C-HOM overview

C-HOM combines elements from theoretical, numerical modeling, and empirical literature in economics, finance, nonlinear systems, and coastal processes.

First, we adopt an asset-price approach that links the sales price of a property to the capitalized flow of housing market rent46,59. We specifically modify the user cost of housing model to parameterize variation in incentives as a function of demographics, the changing physical environment, and broader economic conditions46,60. By linking housing purchases to the flow of coastal amenities and risks, the user-cost approach introduces dynamics that result from different incentives faced by owners, institutional investors, and renters. These differences could become more important as climate change alters the physical environment.

Second, we model feedbacks in the coupled human-natural coastal system29,33,35,41,61. The natural system affects the human system, which in turn affects the natural system62. Specifically, the physical environment changes with erosion, SLR, and storms. These changes affect risks and values of coastal real estate. Human responses, including beach nourishment, create feedbacks between the human and natural systems33,42 (Fig. 2).

Third, we use agent-based modeling to capture nonlinearities and heterogeneity in the coupled human-natural system58,63. In contrast to homogeneous agents with complete information, our model agents have heterogeneous perceptions of and tolerance for environmental risk, and agents use finite-time forecasts of future returns and coastline position to make investment and policy decisions. Nonlinearity is incorporated via positive feedbacks in property value appreciation such that agents can push prices away from equilibrium in the short run, which can lead to transient bubbles in real estate markets64. A bubble occurs when prices rise substantially above expected prices based on market fundamentals over a short period of time. In the long run, arbitrage opportunities move the property market back towards equilibrium.

Fourth, we incorporate flows of amenity values and climate risks based on empirical valuation studies in environmental economics55. Coastal housing markets respond to changes in environmental conditions, and equilibrium market outcomes reveal peoples’ preferences and perceptions of coastal amenities and risks, as well as expectations of climate impacts. Empirical estimates from coastal housing markets show that proximity to the shoreline and coastal wetlands65, beach width39, and beach views66 increase property values. Exposure to storm risk and flood hazards tend to decrease home values67.

Fifth, C-HOM reflects findings that public investments in adaptation and risk mitigation capitalize into real estate prices. Risk reductions from a range of climate adaptation infrastructure are reflected in nearshore housing prices68, including beach nourishment69, construction of vegetated dunes70, and hard structures, such as sea walls or revetments71. Even sandbags can temporarily protect properties and stabilize shorelines. Because investments in coastal adaptation are often federally subsidized in the US, local housing market prices are less volatile relative to the increase in risk12. Federal subsidies for beach nourishment can even create a bubble in coastal real estate markets such that removing subsidies would substantially decrease coastal property values29.

The base model, to which other features are added, is an asset-price model of investment in housing that depends on the flow of housing services (rent) and the opportunity cost of ownership (user cost). The user cost includes cost of capital (the discount rate), depreciation, a risk premium for the real estate market, expected capital gains, and interactions with income and property tax rates that also affect the capitalization of rents46,60. We generalize the model to incorporate the economic value of environmental amenities and risks associated with climate change. In contrast to the standard user cost model, we account for heterogeneity in risk preferences within and across resident owners, resident renters, and an outside institutional investor. This accounts for the ways that peoples’ desire to live at the coast and appreciation of environmental amenities intersect with risk of inundation from storms and other elements of the user cost model.

Capital asset models of housing provide the conceptual relationship between stock and flow variables that determine asset price, namely property sales price (P) and property rent (R). Sale price represents the stock value whereas rents capture the flow value of housing services. The value of an asset is determined from the (expected) flow value, or rents, accrued over time such that the present value of an asset is equal to the discounted sum of future rents. Over an infinite horizon and with constant R and capitalization rate, i, the stock value reduces to:

$$P=\mathop{\sum }\limits_{t=1}^{\infty }\frac{{R}_{t}}{{(1+i)}^{t}}=\frac{R}{i}$$

(1)

Because discounting weighs terms according to exponential decay, the infinite-horizon problem approximates the value of a durable asset, such as real estate, that is expected to be long-lived.

