The Detroit housing market has emerged as a surprising frontrunner, outpacing even the vibrant Miami market, according to the latest report from CoreLogic. In a noteworthy turn of events, Detroit, once synonymous with the boom and bust of the auto industry, has witnessed the highest year-over-year home price increase among the 20 metro areas tracked by CoreLogic as of November 2023, recording an impressive surge of 8.7%.

One striking aspect of Detroit’s housing market is its continued status as one of the most affordable large metros in the United States. Despite the impressive surge in home prices, Detroit maintains its reputation for affordability, offering homebuyers an attractive proposition in comparison to other major cities.

How is the Detroit housing market doing currently?

Detroit, often referred to as the Motor City, has faced significant challenges due to the decline of the auto industry. However, the recent housing market data paints a different picture, showcasing a remarkable resurgence. Despite its industrial setbacks, Detroit has defied expectations and experienced a robust 8.7% increase in home prices, outpacing the growth in Miami, which posted a respectable 8.3% year-over-year advance.

Investing in the Detroit housing market has been a source of contention for investors for a long time. When considering whether or not to add properties in the Motor City to your portfolio, keep these three current trends in mind. The city of Detroit is one of the most populous in the Midwest. It also serves as the county seat for Wayne County.

It’s noteworthy that while Detroit has undergone economic challenges, the housing market seems to be a beacon of resilience and growth. The following factors contribute to the city’s housing market dynamics:

- Industrial Evolution: Despite the historical ties to the auto industry, Detroit has shown adaptability with a diversified industrial landscape, contributing to economic stability.

- Investor Confidence: The resurgence in home prices indicates growing investor confidence in Detroit’s real estate market, recognizing its potential for long-term growth.

- Affordability: Detroit’s affordability, coupled with the upward trajectory in home prices, positions it as an attractive destination for homebuyers and investors alike.

Latest Housing Report on Detroit

According to Redfin, as of November 2023, the Detroit housing market is showing notable trends. The median sale price for homes in Detroit was $80,000, indicating a 1.5% decrease compared to the previous year. Homes are selling faster, with an average of 38 days on the market, down from 51 days last year. The competitiveness in Detroit’s housing market is evident, with some homes receiving multiple offers.

Detroit’s real estate scene is somewhat competitive. Homes sell in approximately 38 days, and the average selling price is about 5% below the list price. Hot homes, on the other hand, can sell for about 2% above the list price, with a quick turnaround of around 14 days. Comparing with nearby cities, Detroit stands out with its unique dynamics, offering a somewhat competitive environment for homebuyers.

Sale-to-List Price Ratio

The sale-to-list price ratio provides insights into negotiation dynamics. In 2023, the sale-to-list price ratio for all home types in Detroit is 80.0%, showcasing a competitive market where buyers may need to make competitive offers to secure a property. Understanding these ratios is crucial for both buyers and sellers navigating Detroit’s housing market.

Detroit Migration & Relocation Trends

Examining migration trends adds another layer to understanding Detroit’s housing market. Approximately 0.78% of homebuyers nationwide searched to move into Detroit from outside metros. New York leads the pack, with homebuyers showing significant interest in moving to Detroit. Conversely, some Detroit residents are exploring opportunities elsewhere, with Washington being a popular destination.

