One property in Virginia Beach has flooded 52 times — including four floods in 2020 and another two in 2021 — with total payments amounting to $784,967. Another property on the Outer Banks of North Carolina has flooded 44 times, with payments totaling more than $2.2 million. There are 30 properties that have flooded at least 30 times, the data shows.

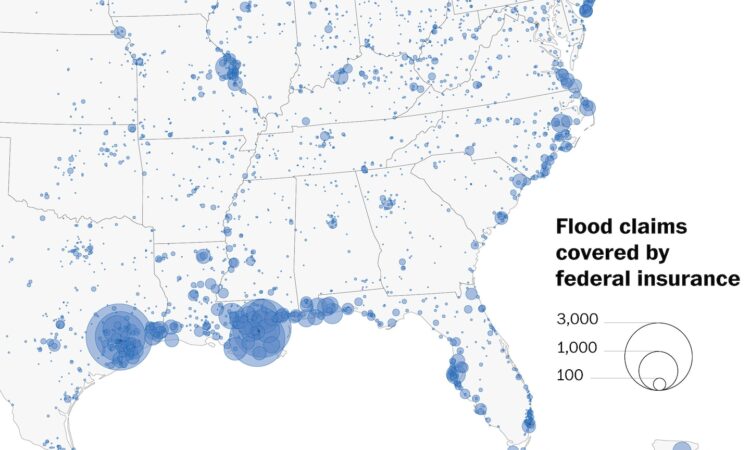

Properties that have repeatedly flooded account for only a small fraction — about 1 percent — of the flood insurance program’s nearly 5 million active policies across more than 22,000 communities. But they are responsible for more than 10 percent of the agency’s claims, according to the Natural Resources Defense Council, an advocacy group that sought the updated records from the federal government and maintains an online dashboard that tracks the issue.

“Essentially, what we are seeing is flooding is increasing faster than we are mitigating our risk,” said Anna Weber, an NRDC senior policy analyst.

Because a relatively low proportion of the country’s flood-prone homes actually have federal flood insurance, the numbers offer only a glimpse of what is likely to be a far broader problem.

“These are basically the tip of iceberg when it comes to repeatedly flooded properties in the United States,” Weber said, noting that the actual number of seriously at-risk homes could be several times larger.

The updated data, which is current through Dec. 11, 2022, highlights how coastal Louisiana and Texas are high-risk areas for devastating and frequent flooding. Houses in some places along the Mississippi River also have repeatedly been deluged, as have parts of the Atlantic coast from Florida to New England. While some of the properties in FEMA’s database have been mitigated through actions such as buyouts or elevating homes, many remain as vulnerable as ever.

David Maurstad, an assistant administrator at FEMA and the flood insurance program’s senior executive, said in an interview that over the past year, the number of repeatedly flooded properties has eclipsed 46,000 — a figure that underscores the need for Congress to implement long-awaited reforms.

“We have to stop the rinse-and-repeat cycle on repetitive loss,” Maurstad said, noting that the main indicator of whether a structure will flood is whether it has flooded in the past.

He said there are multiple factors why such losses are likely to continue to climb in the absence of serious policy changes.

“It’s an indicator of increasing risk as a result of climate change,” Maurstad said. In addition, “We’re seeing more people move into higher-risk areas, so it’s part of that development of where people are located.”

Many of the most flood-prone homes belong to working-class Americans, experts say — although the tally does include eye-popping examples of pricey coastal homes that have relied on taxpayers to pay claim after claim. Even where people are eager to raise their homes or accept buyouts, such efforts often can take years and historically have been beset by a lack of adequate funding.

“Our experience is if your home keeps flooding, it’s a miserable, horrible situation,” said Harriet Festing, executive director of the Anthropocene Alliance, a coalition of front-line communities experiencing the impacts of extreme weather.

“And there’s going to continue to be more flooding with climate change and development standards that facilitate building in floodplains.”

The number of repeatedly flooded properties backed by federal insurance, while a financial albatross for taxpayers, represents only one aspect of the nation’s troubled federal flood insurance program, which an array of advocacy groups, the Government Accountability Office and even FEMA have said is in need of an overhaul by Congress.

Since Hurricane Katrina battered the Gulf Coast in 2005 and forced massive payouts, the NFIP has remained firmly in the red. Subsequent catastrophes such as Hurricane Sandy in 2012 and several hurricanes in 2017 — which led to the second-largest number of claims in the program’s history — have left the program’s current debt to the treasury at more than $20 billion.

By spring 2023, FEMA had implemented a new pricing system, meant to better reflect actual flood risks. That led premiums to fall for many homeowners but to spike for some in high-risk areas, leading to an outcry by some lawmakers over affordability.

The problem underscored what the GAO has described as the flood insurance program’s central dilemma, saying it “has experienced significant challenges because FEMA is tasked with pursuing competing programmatic goals — keeping flood insurance affordable while keeping the program fiscally solvent.”

Congress created the flood insurance program in 1968 amid the escalating costs of disaster assistance, and because private insurers had largely abandoned the market. The program not only requires people purchasing homes in floodplains to take out insurance as a condition of getting a mortgage, but also provides grants to help mitigate vulnerable properties, either by elevating them or in some cases buying out homeowners and tearing down vulnerable structures.

In practice, critics say, the program has not succeeded in discouraging development in risky areas, and in many cases has actually resulted in people remaining in places likely to flood again and again.

Congress has passed dozens of short-term reauthorizations of the flood insurance program in recent years, but has not made substantive reforms to the program in roughly a decade.

In 2022, FEMA submitted a list of 17 legislative proposals to Capitol Hill. It included measures to put the program on a more sustainable financial footing, to require more disclosure about flood risks during real estate transactions and to allow the government to cease coverage for certain properties that have been repeatedly inundated.

A range of other groups, including the NRDC, have made similar sets of recommendations. But even though the flood insurance program has long enjoyed bipartisan support, Congress has struggled to agree on meaningful reforms.

“I’m pretty cynical about it, to be honest with you,” Roy Wright, who oversaw the flood insurance program until his departure in 2018, said of the chances that Congress will overhaul the program in the coming year.

“There’s a whole set of things that need to be done to the program that only Congress can do,” said Wright, now chief executive of the Insurance Institute for Business & Home Safety. But between competing priorities and a contentious election year, he said, “I just don’t see that Congress has an appetite to deal with it. … There’s not a lot of legislation making it to the finish line.”

That means that at least for now, the nation’s flood insurance program remains an insurer of last resort, destined to continue covering many properties that suffer repetitive losses. What concerns Wright more are the interest payments the agency must make on its debt each year — a figure that FEMA said in the fall had eclipsed $600 million, or about $1.7 million per day.

Without debt cancellation that only Congress can provide, Wright said, “Those interest costs are going to eat the program alive.”

In the meantime, Weber and other advocates have implored FEMA to use its existing legal authority to change what it can, such as by strengthening the minimum building codes communities must follow to be eligible for flood insurance, as well as setting minimum elevations for structures build in flood-prone areas.

Maurstad said the agency has begun the process of new rulemakings that will examine existing federal standards and whether they are adequate in the age of “more frequent and more intense disasters.”

But those changes alone probably won’t come fast enough, or be far-reaching enough, to fully offset what is happening on the ground in many places.

“There are more storms, more rain, more high-tide days that flood your community. There’s risky development, there are more hard surfaces. … It’s never just one thing,” Weber said.

“That’s the bottom line, is that the risk and the damages are increasing faster than we are dealing with them.”