Equation (1) forms the conceptual basis for the user cost of housing model46. The user-cost equivalence is a capital-theoretic relationship equating the marginal cost of owning capital to the rate of return. The cost to own one unit of housing for one year is a percentage i of the total present value P, and the return on capital investment is the rent R paid to consume those housing services over the same period. Owner occupants similarly receive a flow of housing services valued at R. In order to simulate coastal housing markets confronted with climate change, C-HOM decomposes the numerator and denominator in Eq. (1) and endogenizes a subset of the individual pieces.

User cost of housing

In the user cost of housing model, the capitalization rate is:

$$i=\delta (1-{\tau }_{t}^{inc})+{\tau }^{p}(1-{\tau }^{inc})+\gamma+{r}^{p}-E[{g}_{t+1}]$$

(2)

The discount rate, δ, represents the interest rate on a mortgage. In the US market, this rate is modified by the marginal income tax rate τinc because homeowners can deduct mortgage interest, which effectively decreases the discount rate; note that this will depend on an individual’s marginal tax rate. Property taxes are also deductible such that individuals are not double taxed on income used to pay local property taxes, and this too is proportional to the marginal tax rate for an individual’s income bracket, (1 − τinc). Capitalization also includes depreciation on the physical structure, γ, which in our model we assume is constant and captures maintenance and repair costs (assumed separate from climate risks). The risk premium, rp, reflects the opportunity of investing in a risky asset (housing in our case), and we further parameterize this as a function of the physical system. Expectations of future capital gains are in E[g]. If one expects house prices to increase by X% over the course of holding it for one period, then the capital gain effectively decreases the cost of owning the asset over that period, and vice versa for an expected decrease in property value. Combining equations 1 and 2, the user cost model is:

$$P=\frac{R}{(\delta+{\tau }^{p})(1-{\tau }^{inc})+\gamma+{r}^{p}-E[g]}$$

(3)

Equation (3) is the basis for C-HOM. The model consists of a fixed number of properties (i.e., the supply of housing is fixed), a pool of agents who generate bid prices for one unit of housing based on Eq. (3), and an investor agent who can purchase multiple units of housing based on the current schedule of agent bid prices and an investor user cost equation similar to Eq. (3).

Our model community is composed of a fixed population of economic agents representing individual households. We only consider residential properties in the model. Because the number of properties and the number of agents who could own or rent those properties is fixed, when a new agent enters the market, the agent necessarily triggers the exit of another agent. For example, when higher income agents enter, lower income agents exit by assumption. We do not model where the exiting agents go and assume that they are absorbed by real estate markets outside the modeled coastal community.

During each model time step, every agent chooses to either purchase one unit of housing in the market or rent one unit of housing from the investor agent. The investor can potentially own all, some, or none of the housing units each year. One can think of the investor agent as a bank or a pension fund that owns coastal real estate as part of its investment portfolio, and it pays a fee to a management company to rent out the properties. For simplicity, there is one investor agent representing a vast pool of potential institutional and individual investors external to the coastal community being modeled. Every agent formulates a unique price and rental bid for housing based on the user cost of housing and value of consumption flow described in more detail below. Some components of the user cost formulation are unique to each agent (e.g., the income tax bracket), while other components are common (e.g., the housing depreciation rate).

The primary model variables describing the state of the system are the equilibrium price and investor market share. These are established by a market clearing condition described below. Lastly, communities manage the beach, to enhance its recreational value and provide some protection from storms, using a combination of government subsidies and self-financing. To self-finance, the resident owners vote on when and how often to nourish. Lastly, a coastal community is geographically divided into two market segments. The oceanfront market is defined as the single row of houses directly adjoining the beach, and the non-oceanfront market is the remainder of the coastal community. Non-oceanfront properties benefit from wider beaches but not as much as oceanfront properties. We model the supply of housing as fixed because most coastal communities along the East and Gulf Coasts are built out and, when storms destroy structures, typically structures are built back. This also means that we model the effects of storm risk on property values and not the episodic nature of actual storm realizations and resulting damages.

The model spatial resolution is smaller than a town but larger than a census block group; we refer to this as a nourishment unit. This spatial extent allows for the decision-making unit for a nourishment project that is funded by property taxes to be a town, but it includes the possibilities that the town may not nourish its entire beach and that there are special tax districts within the town that pay higher rates to fund the project42. The differences between oceanfront and non-oceanfront markets are embedded in fixed parameters discussed below (e.g., there is a base risk premium, which is higher for front row agents) and in how beach management is financed, including a political economy in which the front row pays a higher share of costs42. Agents choose when to nourish the beach width. Extending the beach increases the agent’s rent by increasing their willingness to pay.

