The real estate market today is a topic of much debate among experts. While there is no consensus on whether the historically tight housing market will loosen or not, it is evident that the market has cooled significantly from its previous highs. The housing market today is still a seller’s market.

Home prices are rising, inventory is low, and mortgage rates are increasing. This makes it a challenging time to buy a home, but there are still opportunities for buyers who are prepared. In this post, we will discuss whether the real estate market is slowing down or going to crash.

Is the Housing Market Slowing Down or Going to Crash?

Despite initial concerns of a housing market crash comparable to the Great Depression due to the pandemic, the market has remained stable. However, there are key factors to consider, such as rising home prices and potential declines in home sales due to supply-demand imbalances.

The impact of higher mortgage rates and recession fears has contributed to the market’s cooling from its peak earlier this year. Nevertheless, there are other factors that may influence the market’s pace and favorability for both buyers and sellers. The market is gradually shifting away from being heavily skewed towards sellers, moving towards more balanced conditions. Buyers are still showing interest, maintaining some level of competition, particularly for attractively priced homes.

- The housing market is expected to continue to cool down in the coming months, as rising mortgage rates and inflation make it more expensive to buy a home.

- However, home prices are still expected to rise, albeit at a slower pace.

- The housing market is expected to remain a seller’s market for the foreseeable future, as demand for homes continues to outstrip supply.

While real estate firms generally do not predict a financial or foreclosure crisis on the scale of 2008, they do anticipate a return to more typical housing fundamentals. This moderation may be driven by increasing salaries and declining home prices. As the correction takes place, the housing market is expected to reach a more reasonable valuation and avoid being overvalued.

Mortgage rates will likely play a significant role in determining the decline in home values. Interest rates have a substantial impact on the real estate market, influencing mortgage payments, housing demand, and prices. Although home prices are still experiencing growth, the rate of increase has slowed compared to earlier in the year. Despite this, buyer interest remains high, resulting in a somewhat competitive market, especially for homes that are priced attractively and possess desirable features.

ALSO READ: Real Estate Housing Market Trends for August 2023

However, concerns persist regarding the housing market, particularly regarding the shortage of housing supply and rising interest rates. The shortage of supply has been a primary driver of home price growth, but the increasing interest rates are discouraging potential sellers and new construction. As a result, there is limited hope for an improvement in the housing supply and the establishment of a sustainable market that would benefit from increased inventory.

The significant increase in mortgage rates since last year has further exacerbated the already expensive housing market, making it even less affordable. Home prices saw a meteoric rise during the pandemic, driven by factors such as high demand, low supply, and record-low mortgage rates. However, the sudden surge in mortgage rates has slowed the market’s growth and affordability, posing challenges for buyers looking to enter the market.

As we explore the latest housing market predictions and forecasts for 2024, it becomes evident that the market’s trajectory remains uncertain. Factors such as interest rates, supply-demand dynamics, and affordability will continue to shape the housing market. Staying informed about these predictions will be crucial for prospective buyers, sellers, and industry professionals navigating the ever-evolving housing landscape.

