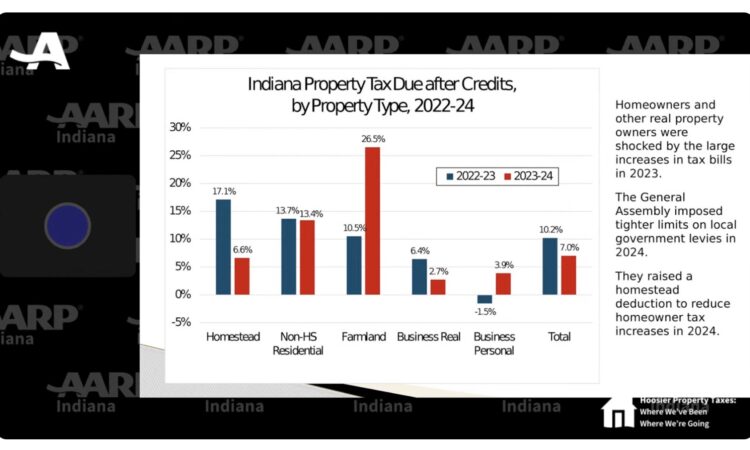

AARP TOWN HALL: Under GOP leadership, average property tax bills will increase 7% this year, after double-digit increases the past two years

INDIANAPOLIS — Homeowners are about to get hit with an average property tax bill increase of 7%, and state lawmakers are wrestling with how to handle it. From credits and deductions, to caps and deferrals — everything seems on the table.

“We’ll get something that we think people will be happy with, but at the same time, we can’t hamper the revenue stream going to local government, because it’s going to affect the police departments and fire departments and local services that are provided by counties and cities and towns,” said Sen. Travis Holdman, R-Markle. “It’s going to take some hard work.”

Holdman was part of an AARP Indiana virtual town hall Wednesday on property taxes, along with a representative from Gov. Mike Braun’s office and several tax experts.

Holdman said new data show average homestead bills will go up 7% statewide when they are sent out for spring payment.

In comparison, homesteads went up 17.1% and 6.6% respectively the last two years, said Larry Deboer, emeritus professor of agricultural economics at Purdue University. This was largely because home values spiked post-pandemic.

Deboer walked through the history of Indiana’s property tax system. He also provided data showing Indiana ranks better than many other states in key areas, from the median property tax paid and the percent of income paid to property tax.

But he noted Indiana’s property taxes ranked 44th lowest in 2022 and dropped to 33rd lowest in just one year.

“Property taxes are rising everywhere, but apparently they’re rising faster in Indiana than in most other states,” Deboer said.

He also explained that increasing homeowner deductions shifts the burden to others, such as farmers and businesses.

Robert Ordway, senior policy advisor for Gov. Mike Braun, talked about the need for Senate Bill 1 — currently up for debate in the Indiana Statehouse — which increases deductions for homeowners and caps annual bill growth in the future.

He said the property tax burden used to be more uniformly split between homeowners, business and farmers at about one-third each. But that amount has risen for owner-occupied homes to about 45%.

Ordway called Senate Bill 1 a “great starting point.”

“And as you’ve heard, there are other bills out there related to property tax reform, and the governor is open to taking his piece of clay and seeing how it can be molded through the process,” Ordway continued. “Hopefully we create a win win for everybody at the end of this first session.”

A recent AARP Indiana survey of Indiana voters aged 50-plus who own a home found that 84% saw an increase in property taxes in the past three years and 66% believe the amount they pay is high.

Other key findings from the survey include:

- Policy Proposals:

- 93% agree that increased communication about existing state property tax relief programs is essential.

- 74% support allowing all Hoosiers to pay property taxes on a monthly basis.

- 76% support the implementation of a new statewide tax credit for older homeowners.

Holdman is carrying the bill but has concerns.

“My concern with the bill is just the price tag that it has on local government, which is $1.1 billion in the first year, grows up to $1.6 billion, which directly impacts local government services,” he said. “We’re trying to reach a compromise.”

Holdman instead talked about four other property tax bills that will be heard in his Tax and Fiscal Policy Committee next week. One, Senate Bill 6, authorizes counties to create a property tax deferral program.

It would allow a homeowner to defer up to $500 of their property tax bill each year, with a maximum cumulative amount of $10,000. Individual counties would decide who is eligible, such as having an income limitation.

Holdman said the deferral becomes a lien on the property and must be satisfied if the property is transferred or sold. And there will be annual interest of 4%.

Ambre Marr, state legislative director for the AARP, said a deferral program is one of the organization’s top proposals for the 2025 session.

— The Indiana Capital Chronicle covers state government and the state legislature. For more, visit indianacapitalchronicle.com.