What Drives the U.S. Services Trade Surplus? Growth in Digitally-Enabled Services Exports | CEA

The United States Has a Services Trade Surplus

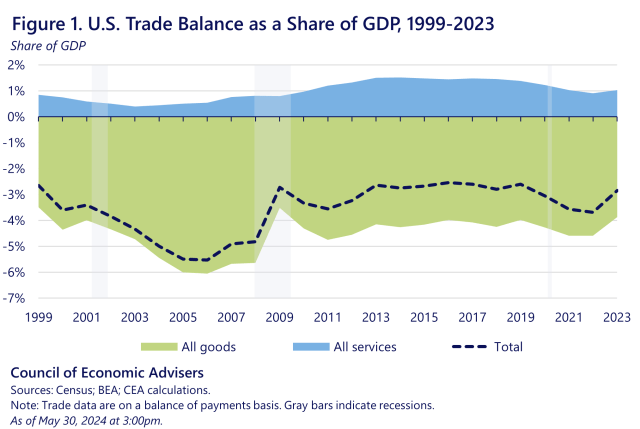

Services exports collectively represent the high-value-added activities in which the United States maintains a global comparative advantage. Although the perennial U.S. goods trade deficit overshadows the enduring surplus in U.S. services trade (figure 1), in 2023, exports of services ($1 trillion) were the highest on record[1] and the services trade surplus ($278.4 billion) was the highest since 2019.

Digitally-Enabled Services Products Drive the U.S. Services Trade Surplus

Since the late 2000s, the services trade surplus has been fueled primarily by the growth in digitally-enabled services (figure 2). Digitally-enabled services encompass those services predominantly delivered over information and communication technologies (ICT) networks including ICT services.[2] Some examples of digitally-enabled services include licenses to use computer software, cloud computing and data storage services, and royalty payments for industrial designs to manufacture specialized equipment.

Digitally-enabled services represent the fastest growing segment of global trade. The growth in U.S. digitally-enabled services exports has far outpaced the growth in exports of other services as well as exports of goods over the last 25 years (figure 3).[3] This trend comports with the expansion of the U.S. digital economy – economic activity generated from or supporting electronic connections. In 2022, while U.S. real GDP grew by 1.9 percent, the U.S. digital economy real value added grew by 6.3 percent driven primarily by growth in software and telecommunication services.[4]

U.S. Manufacturers are the Second Largest Exporter of Digitally-Enabled Services

Economic activity in the United States has transitioned from manufacturing towards services over the past five decades. Notably, U.S. manufacturing firms account for almost a third of this transition – reflecting the importance of services throughout the manufacturing process. In fact, manufacturers are an important source of the U.S. comparative advantage in digitally-enabled services. Manufacturers are the second largest exporter of digitally-enabled services after the finance and insurance sector (figure 4).[5] Over two-thirds of services exports by U.S. manufacturers are charges for the use of intellectual property and research and development (R&D) services, consistent with the manufacturing sector’s innovative capacity.

U.S. manufacturers account for 54 percent of overall industrial R&D[1] which is a key input into goods production as well as service solutions that enhance the performance of manufactured goods. The R&D activities result in the creation of intellectual property, such as patents, trademarks, software and data licenses, that are all types of digitally-enabled services and can subsequently be exported. For example, consider General Electric (GE), known in part for producing commercial jet engines. GE undertakes R&D to propel advancements in its jet engine technology and owns the patents to protect their proprietary technology. GE also develops digital and data analytics services such as the Predix platform to analyze engine data and improve diagnostic capabilities. When companies like GE sell the rights to use their patents, industrial processes, or software licenses abroad, the income from licensing and royalty fees is recorded as a digitally-enabled services export.

Shifts in U.S. manufacturing firms’ activities towards services in the last four decades underscore the deep interconnection between goods and services. A decomposition of employment growth at U.S. manufacturing firms reveals higher employment growth at establishments in the business services industries that account for the largest share of digitally-enabled services.[2] Establishments in the digitally-enabled services industries are characterized by a high degree of knowledge- and technology-intensive activities reflected in the sector’s high-paying occupations (e.g., software and web developers, engineers, architects, and scientists): in 2022, the average weekly wage of workers in digitally-enabled services industries was the highest ($2,195) compared to the economy average ($1,650).[3]

The role of U.S. manufactures as major exporters of digitally-enabled services provides a strong foundation to achieve the Administration’s commitment to build a thriving advanced manufacturing sector (e.g., semiconductors, pharmaceuticals, and critical materials). Investments in advanced manufacturing—a sector that produces and exports both technologically complex goods and intellectual property embedded in patents, industrial processes, trademarks, software licenses, etc.—will continue supporting the U.S. comparative advantage in services.

The Future of Digitally-enabled Services Trade Requires International Cooperation

The growth in U.S. cross-border digital trade mirrors global trends and underscores the changing nature of globalization characterized by a slowdown in flows of tangible goods and an acceleration in intangible flows. The United States is poised to lead the growth in intangible flows given that the digitally-enabled services sector is one of the highest-paying and innovative segments of the economy.

The rapid growth of digital services will require careful consideration in both domestic and international regulatory regimes. While the United States ranks fifth[9] among fifty countries in terms of having the least restrictive barriers to digital trade, African countries have the highest levels of restrictions, followed by the Asia-Pacific region. Continued consideration and consultation will be necessary to support a thriving digitally-enabled services sector in the United States.

[1] Services exports as a share of GDP in 2023 was 3.7%. This share was the highest at 4.3% in 2013, 2014, and 2017.

[2] The U.S. Bureau of Economic Analysis (BEA) measures trade in services using a combination of surveys, estimates from other U.S. agencies, industry reports, and partner-country data. Most of the trade in services statistics, particularly digitally-enabled services, are based on survey collections and include services performed on a cross-border basis as well as services performed in person i.e. an individual temporarily traveling abroad. The vast majority of BEA’s services survey collections reflect cross-border transactions (Mann, 2019).

[3] The three types of exports had different bases in 1999: goods was $996 billion; digitally-enabled services was $151 billion; and other services was $319 billion (in 2022 dollars).

[4] BEA defines the digital economy as the infrastructure that supports computer networks, e-commerce (retail and wholesale trade), priced digital services (services related to computing/communication that consumer are charged for), and the annual budget for federal nondefense government agencies whose services are directly related to supporting the digital economy. The digital economy is comprised of digital markets that “encompasses the interfaces that electronically bring together various agents for economic or social purposes” such as app stores, operating engines, and online marketplaces (2023 ERP, Chapter 7).

[5] BEA does not publish statistics on potentially ICT-enabled services by industry. However, BEA publishes trade in selected services by industry where selected services include ICT-enabled services and in addition, construction, and personal, cultural, and recreational services. ICT-enabled services account for 96% of selected services.

[6] Business R&D performed in the United States by industry is measured using the latest available data from the 2021 Business Enterprise Research and Development (BERD) survey, Table 2.

[7] CEA staff utilized concordances between ISIC Rev.4 and 2022 NAICS from the U.S. Census Bureau to map the services products defined as digitally-enabled based on BEA’s definition of potentially ICT-enabled services to the respective six-digits NAICS. Two-digit sector 54 (Professional, Scientific, and Technical Services) accounts for the largest share of digitally-enabled services sector employment.

[8] Average weekly wages calculated using Bureau of Labor Statistics’ 2022 Quarterly Census of Employment and Wages.

[9] Using the OECD’s latest available Digital Services Trade Restrictiveness Index, in 2022, the United States was in fifth place for least restrictive regulatory environment for digitally-enabled services, tied with Australia, Norway, Switzerland, and the United Kingdom.