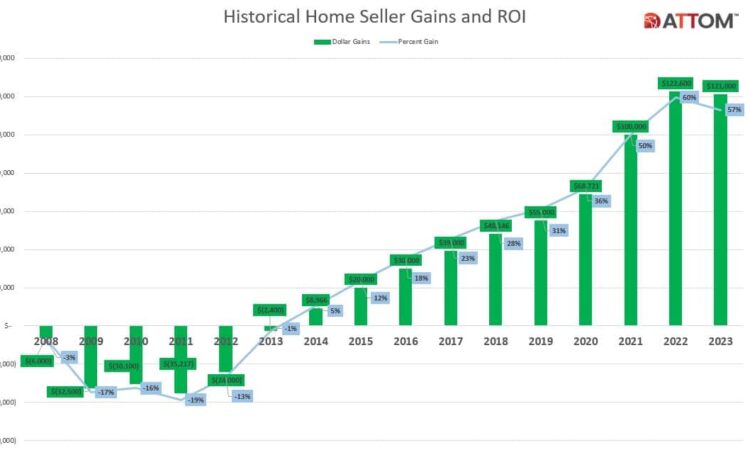

Profits on Home Sales Across U.S. Decrease for First Time Since 2011;

Typical Seller Gains Remain Strong, But Decline from 60 Percent to 57 Percent;

National Median Home Price Rises at Slowest Pace in 12 Years

IRVINE, Calif. – Jan. 25, 2024 — ATTOM, a leading curator of land, property and real estate data, today released its Year-End 2023 U.S. Home Sales Report, which shows that home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.

But even as both gross profits and profit margins remained near record levels, they decreased from 2022, marking the first declines in either category since 2011.

The gross profit on median-priced single-family homes sales dipped down from $122,600 in 2022 while the profit margin dropped, year over year, from 59.8 percent. That happened as the median nationwide home price rose at the smallest annual pace in more than a decade.

The profit fallback came during a year of ups and downs for the U.S. housing market that featured flat prices early in 2023, followed by a spike in the Spring and a drop-off in the fourth quarter. Price patterns were mixed as the upward pressure of strong employment and investment markets, along with a historically tight supply of homes, competed with the downward force of home-mortgage rates that rose during most of 2023.

“Last year certainly stood out as another very good year for home sellers across most of the United States. Typical profits of over $120,000 and margins close to 60 percent were still more than double where they stood just five years earlier,” said Rob Barber, CEO at ATTOM. “But the market definitely softened amid modest price gains that weren’t enough to push profits up higher after a long run of improvements. In 2024, the stage seems set for more small changes in prices as well as seller gains given the competing forces of interest rates that have headed back down in recent months and home supplies that remain tight, but home ownership costs that remain a serious financial burden for many households.”

Among 129 metropolitan statistical areas with a population greater than 200,000 and sufficient sales data, sellers in western and southern states again reaped the highest returns on investment in 2023. The West and South regions had 12 of the 15 metro areas with the highest ROIs on typical home sales last year, led by San Jose, CA (99.4 percent return on investment); Knoxville, TN (98.1 percent); Seattle, WA (92.9 percent); Spokane, WA (90.6 percent) and Scranton, PA (89.6 percent).

Historical U.S. Home Seller Gains

National Median Home Price Rises at Slowest Pace Since 2011

The U.S. median home price increased 2.1 percent from 2022 to 2023, reaching another all-time annual high of $335,000. The typical 2023 price has more than double the nationwide median in 2011, a point in time right before the housing market began recovering from the aftereffects of the Great Recession that hit in the late 2000s.

The 2023 increase, however, represented the smallest annual bump during the extended boom period that began in 2012. The full-year median home-price appreciation slowed down as interest rates rose in 2023 close to 8 percent for a 30-year mortgage.

While gains were mostly small, median prices still rose from 2022 to 2023 in 97, or 75 percent of the 129 metropolitan statistical areas around the U.S. with a population of 200,000 or more and sufficient home price data last year. Those with the biggest year-over-year increases were Hilton Head, SC, (median up 12.2 percent); Naples, FL (up 10.6 percent); Hartford, CT (up 10.5 percent); Savannah, GA (up 10.5 percent) and Rochester, NY (up 9.7 percent).

