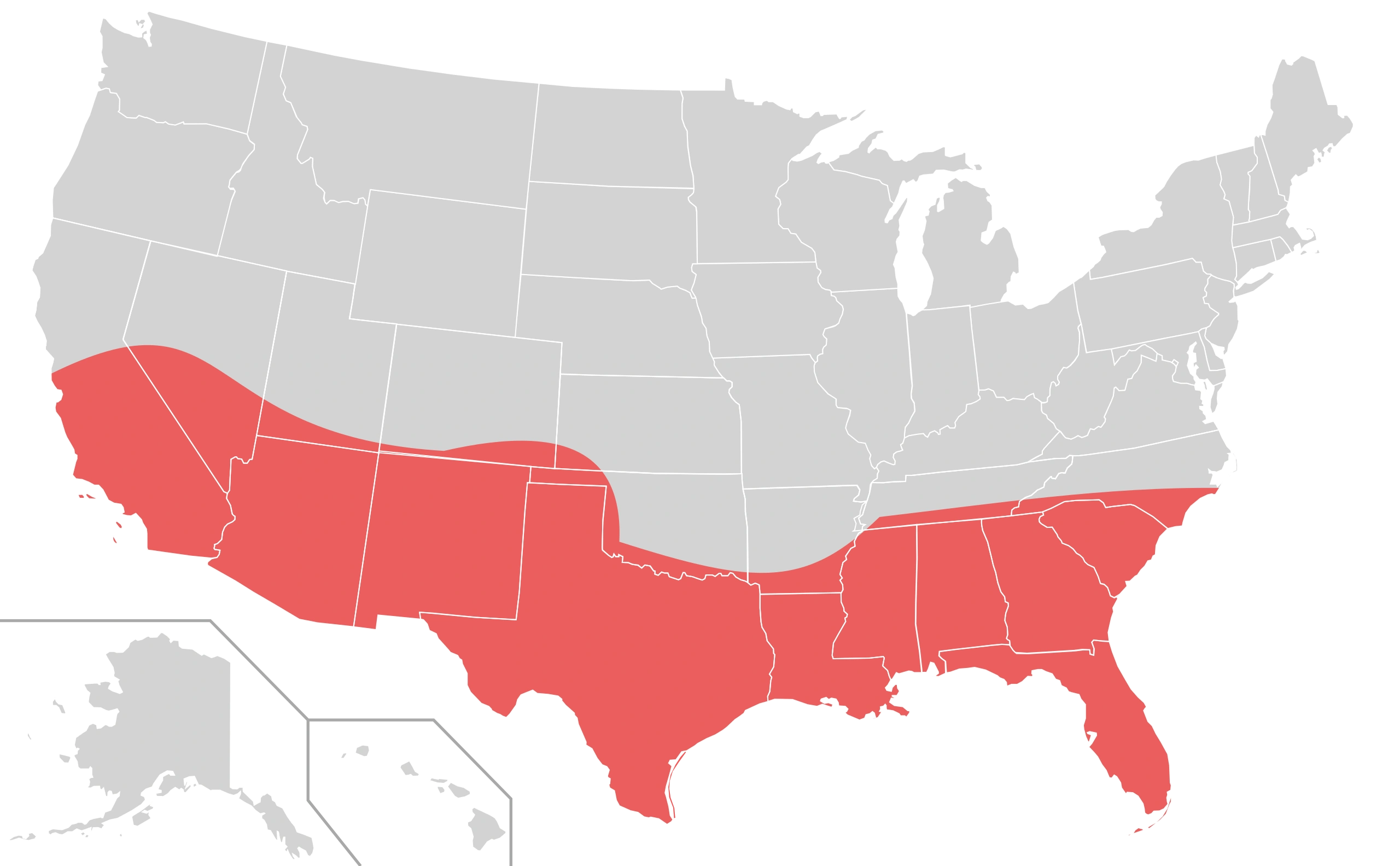

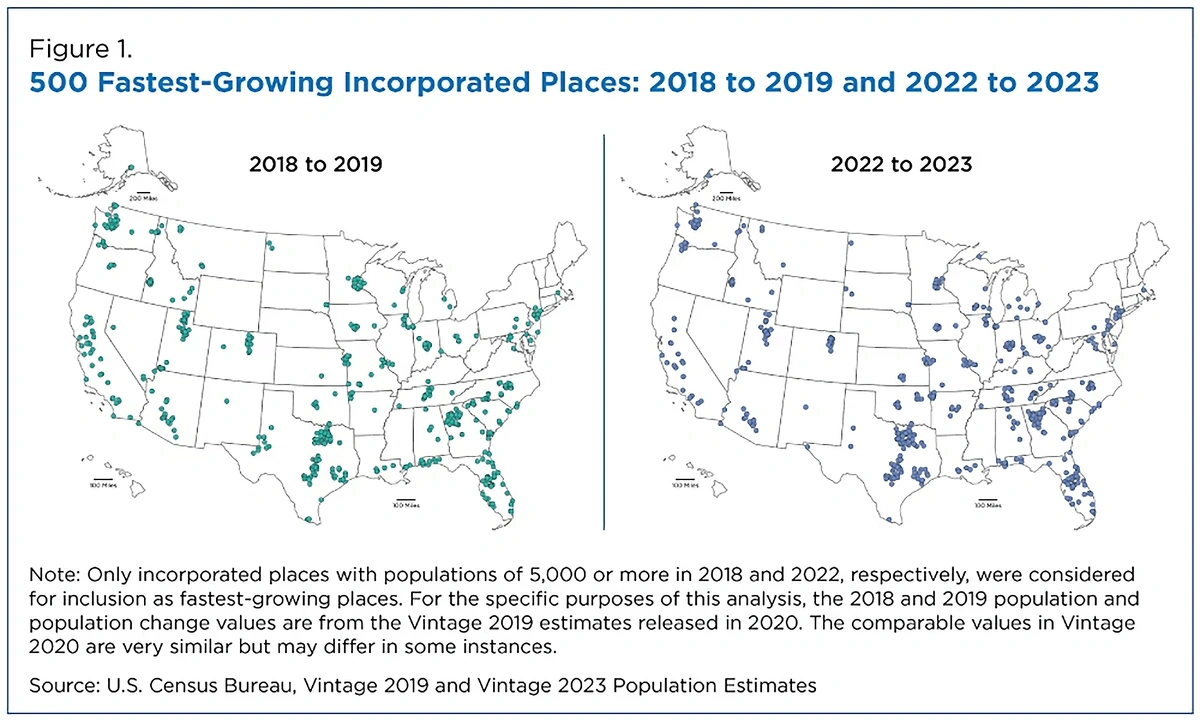

As Americans shift out of big cities, one destination they are moving to is the Sun Belt.

The pandemic reinforced the increasing popularity of the Sun Belt, which is expected to persist for the foreseeable future.

The Sun Belt is the swath of the US that stretches from California to North Carolina and encompasses 18 southern states in between.

Approximately 80% of the country’s population growth has been concentrated in the Sun Belt states.

And according to one estimate, “The Sun Belt now holds about 50% of the national population (335 million), which is expected to rise to about 55% by 2040 “.

The Sun Belt is looking to see increased growth over the next 10 years.

In addition to its appeal to the retired set, the region is also becoming increasingly more attractive to younger professionals due to lower taxes and more affordable housing prices and rent.

Additionally, even the biggest Sun Belt cities offer more space compared to the top US metro areas such as New York.

The growing relocation and rising population in the Sun Belt have bolstered real estate markets in the region.

The growth has not been limited to single-family homes but has also translated to multifamily housing and commercial real estate.