Housing Market Predictions for 2024

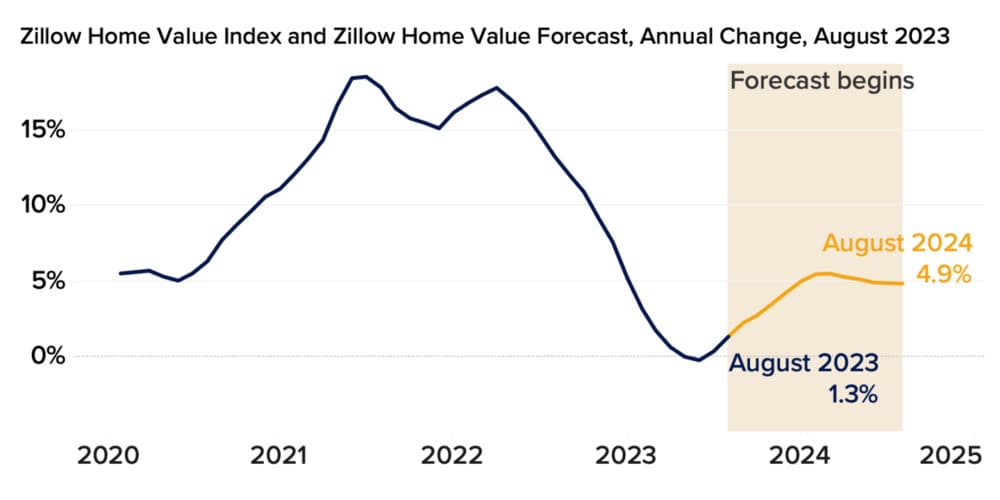

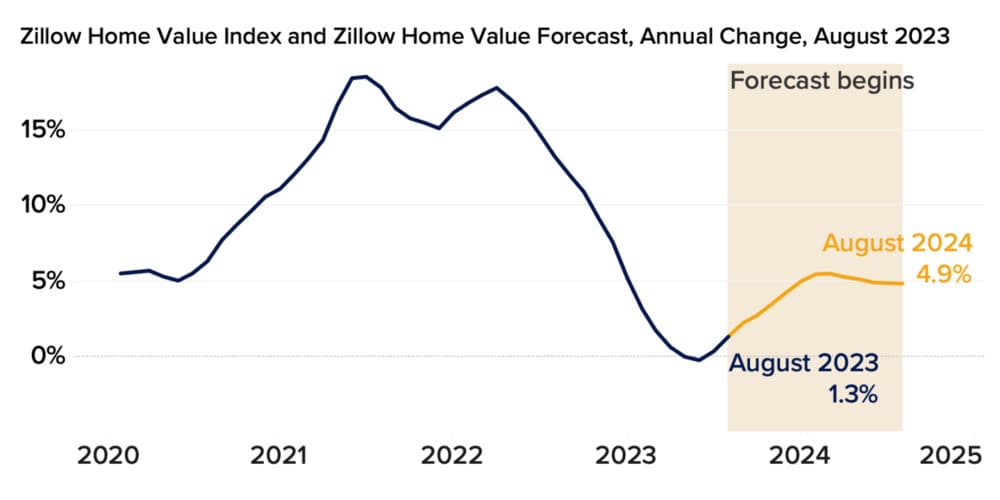

Zillow, a prominent player in real estate data and forecasting, has recently revised its home value forecast for 2024. The revision was influenced by the anticipation of higher mortgage rates and a slight decrease in market tightness.

Zillow now forecasts that the national Zillow Home Value Index (ZHVI) will rise by 4.9% from August 2023 through August 2024. This projection represents a decrease from last month’s prediction, which anticipated a 6.5% increase from July 2023 to July 2024.

Shifts in New Listings and Inventory

The month of August witnessed an unexpected uptick in the number of new for-sale listings entering the market, a phenomenon observed late in the summer. New listings saw a 4.0% increase from July to August. This increase is noteworthy, marking the first time in Zillow’s records where the inflow of listings increased over a two-month span.

However, it’s crucial to emphasize that while this increase in new listings and the total for-sale inventory helped ease market conditions, both remain considerably below the levels seen before the pandemic. Inventory conditions, in general, continue to be very tight.

Impact on Home Values and Sales Volume

The tight inventory conditions, coupled with persistently elevated mortgage rates, are expected to have a continued effect on the housing market. Notably, they are projected to limit sales volume in the coming months. Zillow anticipates approximately 4.1 million existing home sales in 2023, representing an 18% decline from the sales volume in 2022. This prediction slightly deviates from last month’s forecast, which estimated 4.2 million sales for this year.

These shifts in Zillow’s home value forecast and market predictions highlight the delicate balance between various economic factors, including mortgage rates, market tightness, and inventory levels, and their collective influence on the housing market’s trajectory. Staying informed about these forecasts can aid both buyers and sellers in making informed decisions in an evolving real estate landscape.

Top 10 MSAs Where Home Prices Will Grow by July 2024

Among various Metropolitan Statistical Areas (MSAs) across different states, there are ten regions where home prices are projected to experience significant growth by August 2024. These regions and their respective states are as follows:

1. Thomaston, GA (Georgia): The home prices in Thomaston, GA are expected to grow by 0.4% as of 31-08-2023, followed by a 2.0% growth by 30-09-2023 and an impressive 11.3% growth by 31-08-2024.

2. Laurinburg, NC (North Carolina): In Laurinburg, NC, the home prices are anticipated to increase by 1.2% as of 31-08-2023, followed by a 4.0% growth by 30-09-2023 and a notable 10.6% growth by 30-11-2023.

3. Clewiston, FL (Florida): Home prices in Clewiston, FL are predicted to rise by 1.0% as of 31-08-2023, followed by a 2.7% growth by 30-09-2023 and a substantial 10.5% growth by 30-11-2023.