Agent-based user cost

We adapted the user cost of housing model for a household in Eq. (3) to simulate a coastal property market comprised of a population of agents seeking to reside at the coast as either a resident renter or resident owner. There is also one non-resident property investor agent (referred to hereafter as the investor agent, with superscript I) that may purchase many units of housing. The potential owner agents (hereafter referred to as owner agents, with superscript O) are indifferent to owning versus renting beyond incentives captured by the model, and we assume that owner agents who do not end up owning instead rent from the investor agent. Thus, the owner agent enters the market willing to either rent or own.

There are n potential owner agents and n properties. The user cost of housing model determines each agent’s rent and corresponding price bid. Owner agents are indexed with the subscript j. The investor agent considers all potential owner rent and price bids to determine a rent offer based on the user cost of the investor. The investor rent offer is compared to the list of owner agent rent bids to determine what fraction (share) of housing units can be purchased with an owner agent willing to rent at the rate offered by the investor. This fraction is referred to as the investor market share. This calculation determines the equilibrium house price and the share of the n available properties an investor will own.

Owner agent j’s rental bid is composed of their willingness pay for coastal amenities, WTPj, and the annualized value of housing services, HV:

$${R}_{j,t}^{O,bid}=WT{P}_{j,t}+HV$$

(4)

HV is a constant (same for all agents) and WTPj,t is drawn randomly and updated over time according to demographics of the agents. We abstract away from short-term vacation rentals and assume that these values are captured by the flow value of WTP in the prospective owner rent bids. As described below, WTPj,t is further decomposed to incorporate the influence of beach width on each agent’s willingness to pay to live at the beach. Importantly, WTP is an additional amount beyond the fixed value of housing services. It reflects preferences for coastal living in general as well as preferences for specific coastal amenities such as the width of the beach, and it is correlated with income. Rewriting the user cost Eq. (3) to include indices for parameters that vary between agents, and replacing the rent R with the decomposed rent Eq. (4) gives the owner agent price bid function:

$${P}_{j,t}^{O,bid}=\frac{WT{P}_{j,t}+HV}{(\delta+{\tau }_{t}^{p})(1-{\tau }_{j}^{inc})+\gamma+{r}_{j,t}^{p}-{E}_{j,t}^{O}{g}_{t+1}}$$

(5)

The term \({\tau }_{j}^{inc}\) is unique to each agent and drawn randomly, where the parameters of the distribution evolve over time based on how the local market changes relative to other housing markets (details are described below). An agent’s WTPj and \({\tau }_{j}^{inc}\) are correlated such that agents in a higher tax bracket (larger \({\tau }_{j}^{inc}\)) also have a larger WTPj to reflect the influence of income on WTP. The correlation, however, is assumed to be imperfect to allow heterogeneous preferences for coastal living to influence housing markets and outcomes independent of the income channel.

Next, owner agent bid prices are sorted from lowest to highest and corresponding rent bids are sorted according to the ordered list of bid prices (Supplementary Fig. S5). The sorted rents are not monotonically increasing like the bid prices because \({\tau }_{j}^{inc}\) has a stochastic component. Nevertheless, the sorted rents trend upward as a result of the influence of income on WTP.

The resulting investor market share is the highest share of the market for which the investor can outbid potential owners to purchase properties and still rent the properties to prospective owners with zero vacancy. This effectively requires that investors offer a lower rent than the rent bid associated with a prospective owner’s bid price. If the investor purchases 100% of the market, this entails the investor outbidding the highest bid price of prospective owners, while the investor’s associated rent bid is also below all owner rent bids. If this condition does not hold, the investor iterates through each market share until the condition does hold. That is, the investor finds a market share for which it outbids the highest owner bid price and the investor’s rent bid is below all rent bids for non-owners, which is needed to ensure zero vacancy.