ALSO READ: Michigan Housing Market Forecast

Detroit Housing Market Forecast for 2024

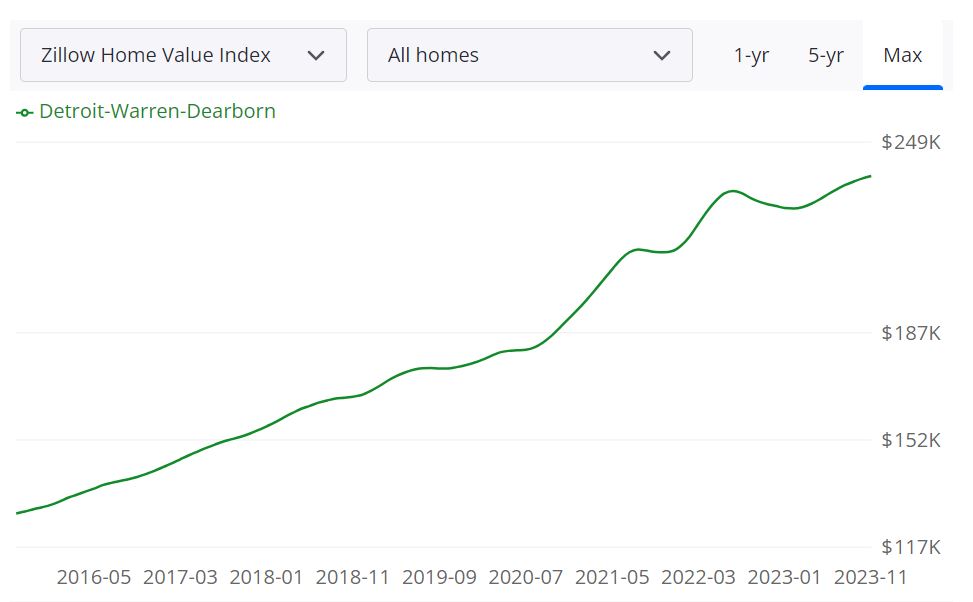

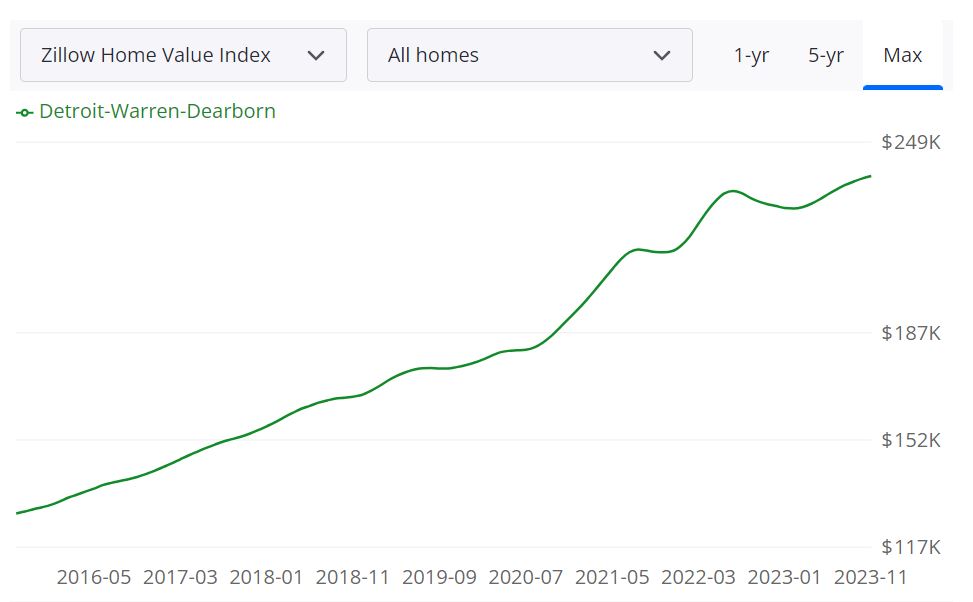

According to Zillow, the Detroit housing market has shown resilience and growth. Based on the current data, the Detroit housing market appears balanced, offering opportunities for both buyers and sellers. The market’s stability and the availability of diverse properties make it an interesting landscape. Currently, the average home value in the Detroit-Warren-Dearborn area stands at $238,284, reflecting a 4.0% increase over the past year. Homes typically go pending in approximately 12 days, indicating a dynamic market.

Key Metrics:

- 1-year Market Forecast (November 30, 2023): -1.1%

- For Sale Inventory (November 30, 2023): 12,067

- New Listings (November 30, 2023): 4,433

- Median Sale to List Ratio (October 31, 2023): 1.000

- Median Sale Price (October 31, 2023): $245,667

- Median List Price (November 30, 2023): $231,167

- Percent of Sales Over List Price (October 31, 2023): 45.3%

- Percent of Sales Under List Price (October 31, 2023): 40.0%

Market Forecast:

Considering the 1-year market forecast of -1.1%, it suggests a slightly challenging scenario for sellers. However, with 12,067 properties available for sale and 4,433 new listings, buyers have a diverse range of options to explore.

