Way back in 2017, I wrote about how bananas Canadian housing prices were.

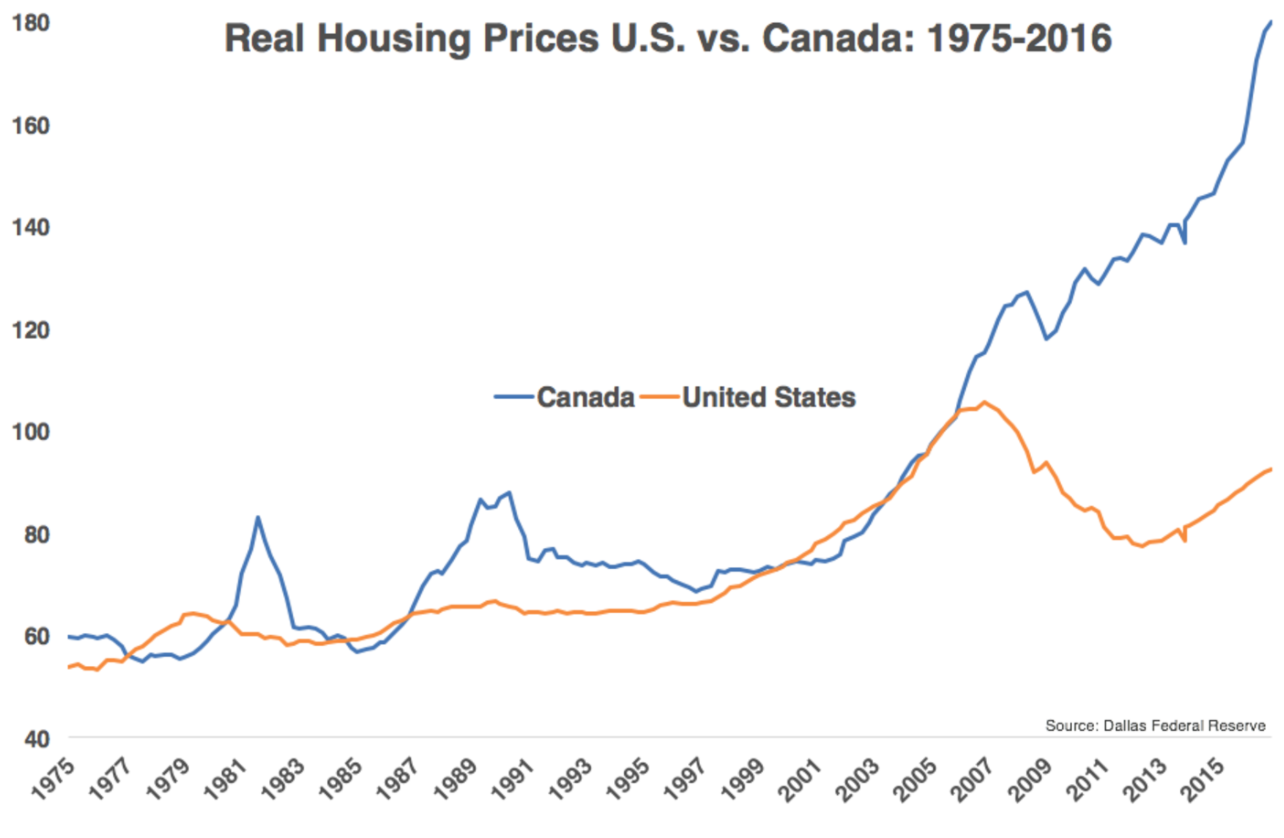

This was the chart I used at the time:

Canada basically skipped the housing bust from the Great Financial Crisis.