The investor’s rent offer is based on the user cost equation in 5 with key differences that the investor has a corporate tax rate τI,c in place of \({\tau }_{j}^{inc}\) and an additional term m subtracted from the rent to reflect the cost of property management. Rearranging terms, rent offers are:

$${R}^{I,offer}={P}_{j,t}^{O,bid}[(\delta+{\tau }_{t}^{p})(1-{\tau }^{I,inc})+\gamma+{r}_{I,t}^{p}-{E}_{t}^{I}\, {g}_{t+1}]+m$$

(6)

For each property, the rent offered by the investor is then compared against the prospective owner agent’s rent bid. If

$${R}^{I,offer}\, < \, {R}_{j}^{O,bid}$$

(7)

then the investor codes this property as occupied and decides to buy it. This process is iterated from j = 1 to n. When the investor rent offer compared against agent j’s rent bid no longer satisfies the inequality in (7), the property is coded as vacant, and it will be purchased and occupied by an owner resident.

Beach and elevation dynamics

We abstract from short time-scale processes that unfold daily or seasonally and use a linear erosion term (ψbw) to represent the long-term erosion signal. Depending on the outcome of beach nourishment decisions (see Shoreline Management below), additional beach width (Δt) can be added. The state equation describing the width of the beach (bw) is then:

$$b{w}_{t+1}=b{w}_{t}-{\psi }_{bw}+{{{\Delta }}}_{t}$$

(8)

The state equation for mean seal level (MSL) also assumes a constant linear rate of increase (ψSL):

$$MS{L}_{t+1}=MS{L}_{t}+{\psi }_{SL}$$

(9)

Willingness to pay

Beach width influences an agent’s willingness to pay to live at the beach39,72. Therefore, WTPj,t(4) is composed of a base willingness to pay and a beach width-dependent willingness to pay. The base willingness to pay component \(WT{P}_{j}^{base}\) reflects coastal amenities that are not directly tied to the beach width. The width-dependent component consists of the average expected future beach width E[bwt+1], a hedonic parameter (β), which reflects the marginal value of the beach width attribute, and a base parameter αj scaling the contribution of beach width to the monetized total willingness to pay, which theoretically can be estimated in a first-stage hedonic model39,73. Both αj and \(WT{P}_{j}^{base}\) are randomly distributed across agents, again with parameters of the distribution changing over time based on demographics of the agents. The value of β is larger for agents in the oceanfront market such that there are separate parameters, βOF and βNOF.

$$WT{P}_{j,t}=WT{P}_{j}^{base}+{\alpha }_{j}E{[b{w}_{t+1}]}^{\beta }$$

(10)

The expected beach width term is calculated by averaging the beach width over the previous tbw years:

$$E[b{w}_{t+1}]=\frac{1}{{t}_{bw}}\mathop{\sum }\limits_{n=1}^{{t}_{bw}}b{w}_{t-n}$$

(11)

Risk premium

All agents are subject to risks from SLR and storms. These risks are included in a risk premium term that includes background risk associated with investment in real estate markets and a dynamic agent-specific term that reflects changing physical risks, heterogeneous climate beliefs, and risk tolerance. In the user cost framework, the risk term effectively augments the discount rate. In our context, this implies that property values are a smaller multiple of rents when physical risks are larger or risk tolerance is lower. Intuitively, this is the same mechanism that exerts downward pressure on property value when interest rates rise.

The risk premium term for agent j at time t is:

$${r}_{j,t}^{p}=\overline{{r}^{p}}+[{r}^{OF}+{r}_{t}^{St}+{r}_{t}^{SL}]{\pi }_{j,t}$$

(12)

where \(\overline{{r}^{p}}\) is background risk in real estate markets, and the three terms inside the square brackets capture climate risks. Specifically, rOF captures the reality that oceanfront properties are more exposed to risk than properties behind them, \({r}_{t}^{St}\) captures risk from storms, \({r}_{t}^{SL}\) captures the risks from SLR that include inundation risk, how SLR increases risks from storm surge, and the effects of SLR on sunny day flooding. The sum of the three physical risk terms in the square brackets is then modified by πj,t, a risk multiplier that combines individual beliefs and tolerance. If an agent is risk neutral and has beliefs that match the objective risks, πj = 1 such that \({r}_{j,t}^{p}\) includes actuarially fair climate risks, and we assume πj = 1 for the outside institutional investor13. We assume that these parameters also reflect the cost of insurance, which capitalizes into property price, and this cost does not vary within the model community.