Price Trends:

The median sale price of $245,667 (October 31, 2023) and the median list price of $231,167 (November 30, 2023) indicate a healthy market. The 1.000 median sale to list ratio reflects a balance between listing prices and actual sale prices.

Buyer or Seller’s Market?

The current data suggests a balanced market, offering opportunities for both buyers and sellers. Sellers benefit from a market where 45.3% of sales are over the list price, indicating demand. At the same time, buyers have the advantage of a market where 40.0% of sales are under the list price, providing potential cost savings.

Market Stability and Future:

While the market is stable, the slight negative forecast suggests caution. Homebuyers may find this period favorable, considering the ample inventory and negotiating power. However, it’s essential to monitor future trends for any significant shifts.

Here are the best neighborhoods to invest in Detroit rentals because they have the highest appreciation rates since 2000 (List by Neigborhoodscout.com).

- Rosa Parks Southeast

- Corktown

- Butzel

- West Village

- Rosa Parks East

- Mcdougall Hunt West

- Mcdougall Hunt South

- Jeffries

- University

- Condon East

Detroit Real Estate Investment Overview

Detroit, Michigan is a city with a rich history, known for its role in the automobile industry and its contributions to music, art, and culture. In recent years, Detroit’s real estate market has been on the upswing, making it an attractive destination for real estate investors looking for long-term returns. In this overview, we will explore the current state of the Detroit real estate market and provide five compelling reasons to invest in this market for the long term.

Detroit, known for its historical significance and urban revitalization efforts, presents a complex yet potentially lucrative landscape for real estate investors. As of the latest available data, the average home value in the Detroit metro stands at $238,284, reflecting an increase of 4% over the past year. This market trend may offer opportunities for value-oriented investors seeking properties with growth potential.

Top Reasons to Invest in Detroit Real Estate for the Long Term:

- Affordable Prices: Detroit’s real estate market offers some of the lowest prices in the country, making it an ideal destination for investors looking to buy low and sell high.

- Strong Rental Market: Detroit’s rental market is thriving, with a high demand for affordable housing. This makes it an ideal market for buy-and-hold investors who are looking for passive income streams.

- Revitalization Efforts: Detroit has undergone a significant transformation in recent years, with major revitalization efforts taking place throughout the city. These efforts have attracted new residents, businesses, and investment to the area, driving up property values and creating new opportunities for investors.

- Job Growth: Detroit’s economy is on the upswing, with job growth in a number of key sectors, including technology, healthcare, and manufacturing. This is driving demand for housing and creating new opportunities for investors.

- Pro-Investor Policies: Detroit has a number of pro-investor policies in place, including tax incentives and other programs designed to encourage investment in the city’s real estate market. This makes it an attractive destination for investors who are looking for long-term returns.

- Thriving Detroit Downtown: Over the past decade, the downtown area of Detroit has undergone a major transformation and has become a hub of economic and cultural activity. The downtown area is home to several major corporations, including General Motors, Quicken Loans, and Ally Financial, as well as numerous startups and small businesses. The thriving downtown area has also led to an increase in demand for housing in the city. As more and more people move to Detroit to take advantage of job opportunities and the city’s vibrant culture, the demand for housing in the downtown area has increased. This has led to an increase in property values and rental rates in the area. Investing in real estate in the downtown area of Detroit can provide a great opportunity for long-term growth and rental income. Properties in the area are likely to appreciate in value over time as the area continues to grow and attract more businesses and residents. Additionally, rental rates in the area are likely to remain high due to the high demand for housing in the downtown area.