Two major Sun Belt metro areas, Dallas and Tampa are ranked in the top ten US cities with the most real estate potential.

However, other fast-growing cities (Austin in particular), are located in the Sun Belt region.

On the other hand, major metropolitan areas, like New York, Philadelphia, and San Francisco are seeing fluctuating real estate demand.

3. House hunting goes digital-first

The pandemic accelerated digitization across all sectors.

Searches for “digital transformation” are up 63% over the last 5 years.

And the real estate market is no exception.

Many buyers able to virtually tour property due to new virtual capabilities, such as:

- 3D Tours

- Drone videos

- Virtual staging

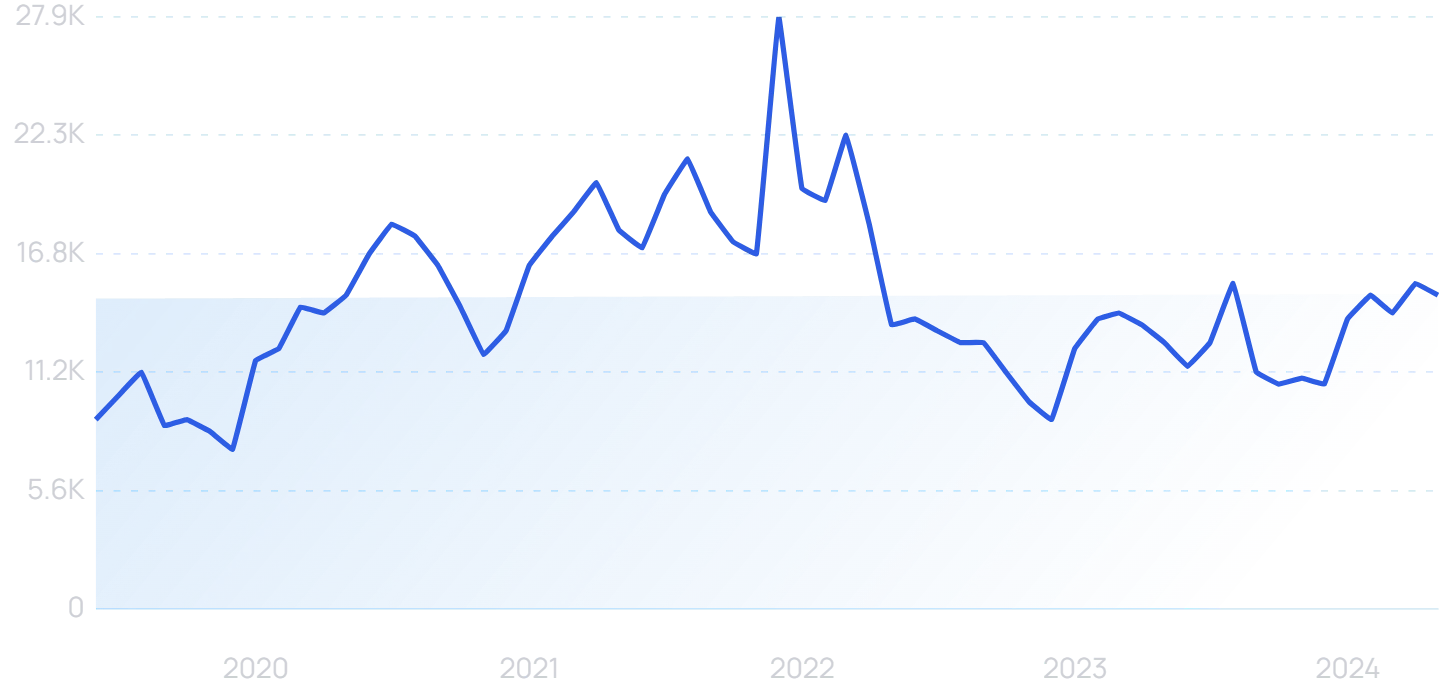

Searches for “virtual staging” are actually now higher than their pandemic peak.