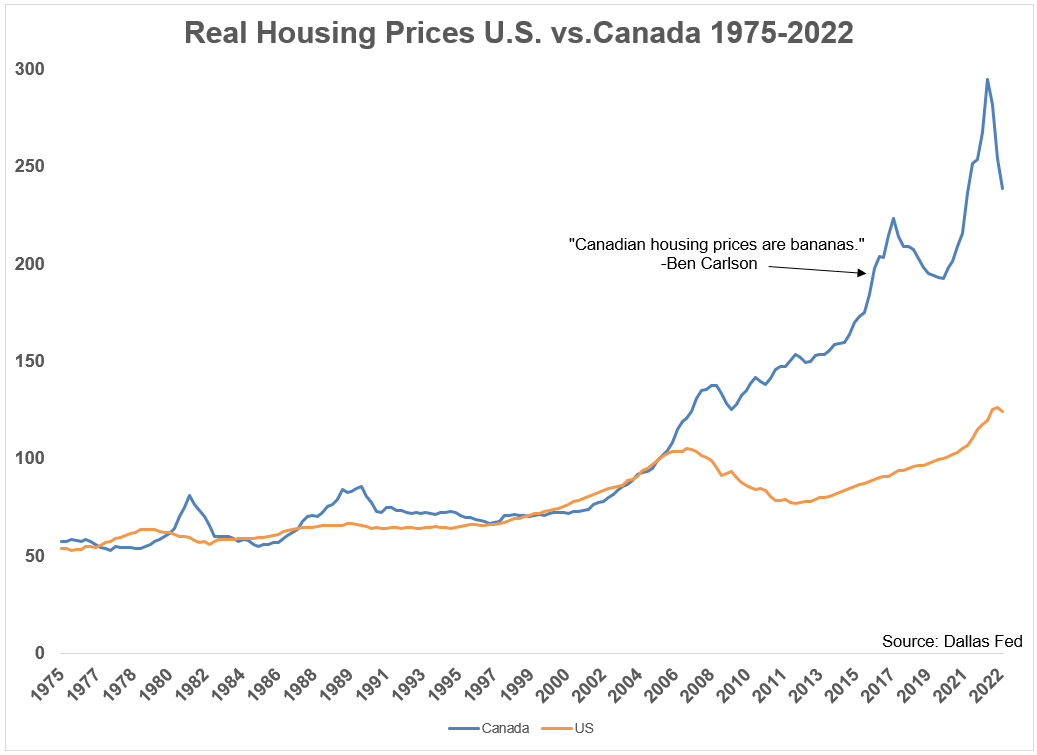

Well, things got even more bananas in the ensuing years.

Here’s the updated version:

Canadian housing prices can remain irrational longer than you can stay solvent or something like that. The crazy thing is Canadian housing prices would have to fall an additional 40%+ from those levels just to get back in line with growth in real U.S. housing prices since 1975.

Since the start of 2005, Canadian home prices are up a staggering 142% on a real basis (after inflation). And that includes a decrease of 19% in the final 9 months of 2022.1 From 2005-2022, U.S. housing prices were up just shy of 26% on a real basis.

Housing price gains in Canada make the U.S. housing price gain look tiny by comparison.

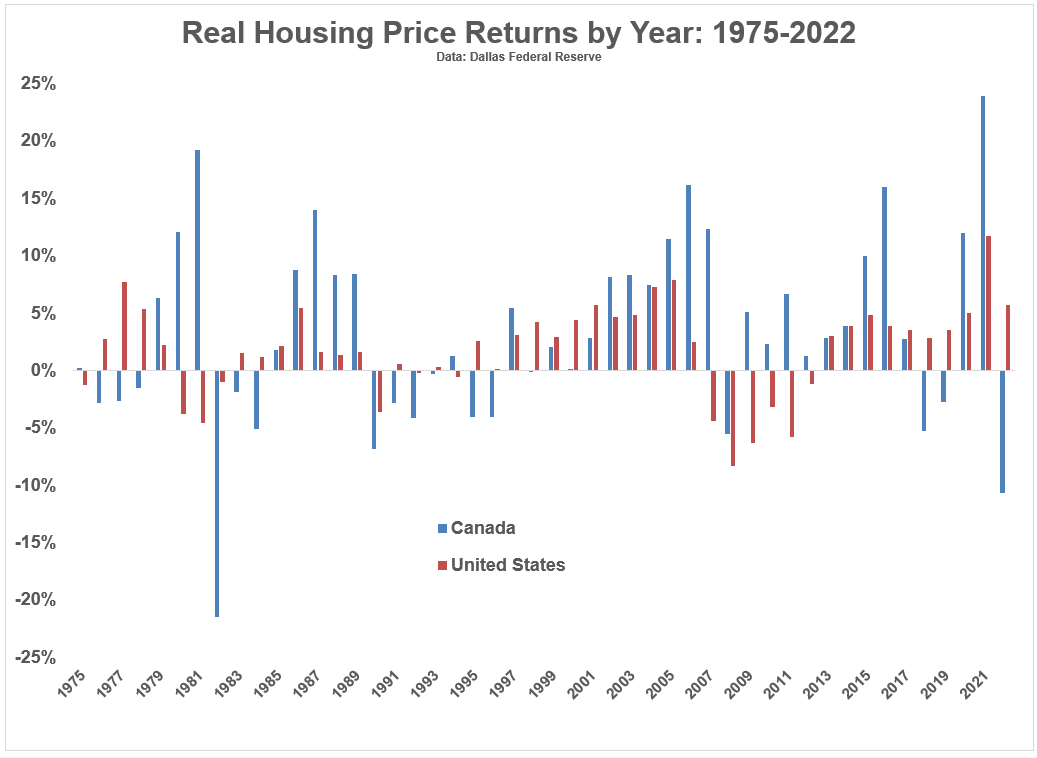

The year-by-year gains and losses stand out here as well:

Bigger gains and bigger losses in Canada. It’s like the S&P 500 versus the Nasdaq 100.

