How impactful will the coming wave of U.S. property-loan refinancing be? Two significant shifts have characterized the real-estate debt market over the past 18 months: a notable drop in property values and a corresponding change in the availability of debt financing. These shifts raise concerns for parts of the real-estate market, where property values have witnessed significant declines and loans are approaching maturity.

How big is the problem?

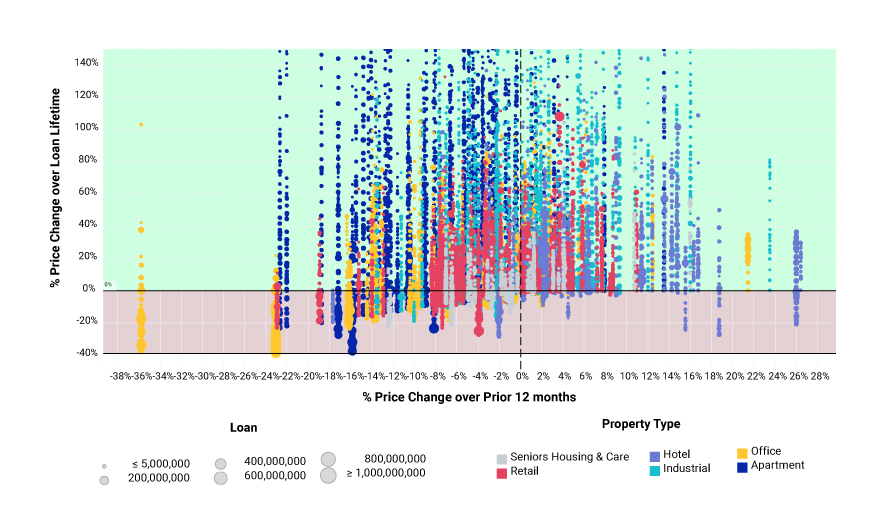

At first glance, it seems the problem could be enormous. Of the USD 2.77 trillion in loans in our study sample derived from the MSCI U.S. Mortgage Debt Intelligence database, roughly 81.5% by value (those to the left of the 0% y-axis in the exhibit below) are linked to properties that have shown declines in their most closely matched MSCI transaction-price indexes over the past year. The last 12 months is not the most relevant measurement period for considering the health of loans, however. Only 40.4% by value (those below the 0% x-axis in the exhibit below) display declines in their price index over the entire lifetime of the loan, as measured from origination to the second quarter of 2023. While this share is significantly smaller than the 81.5% that have experienced recent declines in market prices, it is still substantial. Some of these declines are, however, relatively minor movements, with only 6.6% by value having experienced declines of -20% or more in their price indexes since their respective origination dates.

Despite recent price drops, most collateral was still above water

Loan to value and maturity matter too

The central question investors are seeking to address is to identify which loans are potentially in jeopardy. This question requires an assessment of loan-to-value ratios (LTV),[1] as well as taking into account relevant maturities,[2] rather than just an estimation of collateral value.

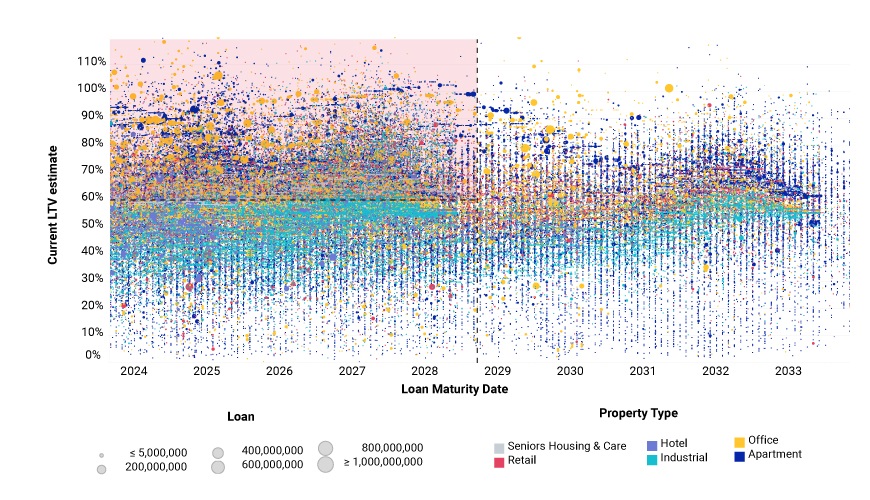

The exhibit below highlights loans maturing over the next decade and for which the corresponding price index has had negative growth over the loan’s lifetime. The original LTV of each loan is adjusted given its relevant price index’s lifetime price growth. For instance, if an asset had an initial LTV of 60% and the price index declined by 40% since the origination date, the estimated current LTV would be 100%. Obviously this approach makes the simplifying assumption of no amortization.

A high LTV implies that borrowers may encounter difficulties when seeking refinancing, particularly for loans nearing maturity. Anecdotal evidence suggests reduced appetite from lenders to offer debt-financing capital at LTVs above 60% today; and around USD 1.227 trillion, or 44.3%, of loans in the sample had estimated current LTVs above that level. Among this subgroup of 60%+ LTVs, 58% face maturities within five years and 37% within three years — which warrants particular attention.

Loans with high LTV and near-term maturities are of most concern

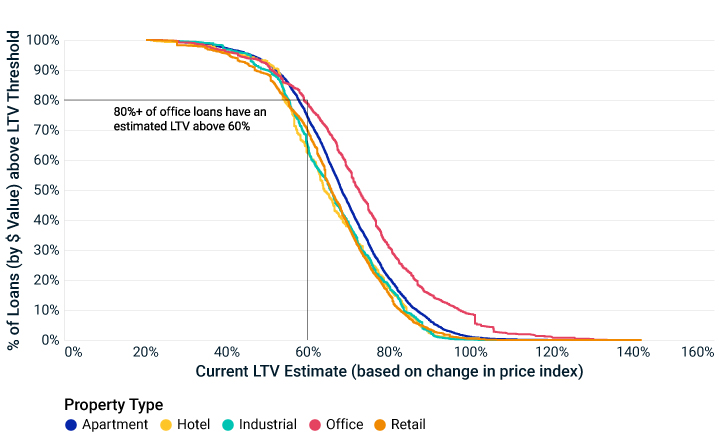

The exhibit below uses the same sample to highlight those loans potentially under stress from a property-type perspective. It shows how the distribution of loans under a particular current estimated LTV varies across property types, illustrating the potential breadth and severity of potential refinancing issues.

Offices are particularly at risk — with around 81.3% of office loans at current estimated LTVs above 60% potentially facing refinancing difficulty if maturing soon. Moving up the LTV spectrum, the distribution across property types begins to diverge significantly. By the time we reach LTVs of 80% and above, there are a higher proportion of office loans (around 30%) with LTVs above that level, whereas only 15% of retail loans and about 20% of industrial and apartment loans have LTVs above that level.

A greater proportion of offices are at risk

A complex picture of risk and opportunity

While a significant majority of U.S. real estate’s loan collateral has been exposed to recent price declines, a closer examination of how lifetime loan-price movement has impacted estimated LTVs allows for a more nuanced picture. Caution is warranted, however — especially with loans that display substantial declines in property values, high LTV ratios and imminent maturities.

The author thanks Alexis Maltin for her contribution to this blog post.