Online searches for “virtual staging”, which were on the rise pre-pandemic, shot up in 2020.

Notably, searches for virtual staging are actually higher in 2024 (13,000 searches per month) vs. 2020 (8,000 searches per month).

Online real estate companies like Zillow, allow home sellers to browse listings, get in touch with real estate agents, and research mortgage options 100% online.

Zillow and some similar companies also provide 3D home tour options.

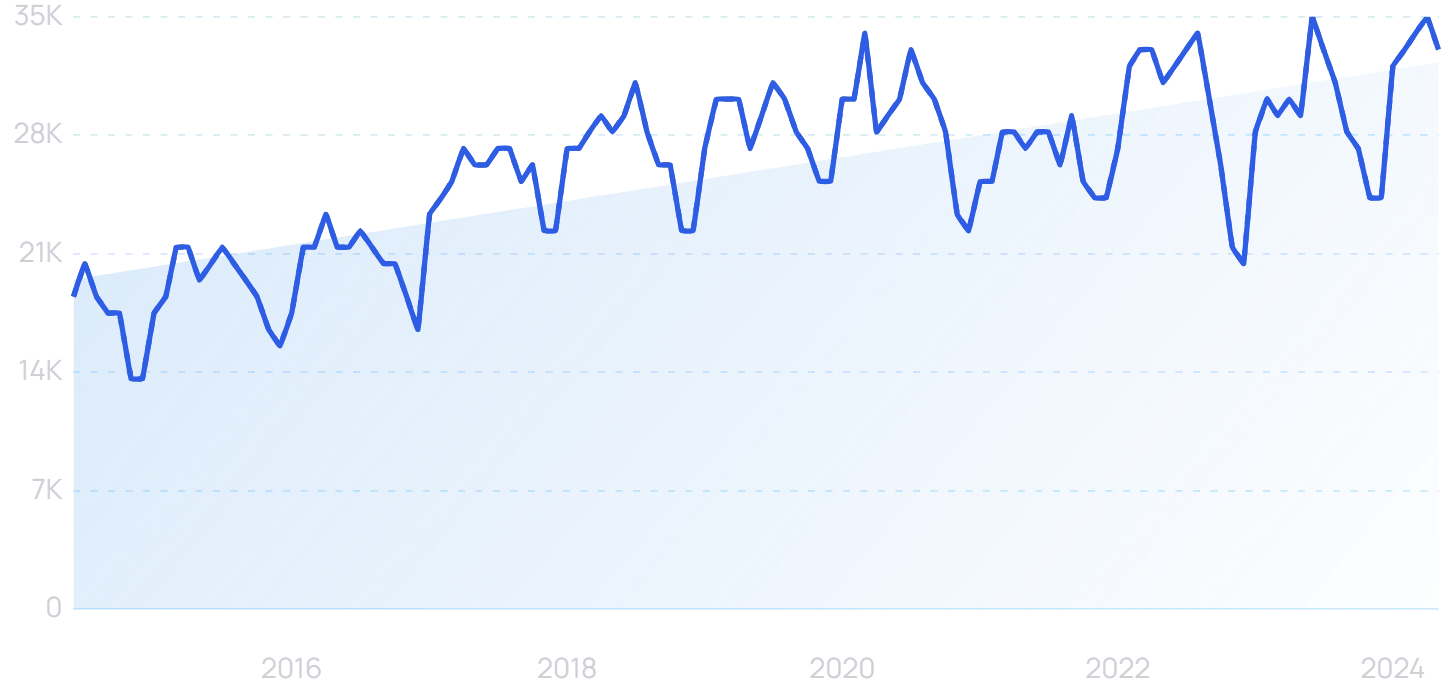

Zillow remains a popular online real estate database, as evidenced by rising searches for “Zillow” over the past 10 years (30%).