We assume that rOF is fixed through time, which implies that there is a permanently higher risk of oceanfront property but that both oceanfront and non-oceanfront properties experience the other physical risks similarly. We parameterize \({r}_{t}^{St}\) to reflect the episodic nature of storms, \({r}_{t}^{St}=\frac{{a}_{1}}{{\lambda }_{t}}\), where λt is the average storm return interval over the past 30 years, and a1 is a scaling parameter. To account for risk of SLR, we parameterize \({r}_{t}^{SL}\) to be a function of property elevation relative to sea level. Specifically,

$${r}_{t}^{SL}={a}_{2}{(1-({h}^{elev}-MS{L}_{t}))}^{n}$$

(13)

where MSLt is mean sea level, which changes with SLR, helev is initial barrier elevation, a2 is a scaling parameter, and n controls the nonlinearity of risk as a function of MSLt.

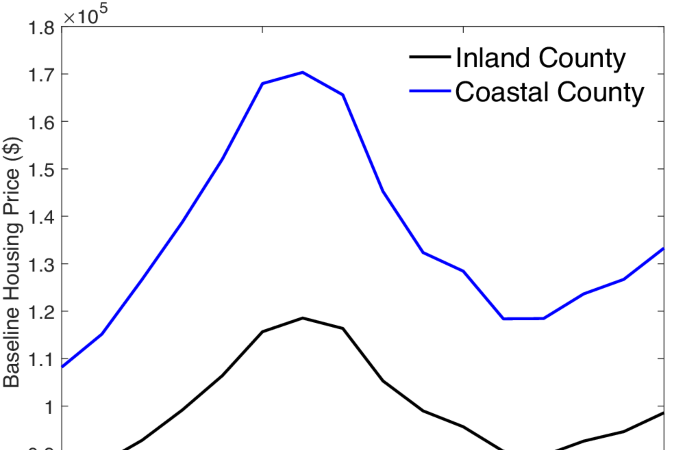

Agent distribution adjustments and outside markets

An important driver in real estate markets is demographic change, and because our model represents coastal real estate markets over long time horizons, we account for demographic changes by updating agent parameter distributions. To this end, we use interactions with outside markets to benchmark these changes. For both oceanfront and non-oceanfront properties, there is a corresponding external market value for housing that serves as a benchmark for owning coastal property in the community, given by \({P}_{e}^{OF}\) and \({P}_{e}^{NOF}\). These external market prices are exogenous and can be thought of as reflecting large-scale real estate market trends in other communities with appropriate amenity adjustments. That is, \({P}_{e}^{NOF}\) is a representative inland property price with sufficient amenities to compensate for the differential between coastal and non-coastal average property values, and \({P}_{e}^{OF}\) is an inland property price with sufficient amenities to compensate for the oceanfront and coastal premia. Examples of amenity adjustments to make inland properties equivalent include being in a particularly good school district, on a lakefront, near green space, or in close proximity to cultural amenities. Deviations in coastal property values from \({P}_{e}^{OF}\) and \({P}_{e}^{NOF}\) drive changes in the owner agent population by shifting the mean income and coastal willingness to pay distributions up or down as property values attempt to equilibrate with the outside markets. Shifts in the distribution of agents lead to a flux of new agents with higher or lower income and possibly different beliefs into the coastal market (and a corresponding flux of agents out) in response to the value of coastal real-estate relative to the outside market.

There are two possible feedbacks in the coastal market due to the external market, one based on arbitrage and the other based on herding. Specifically, over long time scales, there is a sluggish negative feedback component driving the average income distribution and coastal willingness to pay distributions of owner agents up or down, with the effect of driving coastal property value toward Pe (price arbitrage). Over short time scales, there is a faster and positive feedback that can drive income and WTP distributions in the opposite direction with the effect of temporarily driving property values away from Pe (herding behavior). The specific analytical forms are based on Dieci and Westerhoff64.