4. Toccoa, GA (Georgia): Toccoa, GA is expected to see a 0.6% growth in home prices by 31-08-2023, followed by a 2.1% growth by 30-09-2023 and a significant 9.9% growth by 30-11-2023.

5. Butte, MT (Montana): The home prices in Butte, MT are projected to increase by 0.8% as of 31-08-2023, followed by a 2.4% growth by 30-09-2023 and a noteworthy 9.8% growth by 30-11-2023.

6. Jackson, WY (Wyoming): In Jackson, WY, home prices are expected to grow by 0.9% as of 31-08-2023, followed by a 2.4% growth by 30-09-2023 and a substantial 9.8% growth by 30-11-2023.

7. Cedartown, GA (Georgia): Cedartown, GA is anticipated to experience a 0.8% growth in home prices by 31-08-2023, followed by a 2.4% growth by 30-09-2023 and a notable 9.7% growth by 30-11-2023.

8. Laconia, NH (New Hampshire): In Laconia, NH, home prices are predicted to increase by 1.2% as of 31-08-2023, followed by a 3.1% growth by 30-09-2023 and a significant 9.6% growth by 30-11-2023.

9. Mountain Home, ID (Idaho): Home prices in Mountain Home, ID are expected to rise by 0.3% as of 31-08-2023, followed by a 1.3% growth by 30-09-2023 and a noteworthy 9.5% growth by 30-11-2023.

10. Steamboat Springs, CO (Colorado): Steamboat Springs, CO is expected to witness a 0.7% growth in home prices by 31-08-2023, followed by a 1.8% growth by 30-09-2023 and a significant 9.2% growth by 30-11-2023.

These ten metropolitan areas present promising opportunities for potential homebuyers and investors, showcasing positive growth trends in home prices over the specified time frames.

Alternate Views on Predictions

While Zillow’s optimism is palpable, it’s important to note that not all experts share the same sentiment. For instance, Morgan Stanley foresees a different trajectory for U.S. home prices in 2024. Their perspective suggests that home prices will experience a decline during this period, offering potential relief for prospective buyers.

Despite the differing opinions, one thing remains clear: the U.S. housing market is in a state of flux, influenced by factors such as inventory levels, mortgage rates, and economic conditions. As the months roll on, it will be fascinating to see how these predictions unfold and whether the market continues its upward trajectory or experiences the anticipated corrections.