- Detroit Government Initiatives: In recent years, the city’s government has taken several initiatives to revitalize Detroit and attract more businesses and residents to the city. These initiatives have included tax incentives, redevelopment projects, and community outreach programs. One of the most significant government initiatives in Detroit is the Strategic Neighborhood Fund (SNF), which was launched in 2016. The SNF is a public-private partnership that provides funding for neighborhood revitalization projects, such as park improvements, streetscape enhancements, and commercial corridor redevelopment. The program has invested over $40 million in Detroit neighborhoods and has helped to attract new businesses and residents to the city. Another government initiative that has had a positive impact on Detroit’s real estate market is the Neighborhood Enterprise Zone (NEZ) program. The NEZ program provides tax incentives to homeowners and businesses in designated areas of the city. The incentives include a freeze on property taxes for up to 15 years and a reduction in the taxable value of the property. This has made it more affordable for residents and business owners to own property in Detroit, which has led to increased demand for real estate in the city. The Detroit Land Bank Authority (DLBA) is also a government agency that has played a key role in revitalizing the city’s real estate market. The DLBA is responsible for acquiring and disposing of tax-foreclosed properties in the city. The agency has made it easier for residents and investors to acquire property in Detroit, which has helped to stimulate the real estate market and drive up property values.

Detroit Rental Market Trends

Detroit’s rental market has seen significant growth in recent years, with both short-term and long-term rental options becoming increasingly popular. This growth can be attributed to several factors, including the city’s revitalization efforts, an increase in job opportunities, and a growing population. As a result, Detroit’s rental market has become an attractive investment opportunity for real estate investors.

One of the main reasons for the growth of the rental market in Detroit is the city’s revitalization efforts. In recent years, Detroit has undergone a significant transformation, with abandoned buildings and neighborhoods being restored and renovated. As a result, the city’s population has grown, and job opportunities have increased. These changes have created a demand for housing, including rental properties, leading to an increase in rental rates.

Another reason for the growth of the rental market in Detroit is the city’s growing population. According to the U.S. Census Bureau, the population of Detroit increased by over 4% between 2010 and 2020. This growth has led to an increased demand for housing, and rental properties have become a popular choice for many residents.

The short-term rental market has also seen significant growth in Detroit in recent years. With the rise of platforms like Airbnb, short-term rentals have become an increasingly popular choice for travelers. In Detroit, short-term rentals have become an attractive option for tourists and business travelers, with many properties located in desirable neighborhoods close to popular attractions.

Investing in the Detroit rental market offers several advantages for long-term investors. One advantage is the potential for long-term appreciation in property values. As the city continues to grow and improve, property values are expected to increase, leading to a significant return on investment for those who invest in rental properties now.

Another advantage of investing in the Detroit rental market is the relatively low cost of entry compared to other markets. With lower prices for rental properties, investors can purchase properties at a lower cost, increasing their potential return on investment.

Additionally, the high demand for rental properties in Detroit offers the potential for a consistent stream of rental income. As more people move to the city and job opportunities continue to grow, the demand for rental properties is likely to increase, providing a steady source of income for investors.