Let At be a parameter of a Beta distribution that changes according to arbitrage opportunities with property values in outside markets. We fix one shape parameter and allow the other parameter to adjust based on these arbitrage opportunities and control the concentration of probability mass along the [0,1] interval. For each of n agents in each period t, we draw a (4 × 1) vector from the Beta distribution. We then convert these draws on the unit interval to draws from our parameters of interest by re-scaling them based on upper and lower bounds:

$${\tau }_{j,t}^{inc}\in [{\tau }^{inc,L},\, {\tau }^{inc,U}]$$

(14)

$$WT{P}_{j,t}^{base}\in [WT{P}^{base,L},\, WT{P}_{t}^{base,U}]$$

(15)

$${\alpha }_{j,t}\in [{\alpha }^{L},\, {\alpha }_{t}^{U}]$$

(16)

$${\pi }_{j,t}\in [{\pi }^{L},\, {\pi }^{U}]$$

(17)

The upper and lower limits of the income tax parameters do not change over time. They are fixed based on the current US federal tax code. We also fix the bounds of the risk tolerance parameter π. We fix the lower bounds of WTPbase and the beach width scaling parameter α but allow their upper limits to increase or decrease based on the adjustment process described below.

The agent adjustment equation for At that can move the distribution in either direction depending on the sign of \({P}_{t}-{P}_{t}^{e}\):

$${A}_{t}={A}_{t-1}+\phi ({W}_{t}({P}_{t}-{P}_{t}^{e})+(1-{W}_{t})({P}_{t}^{e}-{P}_{t}))$$

(18)

The term Wt is the strength of the short-term positive feedback associated with herding, and (1 − Wt) is the strength of the longer more sluggish negative feedback that drives prices back to equilibrium:

$${W}_{t}=\frac{1}{1+h{({P}_{t}-{P}_{t}^{e})}^{2}}$$

(19)

The parameter h gives the speed of switching between the two types of feedback and the parameter ϕ controls the how quickly the agent distribution changes, and hence how quickly agents can flux in and out of the market. For a given deviation between coastal and non-coastal property values, a larger h value initiates the switching from positive to negative feedbacks more quickly. If h is very high, Wt approaches zero, and the arbitrage effect dominates. Effectively, this means that, ceteris paribus, if coastal properties are undervalued relative to the external market, higher-income agents enter and prices increase, whereas if coastal prices are overvalued, higher-income agents exit and prices drop. Similarly, if coastal properties are undervalued relative to the external market, agents enter who have higher WTP for coastal living, higher WTP for beach width, and higher risk tolerance (to reflect higher-income agents with less relative wealth at risk).

The upper limits of WTPbase and α adjust based on the percent difference in property prices within the community compared to the outside market:

$$WT{P}_{t+1}^{base,U}=WT{P}_{t}^{base,U}\left(1+\frac{({P}_{t}^{e}-{P}_{t})}{{P}_{t}^{e}}\right)$$

(20)

This allows for the possibility that an agent could have a very high WTP for the experience of coastal living (in the numerator of the user cost equation) despite growing risks from SLR (in the denominator of the user cost equation). Similarly, the upper limit for the scale parameter of the value of beach width adjusts based on outside markets:

$${\alpha }_{t+1}^{U}={\alpha }_{t}^{U}\left(1+\frac{({P}_{t}^{e}-{P}_{t})}{{P}_{t}^{e}}\right)$$

(21)

Expected capital gains

Agents form heterogeneous expectations of capital gains based on past values of market returns74. Specifically, each agent evaluates a price return over time, where the time of measuring the return varies between one and 30 years. Agents are randomly assigned one of the thirty price/return time scales to form their expected capital gains. The expected capital gains at the current moment for a given agent is simply the return for one year that would yield the total return the agent found over their assigned time scale. For example, an agent assigned 30 years calculates the annualized capital gain or loss at t based on the ratio of realized property prices 30 years before the previous period (Pt − 31) to the previous period (Pt − 1). In this way, some agents are reactionary as they adjust expected returns over short time scales, while others are more sluggish in computing returns over a long time scale. We assume that foresight about future climate change is captured in the risk parameters, and as a practical matter, the influence on owner bids cannot be separately identified from in the denominator of equation (5). We calculate the investor’s expected capital gain in each period as the median of owner expected capital gains.

Shoreline management

Previous models of beach nourishment decisions show that the human and natural systems jointly determine shoreline position and coastal property values17,31,33,75,76. When a community decides to nourish, they commit to a nourishment plan defined by periodic nourishments over a ten-year horizon. A nourishment plan is chosen from a schedule of possible intervals. Nourishment is funded locally through municipal bonds that are paid for by the residents over the first 5 years of the plan through a temporary (five-year) increase in property taxes (τP). This nourishment decision framework is similar to the one used in Duck, NC77 and described in Mullin, Smith, and McNamara42.

