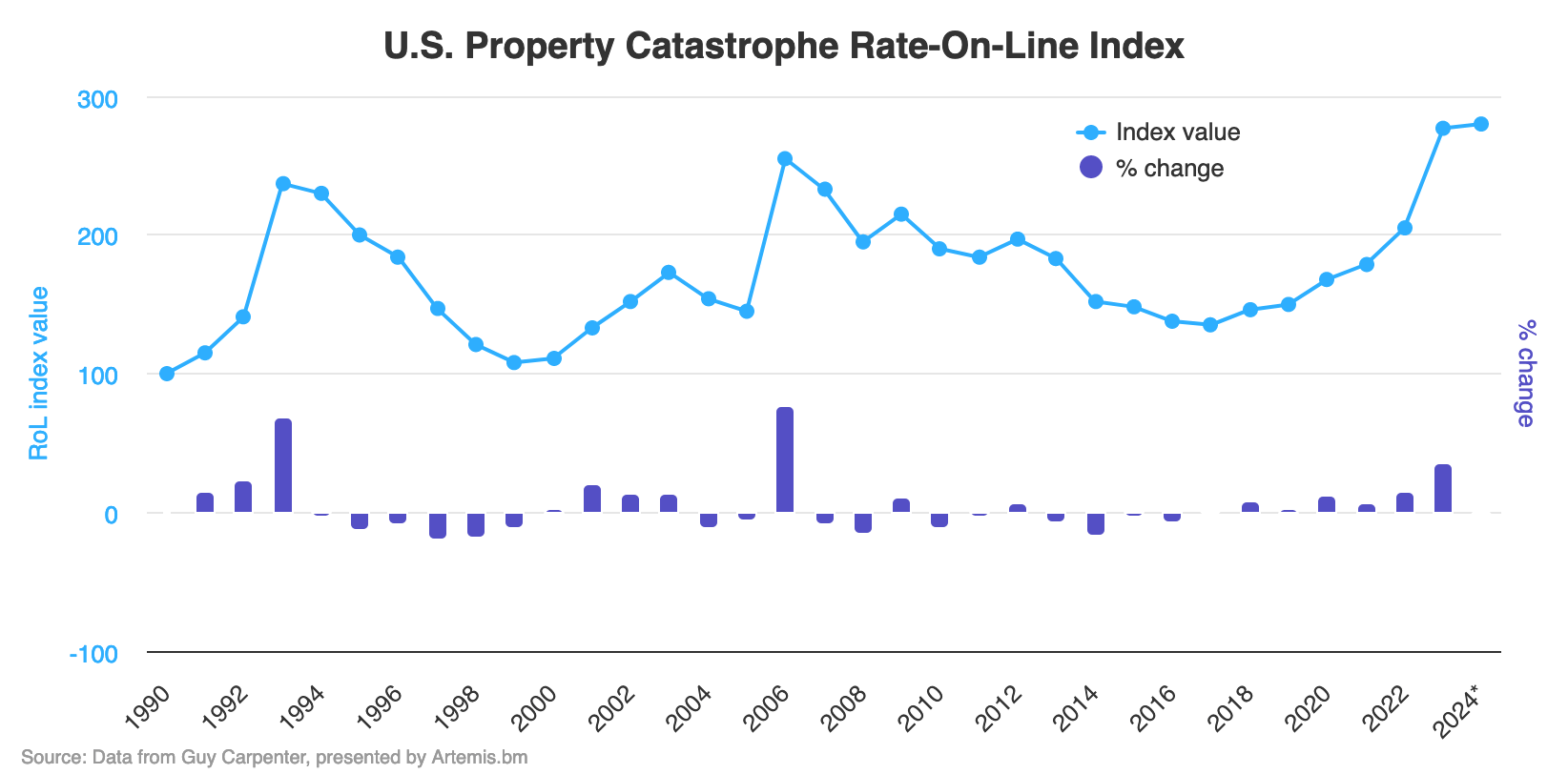

Property catastrophe reinsurance rates-on-line slowed further at the recent mid-year renewals, with a general flat to slightly down rate environment, resulting in broker Guy Carpenter’s U.S. Property Catastrophe Rate-On-Line Index now being up by just 1.2% in 2024.

US property catastrophe reinsurance prices had already decelerated considerably at the January 2024 renewals, after which this Index was up by 5.4%.

Which was a far cry from the significant 35% increase seen in 2023.

As property catastrophe reinsurance pricing peaks, the indices are flattening off, but still signal a very profitable reinsurance underwriting environment.

The reinsurance broker said, “The Guy Carpenter US ROL Index increased 1.2% compared to 2023, which is a decrease from the +5.4% index value at January 1, and reflects the impact of decreased pricing at mid-year.

“While pricing came down on a risk-adjusted basis, the flattish index value reflects stable retentions driving greater catastrophe exposure into programs. Dollars spent increased on average but not quite to the same degree as exposure.”

You can view an interactive version of the Index by clicking on the image below:

The US property catastrophe reinsurance marketplace continues to be the main source of returns for insurance-linked securities (ILS) fund strategies, so the fact the market remains relatively flat at record-high levels, in rate-on-line terms, is still encouraging.

In fact, US property cat reinsurance rates are still up by 107% up since the bottom of the last soft market in 2017, according to Guy Carpenter’s Index.