The home tour is not the only aspect of home buying that is going digital.

Getting a mortgage can be done online now too.

Online searches for “Better Mortgage”, an online mortgage lender, shot up 66% over the last 5 years.

Millennials, who are notorious for their reliance on social media, are also turning to technology to learn more about their new neighborhoods.

Websites like Nextdoor allow residents of a particular area to stay in touch with other locals and keep up with neighborhood events.

4. Americans move from cities to the suburbs

While the shift has slowed since the height of the pandemic, Americans are still moving to the burbs in droves.

In fact, the US Census Bureau reports that Americans are continuing to move to smaller cities and the suburbs.

The US population is shifting away from urban centers and towards smaller cities and towns.

The two underlying reasons for the shift are necessity and choice.

Those who cannot afford to stay are moving out of necessity.

While the wealthy are relocating by choice.

Notably, the rise of remote works means that it’s no longer a requirement to live and work in a big city.

Last but not least, the suburbs are an attractive destination due to lower taxes and cheaper housing and rent prices.

Some who are moving out of big cities are looking for suburbs that retain some of the big city feel, areas that urban planner, Daniel Parolek, refers to as “middle neighborhoods”.

While the predominant feature of “middle neighborhoods” is the single-family home, these areas also retain some of the conveniences of a big city, such as multifamily housing options, good public transportation, high walkability scores, shopping, and restaurants.

According to Parolek, “middle neighborhoods” are difficult to construct from a regulations perspective, but perhaps this will start to change in the future as demand for such areas increases.

The shift from cities to suburbs is also driving some of the other real estate trends on this list.

Such as the increasing popularity of the Sun Belt, rising median home prices, and an overall housing shortage.

5. Single-family housing demand creates shortages

The migration from cities to suburbs is resulting in growing buyer demand for single-family homes.

Single-family homes located in the suburbs are highly coveted.

However, supply doesn’t appear to be catching up with demand.

Since 2012 there’s been a gap of over 7 million single family homes.