A ten-year nourishment plan that will subsequently be voted on is chosen by comparing the property tax burden (cost) against the increase in property value (benefit). A given nourishment plan consists of a series of scheduled nourishments occurring over a ten-year period and an increase in property tax lasting five years. If the benefits minus the costs are negative, then no nourishment plan is chosen – in this case the nourishment plans are re-evaluated every time step until a nourishment plan is chosen. Overlapping nourishment plans and property tax adjustments are permitted so long as they do not conflict with previous plans by scheduling two nourishment events for the same year or result in consecutively scheduled nourishments (i.e., nourishing every year).

Plan costs and benefits are tabulated each step for a range of nourishment intervals (ranging from every other year to every five years) leading to a menu of nourishment options on which agents vote. For each proposed plan option, an average expected beach width over a 30-year time horizon is calculated based on the estimated shoreline retreat rate (from the previous 30 years), and the quantity of sand needed for each nourishment event is tracked with the cost of anticipated nourishment costs occurring later in the plan discounted at a rate δ.

The cost of a nourishment event at some time t is determined from

$$cost(t)=\left.f+c(b{w}_{o}-b{w}_{t})\right) * L * D$$

(22)

where f is the fixed cost of nourishment, c is the cost of sand per m3, bwo is the nourished beach width, L is the alongshore length of the nourishment, and D is the depth of the shoreface.

The total cost (TC) of option i (where i is the nourishment interval) is determined as the sum of the discounted fixed and variable costs of nourishment:

$$T{C}_{i}=\mathop{\sum }\limits_{t=1}^{10}\frac{cos{t}_{i}(t)}{{(1+\delta )}^{t-1}}$$

(23)

A 5-year amortization schedule is then used to determine the total yearly cost of the loan repayment (TCYi):

$$TC{Y}_{i}=T{C}_{i}\frac{\delta {(1+\delta )}^{5}}{{(1+\delta )}^{5}-1}$$

(24)

Oceanfront homes take on a greater share of the nourishment costs. The additional property tax rate is determined by setting the total cost of nourishment per year to the sum of the taxes collected amongst all agents in both the oceanfront and non-oceanfront markets:

$$TC{Y}_{i}=\mathop{\sum }\limits_{j=1}^{n}\rho {\tau }^{p,add}{I}_{j}^{OF}{P}_{t-1}^{OF}+{\tau }^{p,add}(1-{I}_{j}^{OF}){P}_{t-1}^{NOF}$$

(25)

where ρ is the tax ratio of oceanfront to non-oceanfront, the indicator variable \({I}_{j}^{OF}\)=1 for oceanfront homes and 0 for non-oceanfront homes, and τp,add is the additional property tax increment. For example, if a nourishment plan is chosen, then the property tax for oceanfront homes is τp + ρτp,add, and for non-oceanfront homes is τp + τp,add.

The total benefit of each interval/option is estimated by forward simulating property value via the user cost model. The forward simulation accounts for the average beach width under the proposed nourishment scenario that enters the coastal willingness to pay term, and the property tax, including the nourishment tax adjustment (and adjustments for previous nourishments if still applicable), enters into the denominator of the user cost model. The benefit is the increase in property value compared to the case of no nourishment, which will have both a lower expected beach width and lower property tax rate. Each agent evaluates whether the property value increase is greater than the extra tax burden. If yes, then the agent votes to nourish. The proposed nourishment plan is implemented if at least 50% of resident-owner agents vote to nourish. Importantly, institutional investors do not vote but are still taxed if nourishment is approved.

Nourishment projects typically involve dune building in conjunction with widening of the beach. We do not explicitly model dune building and assume that benefits and costs of dune construction are captured implicitly in the nourishment decisions. We leave explicit modeling of dune dynamics as a future extension of the model.

Supplementary Table 1 summarizes model parameters, provides details on how they were chosen, and motivates the sensitivity analysis to explore alternative parameter values, different functional forms, and different scenarios. The model was coded and run in Matlab R2022b.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.