Governor says state can cover costs of eliminating homestead property tax in fiscally constrained counties

The state might have a solution to your property tax problem if you live in one of Florida’s “fiscally constrained” counties.

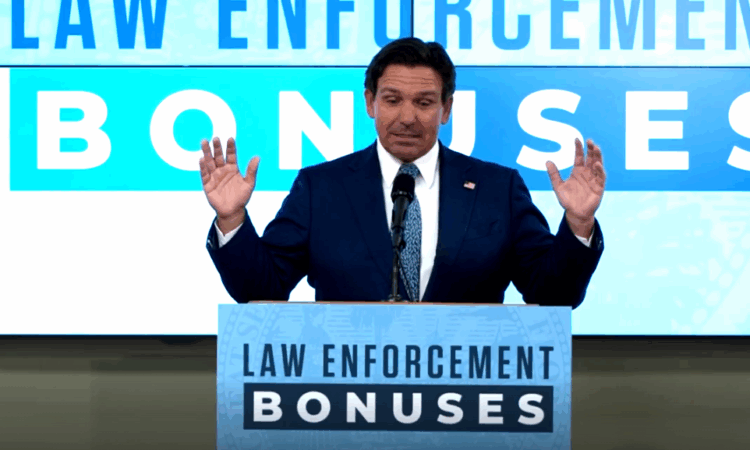

Gov. Ron DeSantis says he’s willing to pay the cost for reluctant rural voters who may not want to support eliminating property taxes on homesteaded properties.

“I can fund all that. I can take all 32 fiscally constrained counties, I could fund 100% of tax revenue that would be derived from a homestead Florida residence, property taxes. And it’s like budget dust for us,” DeSantis said at the Bay County Sheriff’s Office in Panama City.

“We’ve got a massive surplus. So we can do that and we will do that.”

A total of 32 of Florida’s 67 counties are designated as fiscally constrained.

Typically lower in population and property value, they include Baker, Bradford, Calhoun, Columbia, DeSoto, Dixie, Franklin, Gadsden, Gilchrist, Glades, Gulf, Hamilton, Hardee, Hendry, Highlands, Holmes, Jackson, Jefferson, Lafayette, Levy, Liberty, Madison, Okeechobee, Putnam, Suwannee, Taylor, Union, Wakulla and Washington counties.

DeSantis has been leaning on lawmakers in the supermajority Republican Legislature to put a measure eliminating homestead property taxes on the ballot, even teasing a Special Session during the Summer if they don’t ratify something during the Regular Session.

During his remarks on the Panhandle, he questioned the conservatism of some holdouts, and commitment to Republican ideals as he sees them.

“There are some people that wear the label,” DeSantis said, adding that he wonders if they are “a donkey dressed up in an elephant suit.”

Heading into his last Legislative Session as Governor, DeSantis has prioritized property tax relief even as Republican lawmakers have been less eager. The House’s Select Committee on Property Taxes has explored the issue, but the bipartisan panel hasn’t been as excited to move forward as DeSantis wants.