It’s sometimes easy to question the logic of the gentleman governing the third-largest state in the nation.

Like the other day when Gov. Ron DeSantis posted on X:

“Home ownership should mean you fully own your home, not be forced to pay rent to the government in the form of property taxes.”

But this isn’t only about logic.

It’s about the property tax red herring DeSantis and the Florida Legislature continue to use for political misdirection instead of focusing on several more important issues: insurance rates, inflation, access to health care, the economy, better jobs, home rule, etc.

When DeSantis can’t explain what would happen if property taxes are eliminated, something’s awry, big time.

I’ve never considered property taxes like paying “rent.” I don’t live in a state with outrageous property taxes. So, thus far, I’ve considered the taxes reasonable contributions for things like:

-

Police and firefighters, who respond quickly.

-

Public schools our children never used.

-

The parks, pools, pickleball courts and other recreational facilities we don’t use that much.

-

Making sure the roads are well-maintained or, in some cases, built when impact fees and sales taxes can’t cover it all.

Maybe DeSantis doesn’t understand because for six years — as he has seen his net worth jump from $310,971 to $2.1 million ― he’s lived in a house Floridians collectively own: the governor’s mansion in Tallahassee.

His financial disclosures and news reports suggest he’s not — like many of us longtime Floridians — a homesteader. He no longer benefits from the renowned property tax protections that lure so many newcomers to Florida.

Media reports suggest he lost the homestead protection in 2019, when he sold a home in Ponte Vedra Beach with a view of the Sawgrass Players Club for $460,000. He bought it 10 years earlier for $307,000.

In 2018, he sold a home in Palm Coast for $275,000, about $33,000 more than he paid for it two years earlier.

Is DeSantis looking to get something for nothing if, when his term is up in 2026, he wants to buy a home in a real estate market that, along with the cost of homeowners insurance, has dramatically escalated under his watch?

And, unlike folks like us who paid to send our children to private school, DeSantis may not have to, having signed into law one of the nation’s largest private school voucher expansions in 2023.

Even though my family didn’t benefit from such school choice initiatives, I support the concept ― though the specific choice laws DeSantis signed are fraught with accountability and other issues.

But back to property taxes.

I haven’t heard Floridians complain about property taxes since 1992, when they passed the Save Our Homes constitutional amendment. Related law limits the increase of homestead property value to the rate of inflation, or 3%, whichever is less.

If you own non-homesteaded property, its value can increase by up to 10% a year, so it pays to be a Floridian if you have a home. New property owners and non-homesteaders have been bearing the increased costs of local government.

It’s no wonder 70% of Floridians registered to vote didn’t see taxes as an issue causing them “the most stress,” according to a September poll done for the James Madison Institute, a conservative think tank.

Groceries and household essentials (63%), rent or mortgage (44%) and insurance (42%) were far bigger factors than property taxes (30%).

Perhaps that’s because, for many of us, those expenses are increasing faster and add up to more than our annual property tax bill.

A number of tax-reduction bills have been filed in the Legislature already for the session that begins in January. Most would have to be voted on by Floridians in 2026 to take effect.

Why would DeSantis and the Legislature be in a such a tizzy over this issue as the 2026 midterm elections near?

In the survey, about 45% of Floridians said they would be more willing to vote for a candidate who favors eliminating property taxes; 65% if that includes significant cuts.

The question the survey did not ask is how would essential local services be paid for? I have not heard anyone else supporting property tax elimination answer that question, either.

Would some entity potentially double the sales tax, which all of us pay on everyday items, to try and make up for the property tax revenue losses?

What about eliminate local governments and let some faraway central government run things or make decisions on how to serve our own communities?

Traditionally, conservatives believed in government closest to the people being the most effective, conserving the status quo and taking few risks with others’ lives and money.

DeSantis likes to say how successful Florida is and how many people visit and move here. Then let’s stop fiddling around and keep government from messing with it. Do we really want to blow it up?

If DeSantis wants to take those kinds of risks, he should finally get a job in the private sector, maybe as an entrepreneur. Florida records show he’s been successful privately, making about $2.7 million in book-related revenue the past three years.

As an author and Ivy League graduate, he knows the difference between rent and taxes.

As a conservative, I agree keeping taxes down is important ― but it’d be nice for DeSantis and the Legislature to handle some of the critical issues instead.

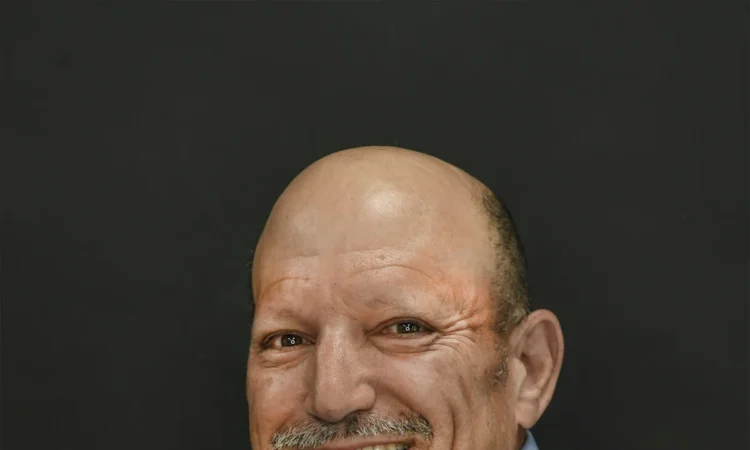

This column was adapted from one originally written by columnist Laurence Reisman and published at Treasure Coast Newspapers (TCPalm.com). The column reflects his opinion.

This article originally appeared on Treasure Coast Newspapers: Florida property tax pays police, firefighters. Keep it | Opinion