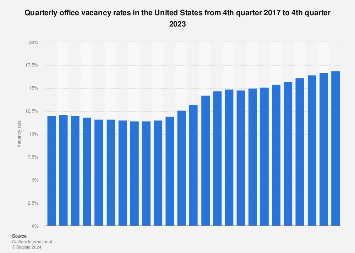

Vacancy rates across the office real estate sector in the U.S. increased during the coronavirus pandemic. Before 2020, the quarterly vacancy rate was around 12 percent, but as the pandemic unfolded, it climbed to above 15 percent. In the fourth quarter of 2023, about 16.9 percent of office space across the country was vacant. In some of the major U.S. markets, vacancies reached up to 30 percent. With a considerable part of the workforce working from home or following a hybrid working model, businesses are cautious when it comes to upscaling or renewing leases.

Workplaces may never be the same again

The COVID-19 pandemic has changed the way that companies operate, and working from home has become the new normal for many U.S. employees. The function of the office has evolved from the primary workplace to a space where employees collaborate, exchange ideas, and socialize. That has shifted occupiers’ attention toward spaces with modern designs that can accommodate the office of the future. Many businesses used the pandemic time to revisit their office guidelines, remodel or do a full or partial fit-out. With so much focus on quality, older buildings with poorer design or energy performance are likely to suffer lower demand, resulting in a two-speed market.

What do higher vacancy rates mean for investors?

Simply put, if landlords do not have tenants, their income stream is disrupted, and they cannot service their debts. April 2023 data shows that several U.S. metros had a significantly high share of distressed office real estate debt. In Charlotte-Gastonia-Concord, NC-SC, more than one-third of the commercial mortgage-backed securities for offices were delinquent, in special servicing, or a combination of both. Nevertheless, offices had a lower delinquency rate compared to other commercial property types, such as lodging or retail properties.