Aside from Hartford and Rochester, the largest median-price increases in metro areas with a population of at least 1 million in 2023 came in Miami, FL (up 8.6 percent); Cincinnati, OH (up 8.1 percent) and Milwaukee, WI (up 6.9 percent).

Metro areas where median prices dropped most in 2023 were Austin, TX (down 6.2 percent); San Francisco, CA (down 4.4 percent); Stockton, CA (down 4.4 percent); Boise, ID (down 4.1 percent) and Phoenix, AZ (down 3.8 percent).

Profit Margins Drop in Two-Thirds of Nation, with Worst Declines in South or West

Profit margins on typical home sales decreased from 2022 to 2023 in 84 of the 129 metro areas with sufficient data to analyze (65 percent). That happened as the 2.3 percent jump in the median sale price nationwide in 2023 fell behind the typical 4.4 percent increase recent sellers had been paying when they originally bought their homes.

The 40 largest decreases in investment returns were all in the South or West, led by Port St. Lucie, FL (ROI down from 104.5 in 2022 to 82.7 percent in 2023); Austin, TX (down from 67.2 percent to 46.2 percent); Phoenix, AZ (down from 79.3 percent to 60.6 percent); Reno, NV (down from 80.6 percent to 64.5 percent) and Salt Lake City, UT (down from 68.3 percent of 52.2 percent).

Aside from Austin, Phoenix and Salt Lake City, the largest ROI losses from 2022 to 2023 in metro areas with a population of at least 1 million were in San Francisco, CA (ROI down from 92.7 percent to 79.5 percent) and Las Vegas, NV (down from 74.3 percent to 61.8 percent).

The biggest increases in investment returns from 2022 to 2023 came in Scranton, PA (ROI up from 75.1 percent to 89.6 percent); South Bend, IN (up from 53.6 percent to 66.5 percent); Hartford, CT (up from 53.2 percent to 65.8 percent); Rockford, IL (up from 48.8 percent to 57.8 percent) and Rochester, NY (up from 53.8 percent to 62.8 percent).

Aside from Hartford and Rochester, metro areas with a population of at least 1 million and increasing profit margins in 2023 included Cincinnati, OH (up from 54.8 percent to 61.2 percent); Cleveland, OH (up from 48 percent to 53.4 percent) and Milwaukee, WI (up from 52.9 percent to 57.2 percent).

Gross Profits Still Top $100,000 in More Than Half the Country, with Largest Again Clustered on West Coast

Despite the small national decrease, gross profits on median-priced home sales in 2023 still topped $100,000 in 77, or 60 percent, of the 129 metro areas with sufficient data to analyze.

The West region had 12 of the top 15 gross profits in 2023, led by San Jose, CA ($698,000); San Francisco, CA ($476,000); San Diego, CA ($354,000); Los Angeles, CA ($330,000) and Seattle, WA ($325,000).

The 15 smallest gross profits in 2023 were in the South and Midwest, reflecting lower home prices in those areas than elsewhere. They were led by Peoria, IL ($35,500); Davenport, IA ($41,052); McAllen, TX ($46,167); Baton Rouge, LA ($47,600) and Toledo, OH ($49,800).

Homeownership Tenure Up to Two-Year High

Homeowners in the U.S. who sold in the fourth quarter of 2023 had owned their homes an average of 7.96 years, up from 7.8 years in the third quarter and from 7.67 years in the fourth quarter of 2022. The latest figure represented the high point since the third quarter of 2021. Average seller tenures were up, year over year, in 80, or 71 percent, of the 113 metro areas with a population of at least 200,000 and sufficient data to analyze.

The biggest increases in average seller tenure from the fourth quarter of 2022 to the fourth quarter of 2023 were in Chico, CA (up 20.9 percent); Modesto, CA (up 12.7 percent); Clearlake, CA (up 11.9 percent); Madera, CA (up 11.2 percent) and Tucson, AZ (up 10.5 percent).

The longest tenures for home sellers in the fourth quarter of 2023 were in Barnstable, MA (14.18 years); Santa Cruz, CA (13.2 years); Bridgeport, CT (13.14 years); New Haven, CT (13.08 years) and Worcester, MA (12.57 years).

Cash Sales at High Point Since 2014

Nationwide, all-cash purchases accounted for 38 percent, or about one of every three single-family home and condo sales in 2023 – the highest level since 2014. The latest portion was up from 36.1 percent in 2022, although still off from the 44.7 percent peak this century in 2011.