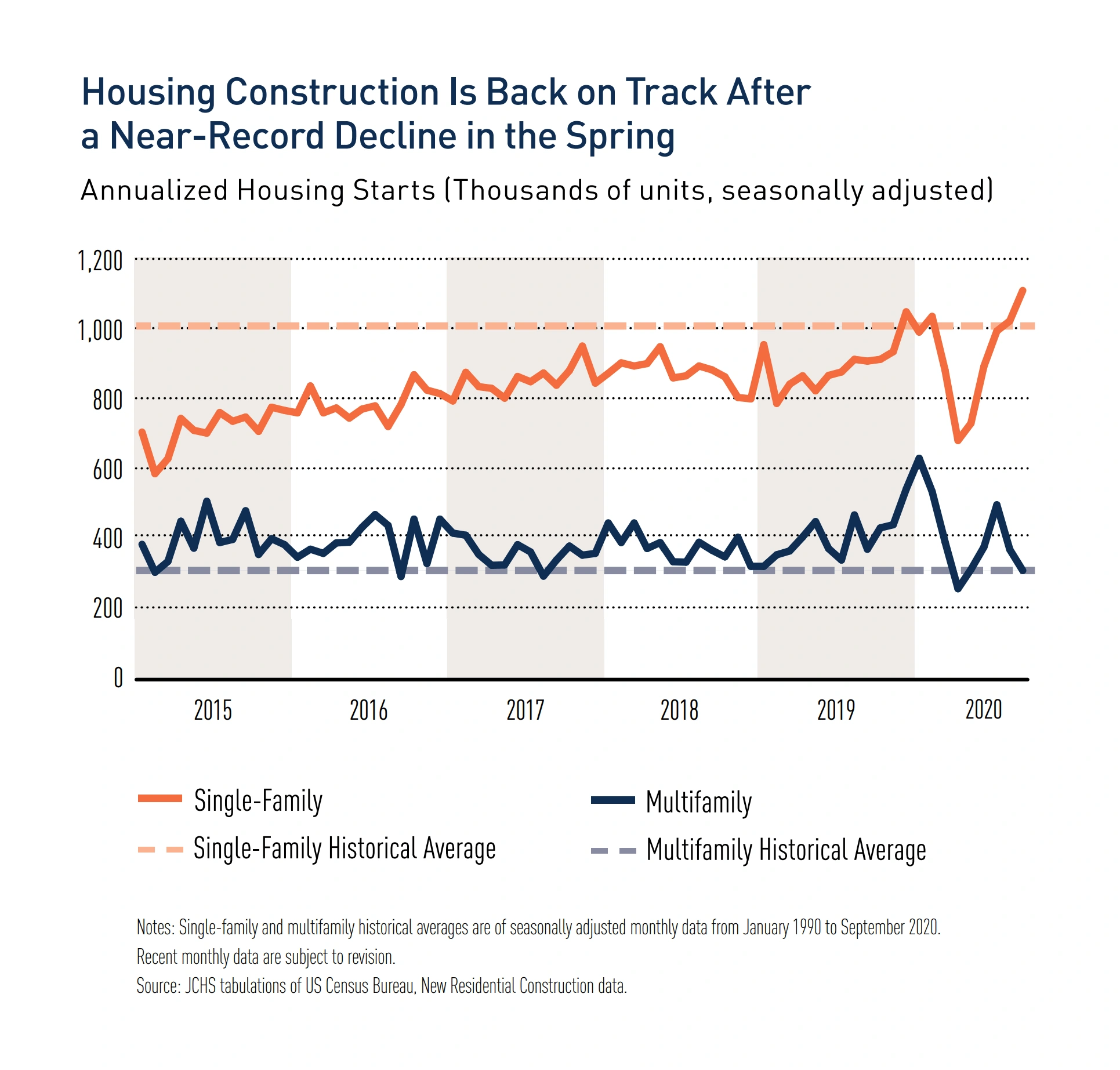

In order to meet demand, the current pace of building would need to triple.

The demand for houses is compounded by another coinciding trend: Millennials entering the home ownership phase of their lives.

Millennials looking to purchase their first house or start a family are also spurring suburban growth.

As a result, single-family housing inventory remains at historic lows.

(The supply issue is exacerbated by the fact that institutional investors are buying approximately 8% of all homes on the market).

The market is projected to eventually stabilize.

And the pace of new construction probably may catch up with the increased demand.

The housing shortage coupled with rising housing prices has been a boon for management and construction companies.