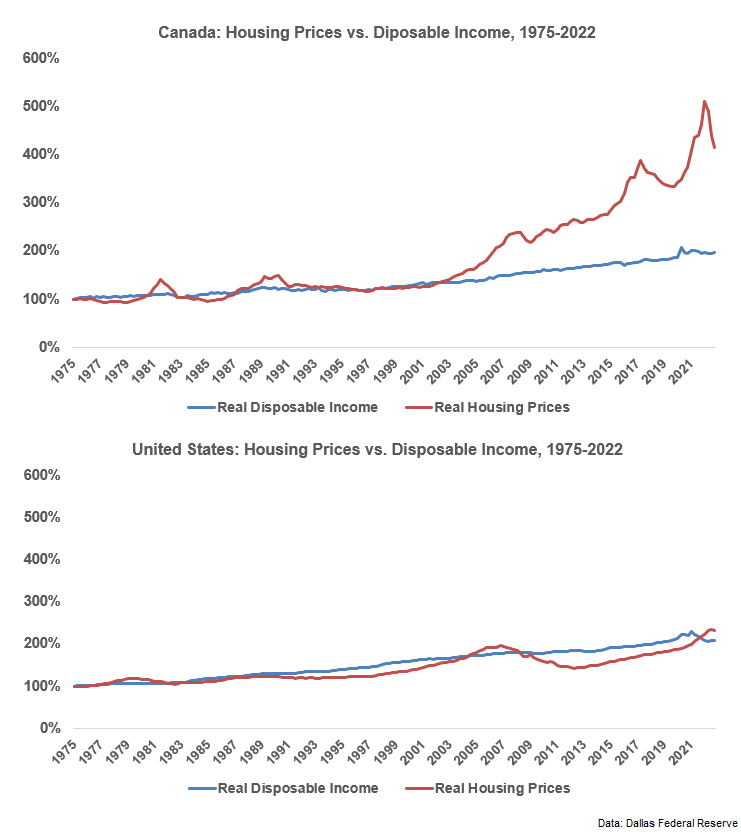

The differences between the two markets look even more stark when you compare the real gains in housing prices to real gains in disposable income over time:

I used the same scale for both to highlight the differences here.

Yes, real housing prices are now growing faster than real disposable income in the United States but that relationship has been relatively stable for the past 50 years or so. Incomes have kept pace with housing prices after accounting for inflation.

But things in Canada have gone completely off the rails over the past 20 years or so. Our kind neighbors to the north are in a completely different stratosphere than we are.

I’m not saying this makes it any easier if you’re looking to buy in the U.S. right now.

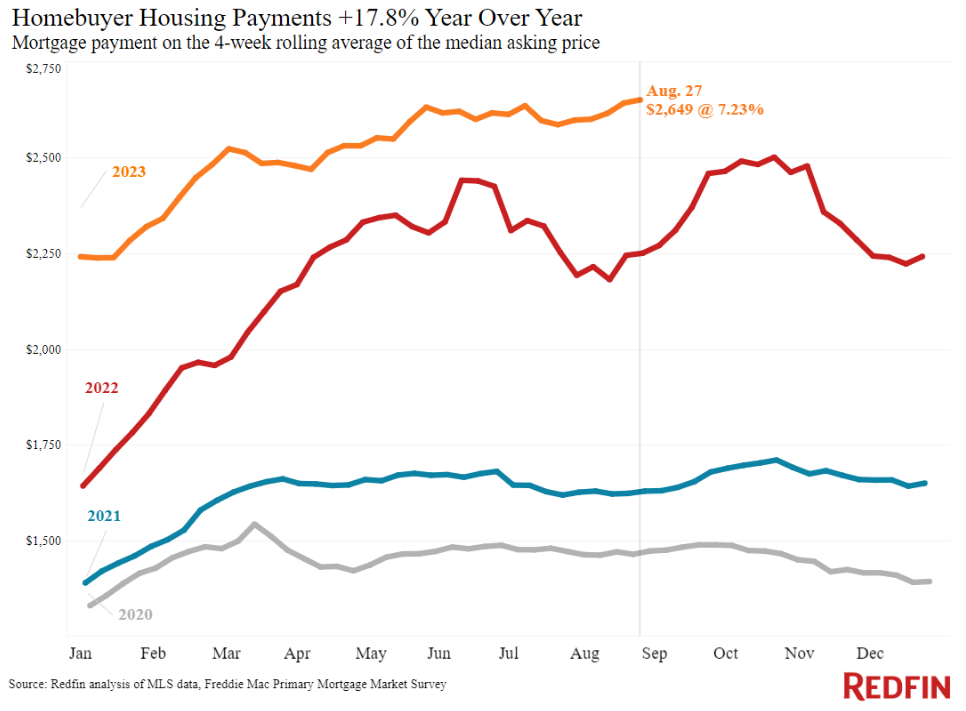

Affordability here is still as bad as it’s ever been. We just hit another new all-time high in average monthly payment (via Redfin):

Just be thankful you’re not trying to buy a house in Canada…it’s even worse there.

Michael and I talked about the insanity of Canadian housing prices and much more on this week’s Animal Spirits video:

We talked about the way the Canadian mortgage market differs from how we do it in the United States on Ask the Compound last month.

Subscribe to The Compound so you never miss any of our wonderful videos.

Further Reading:

Will We Ever See Affordable Housing Prices Again?

Now here’s what I’ve been reading lately:

Books:

1The Fed doesn’t have updated data through 2023 yet. These numbers are through the end of 2022.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.