Among 186 metropolitan statistical areas with a population of at least 200,000 and sufficient cash-sales data, those where cash sales represented the largest share of all transactions in 2023 included Macon, GA (61.5 percent of sales); Naples, FL (58.9 percent); Myrtle Beach, SC (56.3 percent); Youngstown, OH (55.1 percent) and Salisbury, MD (54.4 percent).

Lender-Owned Foreclosure Purchases in U.S. Up Slightly, but Still at One of Lowest Levels Since 2005

Foreclosure sales to lenders accounted for just 1.5 percent, or one of every 67 single-family home sales in 2023. That was the third lowest level since 2005. The 2023 figure was up from 1.2 percent of sales, or one in 83, in 2022 but still far below the peak of 23.6 percent in 2009.

States where lender-purchased (REO) foreclosure sales comprised the largest portion of total sales in 2023 were Illinois (3.9 percent of sales), Michigan (3.9 percent), Wyoming (3.3 percent), Louisiana (3.1 percent) and Alaska (2.9 percent).

Among 156 metropolitan statistical areas with a population of at least 200,000 and sufficient data, those where lender-purchased foreclosure sales represented the largest portion of all sales in 2023 were Binghamton, NY (8.5 percent of sales); Flint, MI (8.4 percent); Peoria, IL (6 percent); Lansing, MI (4.8 percent) and Macon, GA (4.6 percent).

Among 55 metropolitan statistical areas with a population of at least 1 million, those with the highest levels of lender-purchased foreclosure sales in 2023 were St. Louis, MO (3.9 percent of sales); Chicago, IL (3.6 percent); Detroit, MI (3.5 percent); Honolulu, HI (2.9 percent) and Birmingham, AL (2.8 percent).

Metro areas with the smallest shares were Raleigh, NC (0.3 percent of sales); Denver, CO (0.3 percent); Phoenix, AZ (0.4 percent); Tucson, AZ (0.4 percent) and San Francisco, CA (0.4 percent). All five had populations of at least 1 million in 2023.

Institutional investing Down in 2023

Institutional investors nationwide accounted for 6.1 percent, or one of every 16 single-family home and condo sales in 2023 in the U.S. The latest figure was down from 7.6 percent in 2022 but was still at a higher level than previous years.

Among metropolitan statistical areas with a population of at least 200,000 and sufficient institutional-investor sales data, those with the highest portions of institutional-investor transactions in 2023 were Memphis, TN (14.3 percent of sales); Indianapolis, IN (11.6 percent); Yuma, AZ (11.1 percent); Atlanta, GA (10.4 percent) and Birmingham, AL (10.2 percent).

FHA Sales Reverse Three-Year Decline

Nationwide, buyers using Federal Housing Administration (FHA) loans accounted for 8.8 percent, or one of every 11 single-family home and condo purchases in 2023. That was up from 7.5 percent in 2022, marking the first increase after three straight annual declines.

Among metropolitan statistical areas with a population of at least 200,000 and sufficient FHA-buyer data in 2023, those with the highest share of purchases made with FHA loans were Merced, CA (24.2 percent of sales); Bakersfield, CA (22.3 percent); Lakeland, FL (21.8 percent); Visalia, CA (19.4 percent) and Modesto, CA (19 percent).

###

Report Methodology

The ATTOM U.S. Home Sales Report provides percentages of distressed sales and all sales that are sold to investors, institutional investors and cash buyers in states and metropolitan statistical areas. Data is also available at the county and zip code level upon request. The data is derived from recorded sales deeds, foreclosure filings and loan data. Statistics for previous quarters are revised when each new report is issued as more deed data becomes available.

Definitions

All-cash purchase: sale where no loan is recorded at the time of sale and where ATTOM has coverage of loan data.

Homeownership tenure: for a given market and given quarter, the average time between the most recent sale date and the previous sale date, expressed in years.

Home seller price gains: the difference between the median sales price of homes in a given market in a given quarter and the median sales price of the previous sale of those same homes, expressed both in a dollar amount and as a percentage of the previous median sales price.

Institutional investor purchases: residential property sales to non-lending entities that purchased at least 10 properties in a calendar year.

REO sale: a sale of a property that occurs while the property is actively bank owned (REO).

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Jennifer von Pohlmann

jennifer.vonpohlmann@attomdata.com

Data and Report Licensing:

949.502.8313

datareports@attomdata.com