6. Mortgage rates see no signs of dropping

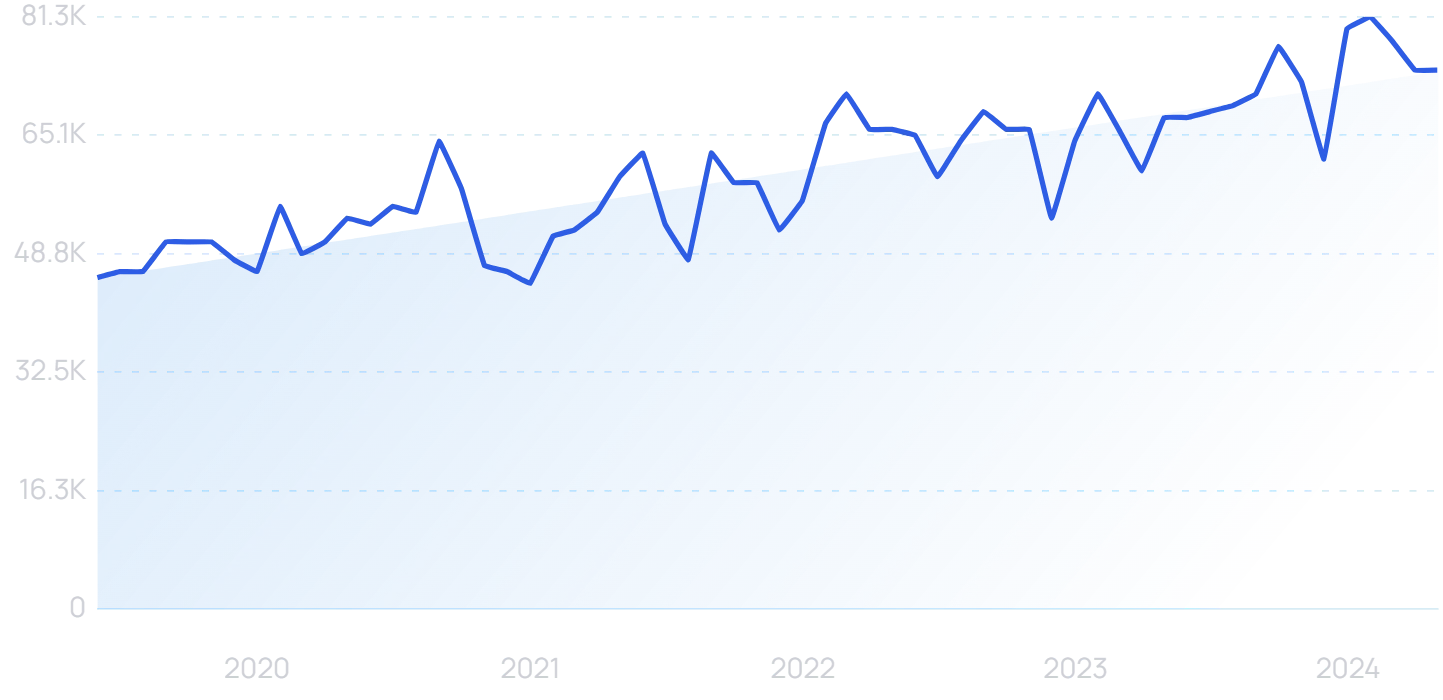

At the beginning of January 2021, mortgage rates hit a record low of 2.65%.

This caused a spike in mortgage applications.

However, in an effort to combat inflation, interest rates have seen multiple increases over the last few years.

The average 30-year fixed rate jumped to 7.08% in October 2022.

This sudden increase in interest rates made buying a home more expensive. And increased monthly mortgage payments for those with variable mortgages.

Looking ahead, the Fannie Mae Housing Forecast predicts that “We revised our mortgage rate forecast downward slightly month over month. We now forecast the 30-year fixed rate mortgage rate to average 6.6% in 2024, and to average 6.1% in 2025.”

However, other experts do predict rate drops over the next 12 months.

7. Rental property market declines

Partly due to the shift of people from cities to suburbs, the rental market for both residential and commercial properties in big cities is on a slight decline.

According to Zillow, as of April 2024, rental price growth has slowed to only around 3.5%. Down from 4.1% pre-pandemic.

Demand for rental properties will likely continue to decline in the biggest cities as people who can afford it look to buy a house and those who cannot, look for other alternatives to save money or fall behind on their rent.

While rental vacancies are increasing in major metropolitan areas, demand for rental properties is actually going up in mid-size and smaller cities around the country as the demand for homes in these areas outpaces the supply.

The downturn in the rental market is creating real estate investment opportunities.

Investors can also take advantage of commercial properties, such as hotels and retail buildings, and repurpose them into housing units.

Conclusion

That wraps up our list of important real estate trends happening right now.

As more people move to the suburbs and look to purchase a home, single-family housing prices are expected to stay high and supply low.

High mortgage rates may hurt demand for homes.

In the meantime, the rental property market in large cities will remain in decline, which will provide opportunities for real estate investors planning for a post-pandemic recovery of city life.

Signs of their reversal include a rise in mortgage rates and an increase in housing supply as construction catches up with demand.