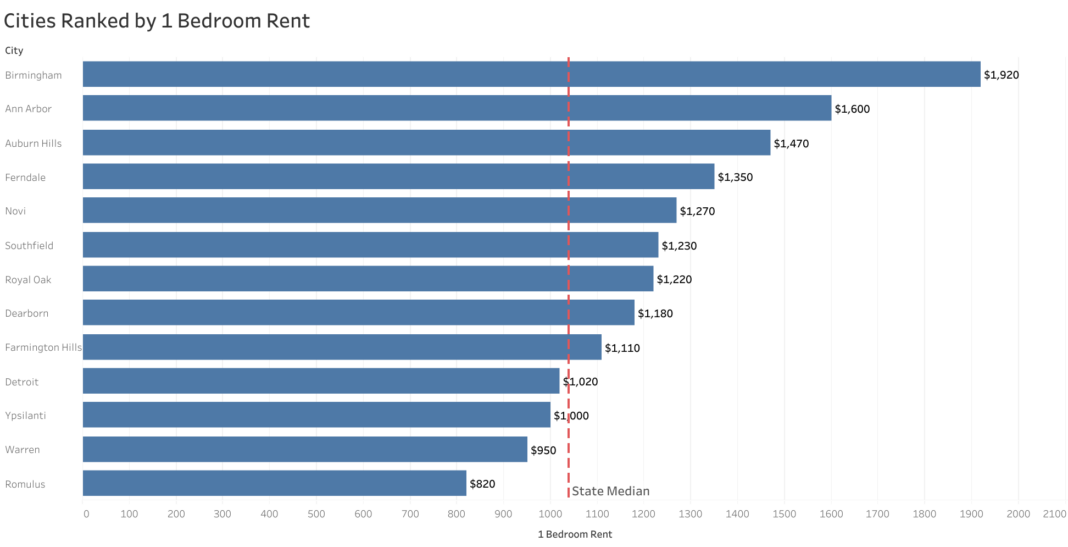

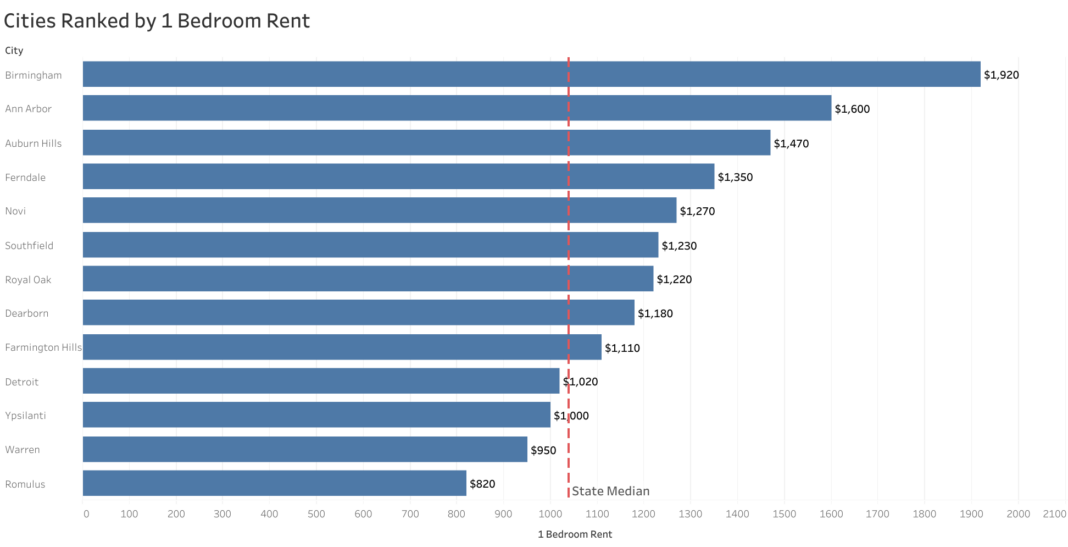

The Zumper Detroit Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Michigan one bedroom median rent was $1,039 last month. Birmingham was the most expensive city with one bedrooms priced at $1,920 whereas Romulus was the most affordable city with one bedrooms priced at $820.

The Fastest Growing Cities in Detroit Metro Area For Rents (Y/Y%)

- Ann Arbor had the fastest growing rent, up 12.7% since this time last year.

- Southfield saw rent climb 8.8%, making it second.

- Warren was third with rent increasing 8%.

The Fastest Growing Cities in Detroit Metro Area For Rents (M/M%)

- Birmingham had the largest monthly growth rate, up 6.1%.

- Ann Arbor was second with rent increasing 6%.

- Southfield saw rent climb 6%, ranking as third.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

References:

- https://www.zillow.com/detroit-warren-dearborn-mi/home-values/

- https://www.zumper.com/blog/detroit-metro-report/

- https://www.redfin.com/state/Michigan/housing-market/

- https://www.realtor.com/realestateandhomes-search/Wayne-County_MI/overview

- https://www.neighborhoodscout.com/mi/detroit/real-estate

- https://gmaronline.com/resource-library

- https://www.mirealtors.com/housing-statistics

- https://detroitmi.gov/search?search=strategic+neighborhood+fund

- https://detroitmi.gov/search?search=neighborhood+enterprise+zone+%28nez%29+program