Housing Market Predictions Until August 2024

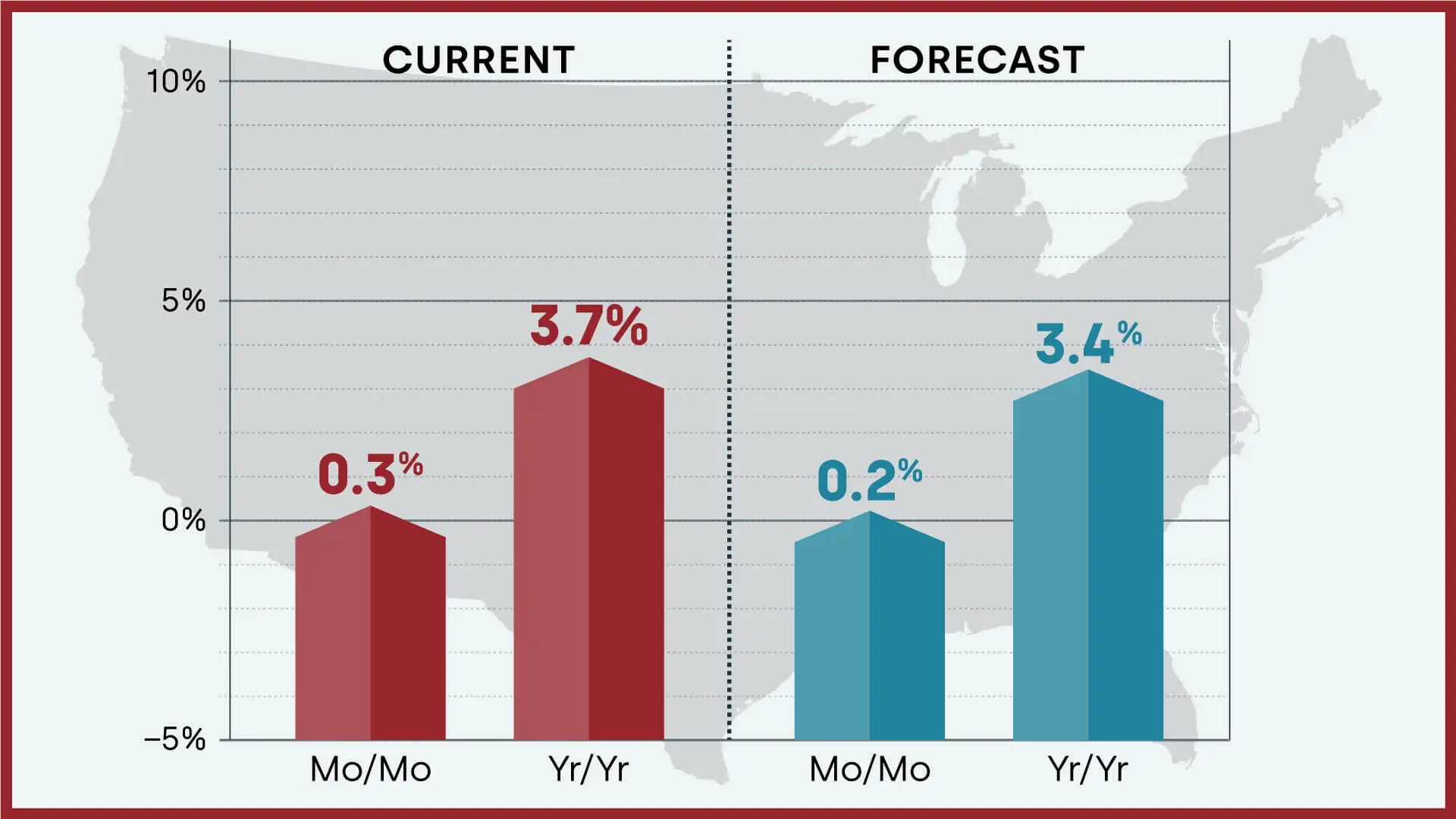

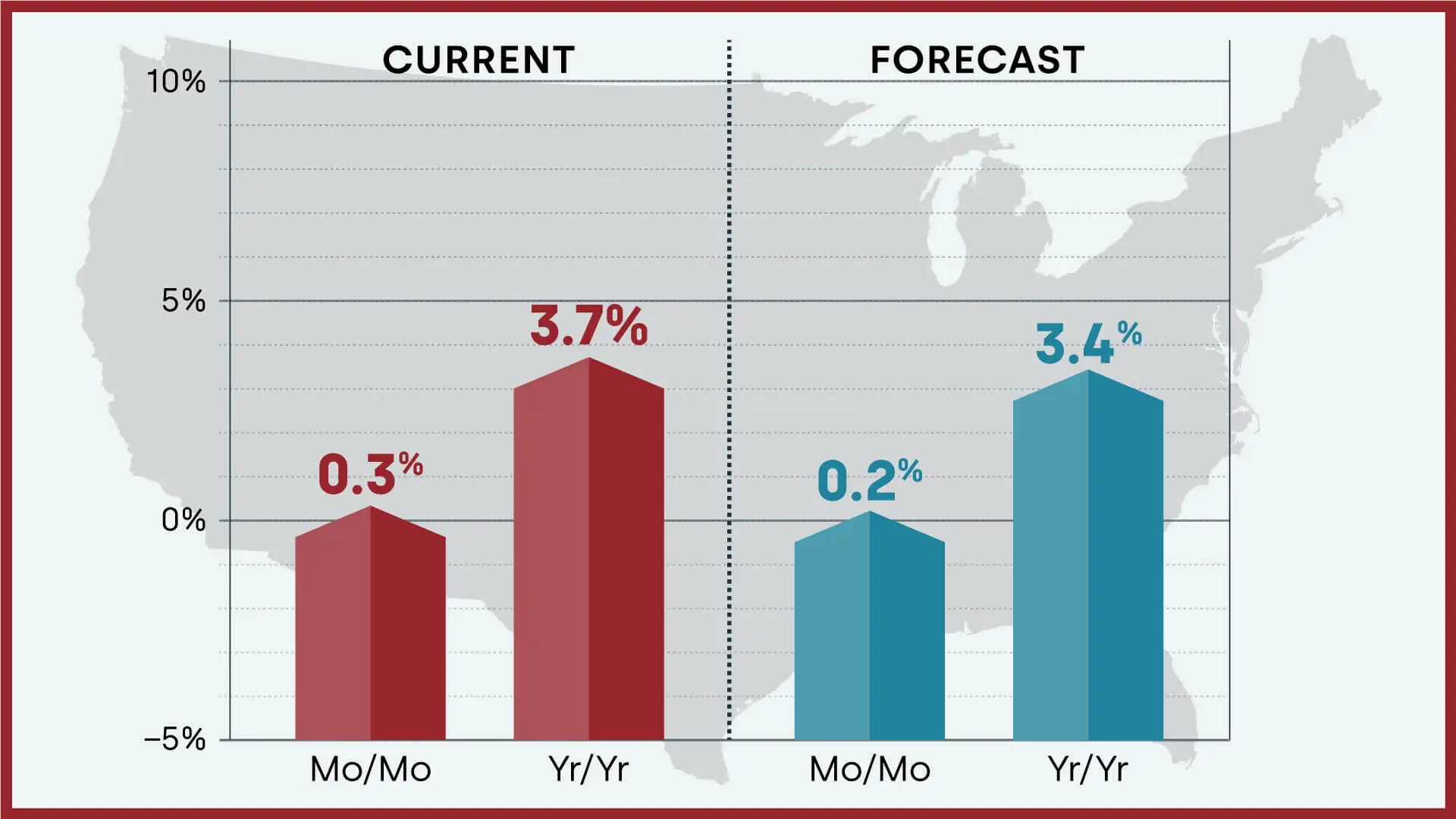

Providing a comprehensive view of the US housing market, CoreLogic’s home price insights for October 2023 offer valuable data and forecasts up to August 2024. In August 2023, home prices across the nation, including distressed sales, demonstrated a year-over-year increase of 3.7% compared to August 2022.

Additionally, on a month-over-month basis, there was a 0.3% increase in home prices in August 2023 compared to the preceding month. Notably, CoreLogic emphasizes the importance of incorporating newly released public data to ensure accurate results due to standard revisions with public records data.

Forecasted Home Prices Nationally

The CoreLogic Home Price Index (HPI) Forecast foresees a 0.2% month-over-month increase in home prices from August 2023 to September 2023. Moreover, it predicts a 3.4% year-over-year increase in home prices from August 2023 to August 2024.

New England States Lead in Annual Home Price Gains for August

Despite experiencing an 11-year low in the spring of 2023, CoreLogic’s Home Price Index is regaining momentum. States in the West that previously faced annual home price losses have seen a decrease in these numbers since this year’s spring. On the other hand, housing markets in New England are beginning to show increased activity, with New Hampshire, Maine, Vermont, and Rhode Island witnessing the largest year-over-year price gains in August.

Quote from Selma Hepp, Chief Economist for CoreLogic:

“While continued mortgage rate increases challenge affordability across U.S. housing markets, home price growth is in line with typical seasonal averages, reflecting strong demand bolstered by a healthy labor market, strong wage growth, and supporting demographic trends. Still, with a slower buying season ahead and the surging cost of homeownership, additional monthly price gains may taper off.”

HPI Top 10 Metros Change

Examining home price changes in large U.S. metros for August, Miami stands out with the largest gain at 8.3% year over year. For more details on home price changes in select metro areas, refer to Chart 3: Year-over-Year Home Price Changes by Select Metro Areas for August 2023.

Top Markets at Risk of Home Price Crash in 2024

The CoreLogic Market Risk Indicator (MRI) assesses the overall health of housing markets and identifies those at risk of a decline in home prices. For the next 12 months, Spokane-Spokane Valley, WA is identified as having a very high risk (70% probability or more) of a decline in home prices. Additionally, Cape Coral-Fort Myers, FL; Youngstown-Warren-Boardman, OH-PA; Ocala, FL; and Deltona-Daytona Beach-Ormond Beach, FL are also at very high risk for potential price declines.

Hence, we can form an opinion that the landscape of the U.S. housing market is a complex tapestry woven by economic currents, supply and demand dynamics, and evolving trends. The housing market predictions fir 2024 offer a compass for individuals seeking insights into the future of home prices and market conditions. In this realm of forecasting, three significant players stand out: Zillow, CoreLogic, and Morgan Stanley.

References

- https://www.realtor.com/research/

- https://www.nar.realtor/research-and-statistics/housing-statistics/

- https://www.corelogic.com/intelligence/u-s-home-price-insights/

- https://www.zillow.com/research/daily-market-pulse-26666/